The question on many Americans' minds is: Will the Housing Market Slowdown Because of Reciprocal Tariffs? The short answer, according to a recent survey, is that the majority of people are concerned. A whopping 72% of Americans believe that “Reciprocal Tariffs” will negatively impact the US housing market, with some even fearing a significant downturn.

While a complete crash might not be a certainty, these trade tensions are undoubtedly creating uncertainty and could potentially slow down the market. Let's dive into why this is the case and what the potential consequences could be.

Will the Housing Market Crash Due to Reciprocal Tariffs?

I've been following economic trends, especially those affecting the real estate sector, for a while now. In my opinion, it's not just about the numbers; it's about understanding the psychology behind market movements. And right now, a lot of that psychology is driven by fear of the unknown.

What are Reciprocal Tariffs, and Why Should You Care?

Tariffs, in their simplest form, are taxes on imported goods. Reciprocal tariffs take this a step further, implying that if one country imposes a tariff on another, the second country will respond with a similar tariff on goods coming from the first. This can escalate into a trade war, where both countries keep raising tariffs on each other, ultimately making goods more expensive for consumers and businesses.

Why should you care? Because the housing market is intricately connected to the broader economy. Think about it:

- Construction materials: Many building materials, like lumber, steel, and even certain types of drywall, are imported. Tariffs on these goods increase the cost of building new homes.

- Home appliances: From refrigerators to washing machines, many appliances are also imported. Higher tariffs mean higher prices for these essentials, making homes less affordable.

- Investor confidence: Trade wars create uncertainty, which can make investors hesitant to put money into the housing market.

