Small is Big!

Small is Big!

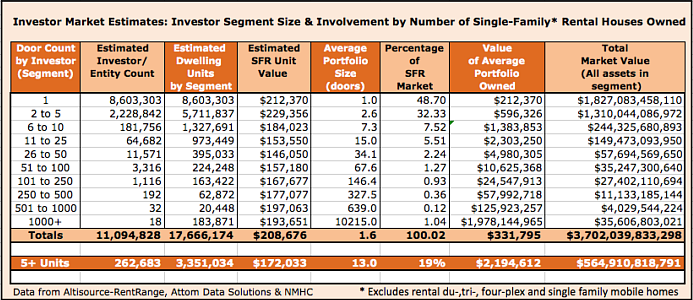

If you own one investment property you are a significant investor and contributor to the American economy. The engaged (as opposed to “aspiring,”) real estate investor population is estimated to be at 11.1 million individuals and companies. Together this tier of investors owns $3.1 trillion in single-family residential (SFR) asset value representing 13.3 million homes.

If you own more than six SFR properties you are in the top 19% of real estate investors meaning 81% of investors own fewer than 6 properties and are an incredibly meaningful factor to American life.

If you own more than 100 SFR properties you are in the top 2.45% of investors. What is probably more astounding is that for all the noise generated by the Wall Street buying activity, they only own and manage just over 1% of SFR investment properties.

Thanks is due to Altisource Division, RentRange, Realty Trac (Attom Data Solutions) and the National Multi-Housing Council for separate publishing this recent data. When put together and compared this allows us to publish a ranking of investors by the market size and number by their single-family residential investments. We use each of these separate sources to cross compare and arrive at a sounder number, as real estate investing data has a history of using “scientific estimates.” These three companies gather their data from various sources such as county records, U.S. Census Bureau data and membership surveys. They then apply proprietary algorithms to smooth out data lumps to offer defensible data.

BIG IS SMALL (Actually very small compared to the market mass)

Their impact that was initially dismissed as simply a Wall Street profit play brought real value to the housing market. During their peak buying years they dominated buyer activity, helped stabilize the market by putting a floor in housing prices, and gave credibility to investing in single family residential rentals.

Thank you Wall Street. They lifted the perception and discipline of our industry and helped the visibility of this asset class as a mainstream investment.