Is the housing market crashing? Not everywhere! The housing market has been stuck in neutral for a while now. High home prices and unpredictable mortgage rates have left both buyers and sellers hesitant. But wait! There are some bright spots in this seemingly gloomy scenario. Certain U.S. cities are defying the national trend, experiencing brisk sales and even rising home prices.

Let's delve into the data from Realtor.com's recent analysis of the hottest markets. While the national average for home price increase is a measly 2%, these top markets boast a jump of a significant 5.3% annually. Why the hot streak? According to Hannah Jones, an economic analyst at Realtor.com, high demand is the driving force.

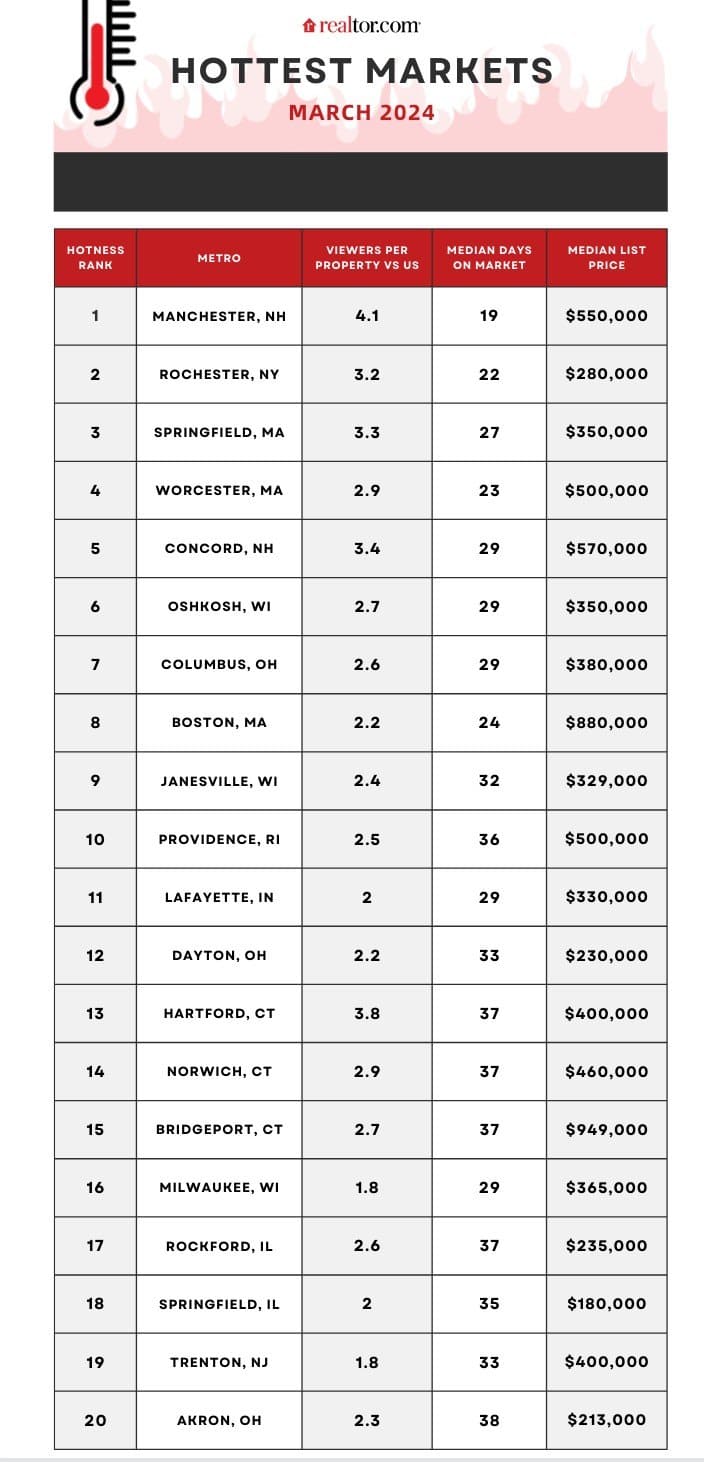

The champions this March were the Northeast and Midwest, grabbing 13 and 7 spots on the hot markets list, respectively. Manchester-Nashua, NH, takes the crown for the seventh time in a row, followed by Rochester, NY, and Springfield, MA. Realtor.com identifies these hot markets by analyzing two key metrics: the number of unique views per property and the average listing duration.

Should You Buy into the Hot Markets?

So, should you rush to buy in these desirable cities? Not so fast. While prices are rising, Jones points out that overall buyer demand is actually shrinking. The good news? The once scorching price growth in these hot markets is starting to simmer down. This suggests a potential opportunity for buyers who've been priced out in the past. However, careful consideration is still crucial. Consider factors like your long-term financial goals, desired home features, and preferred location before diving in.

Finding Diamonds in the Rough: Markets with Price Relief

For buyers hoping for a price dip, there are some gems on the list. Seven out of the 20 hottest markets are showing a decrease in median listing prices. The top spot goes to Bridgeport-Stamford, CT, where prices dropped a substantial 13.6% to a median of $949,000 (still a hefty sum!). This area is followed closely by Norwich-New London, CT, with a 9.6% decline.

Other contenders with falling prices include Oshkosh-Neenah, WI (down 6.4%), Providence-Warwick, RI (down 2.8%), Hartford, CT (down 0.7%), Janesville, WI (down 0.4%), and Milwaukee, WI (down 0.3%).

Why the price drop in these once-hot markets? The answer might surprise you – it's partly due to a rise in smaller homes hitting the market. For instance, Bridgeport and Providence saw a significant drop in price per square footage, suggesting a shift towards more affordable options that might attract first-time buyers or those looking to downsize.

The Sun Belt Cools Down

The South and West regions are noticeably absent from the hot markets list. In fact, they haven't been on the list for the past six months! The once sizzling Sun Belt holds the dubious honor of having the most metros (4 out of 5) that have fallen the furthest in rankings. Places like North Port-Sarasota-Bradenton, FL, and Dothan, AL, have witnessed a staggering drop of 149 spots.

The reason? Jones explains that the surge in prices and mortgage rates in these areas eventually dampened buyer enthusiasm. As a result, more affordable markets in the Northeast and Midwest gained traction, leaving the once-frenzied Southern markets behind.

A Silver Lining for Homebuyers

The South and West taking a break from the hot markets list is actually a positive development for buyers. This drop in demand has allowed inventory levels to recover and price growth to slow down, suggesting a move towards a more balanced market in the near future. This could mean more breathing room for buyers who may have felt pressured by bidding wars in the past.

Beyond the Data: Market-Specific Considerations

The national trends don't paint the whole picture. While the data provides valuable insights, it's essential to consider local market dynamics before making a decision. Look into factors like job growth, crime rates, and the quality of schools in your target area. Consulting a reputable real estate agent familiar with your preferred location can be invaluable. They can provide you with hyperlocal market insights and help you navigate the complexities of the buying process.

Beyond the Hot and Cold: Emerging Markets

It's also important to acknowledge that the hot and cold markets may not be the only areas worth considering. Certain cities might not be on the Realtor.com hot list yet, but they could be experiencing steady growth and offer a good value for your money. Look for areas with a healthy job market, good schools, and a sense of community. These factors can contribute to long-term appreciation potential for your property.

ALSO READ:

Housing Market Crash 2024: When Will it Crash Again?

Housing Market Crash Alert: Mortgage Demand Dips, Will Prices Crash?