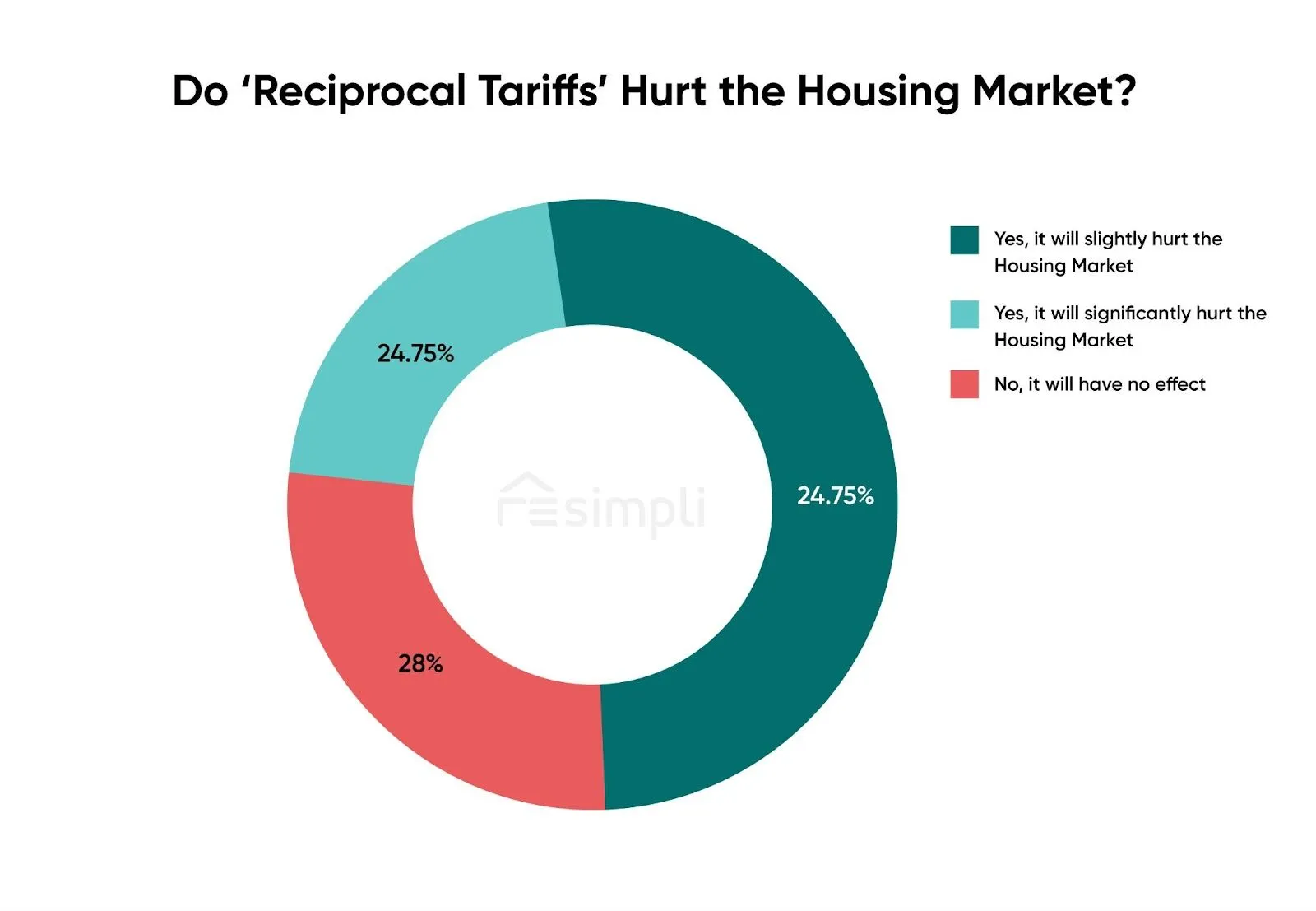

A New Survey Reveals Growing Anxiety

A recent survey conducted by REsimpli, analyzing the opinions of 1,200 Americans concerned with political and economic changes, sheds light on the public's perception of the potential impact of reciprocal tariffs. The results are telling:

- High Level of Concern: 72% of those surveyed believe reciprocal tariffs will hurt the US housing market.

- Border Communities at Risk: 53.25% think housing markets near the US-Canada border will be most affected.

- Supply Chain Worries: 33.75% are highly concerned about disruptions to housing supply chains.

- Investor Pullback: 66.42% believe Canadian investors will pull back from the US.

- Liquidity Concerns: 69.5% expect the housing market to become less liquid.

- Affordability Impact: 55.92% believe housing affordability will be negatively impacted.

- Mortgage Rate Hikes: 51.25% anticipate increases in mortgage rates.

These numbers paint a picture of growing anxiety surrounding the housing market's future.

Digging Deeper: The Implications of Reciprocal Tariffs

Let's break down some of the key concerns and explore their potential implications:

1. Impact on Housing Supply Chains:

- Increased Construction Costs: Tariffs on imported building materials like lumber, steel, and aluminum will drive up construction costs. This means new homes will be more expensive to build, potentially leading to fewer new construction projects.

- Supply Shortages: Trade disputes can disrupt supply chains, making it harder to get the materials needed to build homes. This could lead to delays in construction and further price increases.

- Example: Imagine a homebuilder relying on Canadian lumber, which now carries a 20% tariff. This instantly increases the cost of framing a house, forcing the builder to either absorb the cost (reducing profit) or pass it on to the buyer (making the home less affordable).

2. Canadian Investor Behavior:

- Reduced Investment: Canada is a significant investor in the US housing market, particularly in certain regions. Tariffs and trade tensions could deter Canadian investors, leading to a decrease in demand for US properties.

- Impact on Condo Markets: Canadian investors often focus on condo markets in major US cities. A pullback could put downward pressure on condo prices in these areas.

- Example: A Canadian investor who previously purchased several condos in Miami as rental properties might decide to halt future investments due to tariff-related uncertainty, potentially impacting the demand and prices in that market.

3. Liquidity and Affordability:

- Slower Sales: If buyers become more cautious due to trade tensions, homes may take longer to sell. This can reduce the liquidity of the market, making it harder for sellers to find buyers quickly.

- Increased Mortgage Rates: While the direct link between tariffs and mortgage rates is complex, a trade war can lead to increased economic uncertainty, which can, in turn, push mortgage rates higher. This makes buying a home more expensive for everyone.

