As of February 18, 2025, today's mortgage rates have seen a slight decline, making it a good time for buyers and those considering refinancing. This month, the average for a 30-year fixed mortgage is 6.53%, down 15 basis points from earlier this year, while the 15-year fixed rate is now 5.87%, having dropped by 17 basis points. These reductions in rates provide potential homebuyers and those looking to refinance with favorable conditions to lock in lower monthly payments.

Today’s Mortgage Rates February 18, 2025: Rates Drop Slightly

Key Takeaways

- Current Average Rates:

- 30-Year Fixed: 6.53%

- 15-Year Fixed: 5.87%

- 20-Year Fixed: 6.19%

- Refinance Rates:

- 30-Year Fixed Refinance: 6.57%

- 15-Year Fixed Refinance: 5.91%

- Type of Mortgages Available:

- FHA & VA loans are also showing competitive rates.

- Market Insight: Rates are expected to gradually decrease over the year, but significant drops are unlikely in the near future.

Current Mortgage Rates Overview

Today, the national average mortgage rates are as follows for various terms according to Zillow:

| Loan Type | Interest Rate |

|---|---|

| 30-Year Fixed | 6.53% |

| 20-Year Fixed | 6.19% |

| 15-Year Fixed | 5.87% |

| 5/1 ARM | 6.45% |

| 7/1 ARM | 6.40% |

| 30-Year VA | 5.98% |

| 15-Year VA | 5.43% |

| 5/1 VA | 6.05% |

| 30-Year FHA | 5.75% |

| 15-Year FHA | 5.25% |

These rates can vary based on location and the borrower's financial situation, such as credit score and down payment amount.

Today's Mortgage Refinance Rates

Refinance rates today are slightly higher than purchase rates, which is typical. Here are the current average refinance rates:

| Loan Type | Interest Rate |

|---|---|

| 30-Year Fixed | 6.57% |

| 20-Year Fixed | 6.25% |

| 15-Year Fixed | 5.91% |

| 5/1 ARM | 6.51% |

| 7/1 ARM | 6.46% |

| 30-Year VA | 5.92% |

| 15-Year VA | 5.52% |

| 5/1 VA | 5.90% |

| 30-Year FHA | 6.35% |

| 15-Year FHA | 6.00% |

As seen in the tables above, FHA and VA loans are available at competitive rates, making them attractive options for eligible homebuyers.

Impact of Interest Rates on Home Buying Decisions

Understanding the significance of mortgage rates can influence when and how buyers choose to make a purchase. Mortgage rates have a direct impact on monthly payments, overall affordability, and long-term financial commitments. It’s crucial to consider that even a small change in the interest rate can lead to substantial variations in monthly payments and total interest paid over the loan’s life.

For instance, if a borrower takes out a $300,000 mortgage and interest rates drop by 0.25%, the monthly payment could decrease by about $40. Over a 30-year term, this translates to $14,000 less in interest payments. Therefore, many potential homeowners monitor rate trends closely before deciding to lock in a rate.

Monthly Payment Calculations

To help you understand how these rates impact potential monthly payments, here are the calculations for different mortgage amounts at the current 30-year fixed rate of 6.53%.

Monthly Payment on a $150,000 Mortgage

If you secured a $150,000 mortgage at 6.53% for 30 years, your estimated monthly payment for principal and interest would be approximately $948. Over the life of the loan, you would pay about $171,089 in interest alone.

Monthly Payment on a $200,000 Mortgage

For a $200,000 mortgage at the same rate and term, your monthly payment would be around $1,264. By the end of the loan term, total interest paid could amount to approximately $228,678.

Monthly Payment on a $300,000 Mortgage

When it comes to a $300,000 mortgage, the expected monthly payment jumps to roughly $1,896. Interest payments over the life of the mortgage would total about $342,516.

Monthly Payment on a $400,000 Mortgage

Taking out a $400,000 mortgage, you'd be looking at a monthly payment of about $2,528. Total interest payable would be close to $456,354.

Monthly Payment on a $500,000 Mortgage

Finally, for a $500,000 mortgage, it would cost you around $3,210 monthly. Over thirty years, you could end up paying about $570,192 in interest.

These calculations illustrate how mortgage amounts and interest rates directly influence monthly payments and total costs over time.

Recommended Read:

Mortgage Rates Trends as of February 17, 2025

Will Mortgage Rates Go Up as Inflation Surges Back Up to 3%

Will Mortgage Rates Rise Back Above 7% or Go Down in 2025?

Mortgage Rate Predictions for February 2025: Will Rates Drop?

Understanding Fixed vs. Adjustable-Rate Mortgages

A crucial decision for potential homebuyers is whether to choose a fixed-rate or an adjustable-rate mortgage (ARM). With a fixed-rate mortgage, the interest rate remains constant for the entire loan term. This means your monthly payments will not fluctuate, providing stability in budgeting and financial planning.

On the other hand, an adjustable-rate mortgage typically starts with a lower interest rate for an initial period, after which the rate can change based on market conditions. For example, a 7/1 ARM offers a fixed rate for the first seven years, after which it adjusts annually. While ARMs can provide lower initial payments, they carry the risk of increasing payments after the adjustment period.

Homebuyers should weigh the benefits and risks based on their financial situations and how long they plan to stay in the home. For those staying for the long haul, a fixed-rate mortgage may be beneficial, while those looking for a shorter commitment might benefit from an ARM.