- Reduced Affordability: The combination of higher construction costs, potential price increases on imported appliances, and potentially higher mortgage rates could significantly reduce housing affordability, pricing some potential buyers out of the market.

4. Regional Impacts:

- Border States at Risk: The survey suggests that housing markets near the US-Canada border are particularly vulnerable. This is because these areas often have strong trade ties and cross-border investment flows.

- Example: Cities like Detroit, Buffalo, and Seattle, which rely heavily on trade with Canada, could experience more significant housing market impacts than other regions.

- Specific Regional Impacts: Some states such as Maine, Michigan, North Dakota, and Montana, have closer proximity with Canada. These states could witness significant trade and supply chain disruptions.

5. Property Tax Implications:

- Decreased Property Values: In areas where the housing market softens due to trade tensions, property values could decline. This, in turn, could impact property tax revenues for local governments.

- Tax Increases: To compensate for lost revenue, local governments might be forced to increase property tax rates, adding another financial burden on homeowners.

Recommended Read:

Fannie Mae Lowers Housing Market Forecast and Projections for 2025

Housing Market Forecast 2025 by JP Morgan Research

Housing Predictions 2025 by Warren Buffett's Berkshire Hathaway

Is a Housing Market Crash Inevitable?

While the survey results are concerning, they don't necessarily guarantee a housing market crash. The housing market is influenced by a complex interplay of factors, and tariffs are just one piece of the puzzle. Here are some factors that could mitigate the negative impacts:

- Strong US Economy: A strong overall economy could help offset the negative effects of tariffs. If people have jobs and confidence in the future, they are more likely to buy homes.

- Low Inventory: In many areas, housing inventory remains low. This could help support prices, even if demand softens somewhat.

- Government Intervention: The government could take steps to address the situation, such as negotiating trade agreements or providing assistance to affected industries.

What Homebuyers and Investors Should Do?

If you're considering buying or investing in real estate, it's important to be aware of the potential risks and opportunities associated with reciprocal tariffs. Here's some advice:

- Do Your Research: Stay informed about the latest developments in trade policy and their potential impact on your local housing market.

- Be Cautious: If you're planning to buy, don't overextend yourself financially. Leave room in your budget for potential increases in mortgage rates or property taxes.

- Consider Location: Think carefully about the location of your investment. Areas with strong local economies and diverse industries may be less vulnerable to trade shocks.

- Talk to the Experts: Consult with a real estate agent, mortgage broker, and financial advisor to get personalized advice based on your individual circumstances.

My Take: Uncertainty is the Biggest Threat

In my opinion, the biggest threat posed by reciprocal tariffs isn't necessarily a dramatic crash, but rather the uncertainty they create. Uncertainty makes people nervous, and nervous people tend to hold back on big decisions like buying a home.

I think it's crucial for policymakers to consider the potential impact of trade policies on the housing market. The housing market is a major driver of the US economy, and policies that destabilize it could have far-reaching consequences.

Looking Ahead: Monitoring the Situation

The situation is constantly evolving, so it's important to stay informed and monitor developments closely. Pay attention to:

- Trade negotiations between the US and Canada. Any progress in resolving trade disputes could help ease market anxieties.

- Economic data on housing starts, home sales, and prices. These indicators will provide insights into the health of the housing market.

- Consumer sentiment surveys. These surveys can gauge the level of confidence among potential homebuyers.

Summary:

While a complete housing market crash due to reciprocal tariffs isn't a foregone conclusion, the concerns expressed by the majority of Americans in the REsimpli survey are valid. The potential impact on supply chains, investor behavior, and affordability could create significant headwinds for the housing market. Staying informed, seeking expert advice, and exercising caution are essential for both homebuyers and investors in this uncertain environment.

Work with Norada, Your Trusted Source for Investment

in the Top Housing Markets of the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Read More:

- 4 States Facing the Major Housing Market Crash or Correction

- 5 Cities Where Home Prices Are Predicted To Crash in 2025

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Housing Market Forecast 2025: Affordability Crisis Will Continue

- Lower Mortgage Rates Will Reignite the Housing Demand in 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for the Next 4 Years: 2025 to 2028

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?