The Influence of Market Trends

The slight decline in mortgage rates this month may encourage more buyers to enter the market, particularly before the spring home-buying season, when competition tends to increase. Historically, when interest rates are lower, more people look to buy homes, which can lead to higher prices.

However, it’s important to note that while rates have dropped slightly, they remain historically elevated. Consequently, many potential buyers may still struggle to find the right financing solution that fits their budgets. The current housing market is also characterized by an inventory shortage in many areas, further complicating the buying process for those looking to lock in lower rates.

Economic Factors Underpinning Rate Changes

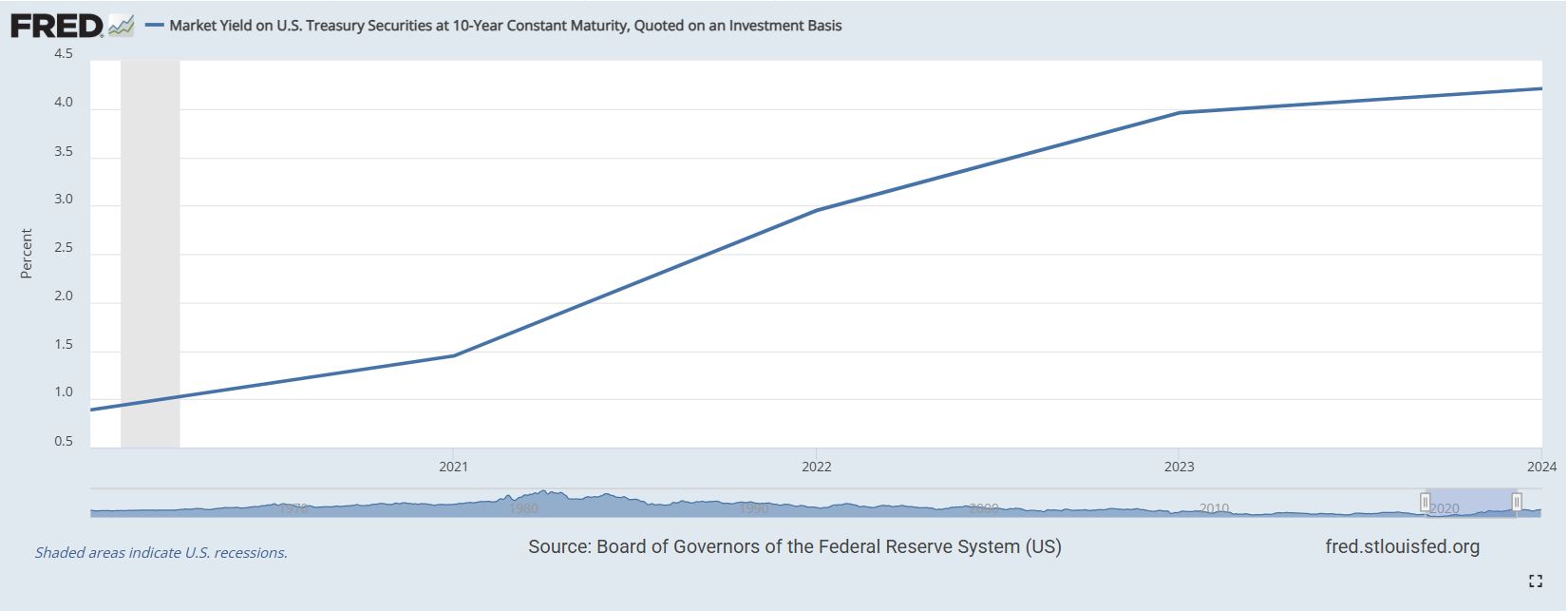

Several economic indicators influence mortgage rates, such as inflation, employment rates, and the Federal Reserve's monetary policy. The recent decisions made by the Federal Reserve regarding interest rates can drastically affect mortgage rates.

For example, in late 2024, due to signs of economic stabilization, the Federal Reserve cut the federal funds rate to spur growth and make borrowing cheaper. Such moves have an immediate impact on mortgages, with lenders adjusting their rates in response. Predicting the Fed's future actions remains critical for any prospective homeowners or those considering refinancing, as these decisions directly affect mortgage rates.

What’s Next for Mortgage Rates?

Looking ahead, the trajectory of mortgage rates will hinge on various economic factors, especially the decisions made by the Federal Reserve regarding interest rates. As of now, experts suggest that while some reductions in mortgage rates might be on the horizon, substantial drops are unlikely anytime soon. The Federal Reserve's recent actions indicate a cautious approach as they navigate inflationary pressures and overall economic stability.

The Mortgage Bankers Association (MBA) has forecasted a slight decrease in mortgage rates over the course of 2025 as inflation begins to moderate. Experts predict that early adopters will likely benefit from better offers, but the competition is expected to increase as more buyers re-enter the market with the uptick in rates.

In conclusion, today’s mortgage and refinance rates present a window of opportunity for potential homebuyers and those considering refinancing. Whether you’re a first-time buyer or looking to upgrade, staying informed about current rates and market conditions is essential for making the best financial decisions.

Work with Norada in 2025, Your Trusted Source for

Real Estate Investing

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Mortgage Rates Predictions for 2025: Expert Forecast

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for 2025: Expert Forecast

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?