As of January 29, 2025, mortgage rates have dipped slightly, with an average rate of 6.67% for 30-year fixed mortgages. Economic shifts, particularly a tech stock sell-off influenced by developments in artificial intelligence, have pushed bond yields lower, contributing to this decrease. This blog post provides you with an in-depth insight into today's mortgage rates, what influences them, and their trends, so you can stay informed about your financing options.

Today's Mortgage Rates: January 29, 2025 – Rates Dip Slightly

Key Takeaways

- Current Average Mortgage Rates:

- 30-Year Fixed: 6.67%

- 15-Year Fixed: 5.97%

- Economic Influences: Recent tech stock volatility affecting bond yields.

- Federal Reserve Watch: Attention on the upcoming Fed meeting for rate outlook changes.

- Refinancing Costs: Changes in rates may prompt refinancing considerations.

- Long-Term Trends: Rates are expected to remain stable but influenced by inflation dynamics and federal policies.

Understanding Today's Mortgage Rates

Mortgage rates fundamentally reflect the cost of borrowing money to purchase or refinance a home. Today’s mortgage rates indicate a modest decline influenced by the recent economic climate, especially the performance of tech stocks and the reaction of bond markets. As of January 29, 2025, here’s how the various mortgage rates break down according to Zillow:

| Mortgage Type | Average Rate Today |

|---|---|

| 30-Year Fixed | 6.67% |

| 15-Year Fixed | 5.97% |

| 20-Year Fixed | 6.38% |

| 7/1 ARM | 6.99% |

| 5/1 ARM | 7.00% |

| 30-Year FHA | 6.29% |

| 30-Year VA | 6.00% |

These rates indicate a slight downward trend from last month, where rates were notably higher, driven by economic uncertainties and ongoing Fed policies.

What Influences Mortgage Rates?

Mortgage rates don’t exist in isolation; they are heavily influenced by a combination of economic indicators and Federal Reserve actions. Key factors that typically affect the rates include:

- Economic Conditions: When the economy is strong, and inflation is rising, mortgage rates tend to increase. Conversely, during economic downturns, rates often decrease as the Fed looks to stimulate spending.

- Federal Reserve Policies: Although mortgage rates are not directly tied to the federal funds rate, they generally follow its lead. The Fed's stance on interest rates sends signals to investors that can impact demand for mortgage-backed securities, subsequently affecting mortgage rates.

- Bond Market Trends: Bond prices and yields are integral to the level of mortgage rates. If bond yields are low, mortgage rates generally decrease since lenders have lower costs and can pass those savings onto their customers.

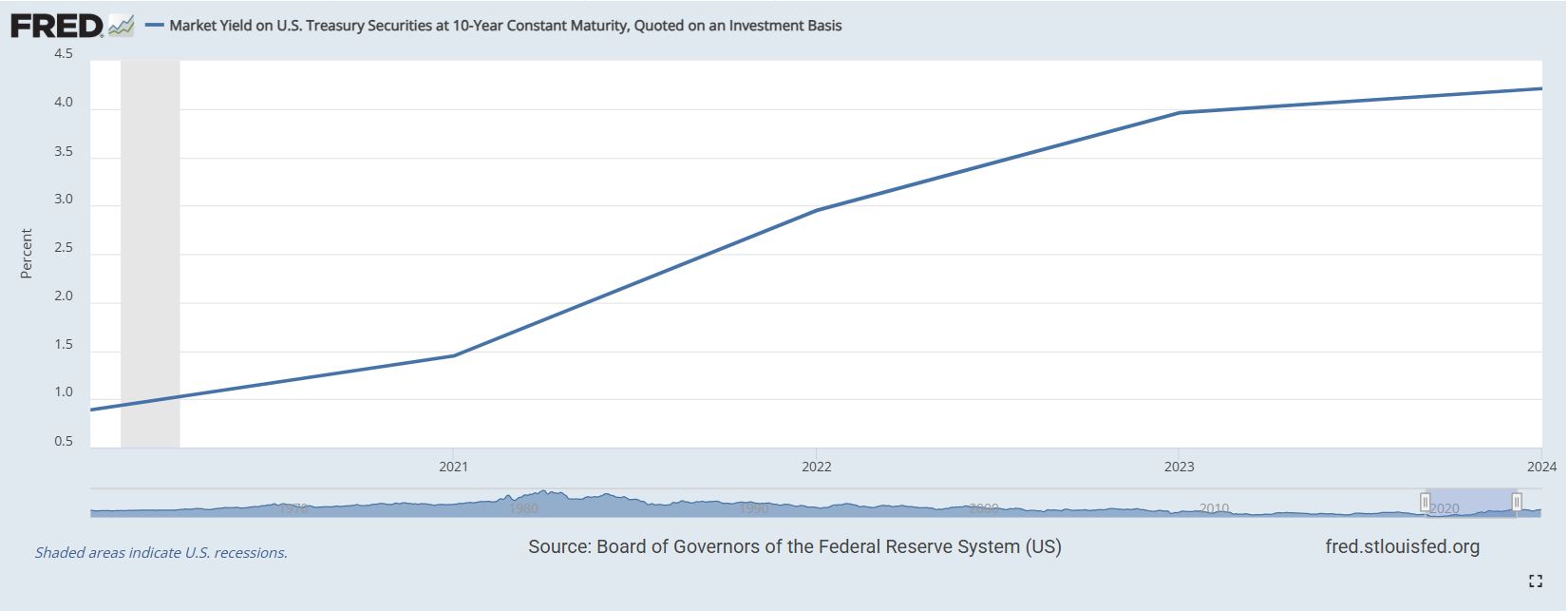

Historical Perspective on Trends

Over the past five years, mortgage rates have seen significant fluctuations, primarily influenced by economic conditions and Federal Reserve decisions. The rapid increases seen in 2022 and parts of 2023 were responses to soaring inflation. However, by the end of 2024, rates began to stabilize as inflation appeared to ease.

| Year | 30-Year Fixed Rate (%) | 15-Year Fixed Rate (%) |

|---|---|---|

| 2020 | 2.75 | 2.25 |

| 2021 | 3.00 | 2.40 |

| 2022 | 4.00 | 3.25 |

| 2023 | 5.50 | 4.20 |

| 2024 | 6.00 | 5.00 |

| 2025 | 6.67 | 5.97 |

This trend suggests a gradual increase in rates following the historical lows experienced during the pandemic but hints at potential easing as inflation stabilizes.

Calculating Your Mortgage Payment

Understanding how mortgage rates affect your monthly payment is crucial for prospective homeowners. For example, if you are taking out a $300,000 mortgage at an interest rate of 6.67% over 30 years, your monthly payments would approximately break down as follows:

- Principal and Interest Payment: $1,161

- Total Payment (Interest & Principal): Approximately $1,896 for the first month.

Here’s a simplified amortization to illustrate how payments transition over time:

- In the first month: Approximately $1,625 goes toward interest, and only $271 pays off the principal.

- After 20 years: Approximately $905 toward interest and $992 reduces the principal.

This illustrates that although your payment remains constant, how much goes to interest versus principal changes significantly over time.

The Federal Reserve and Its Impact

The Federal Reserve's decisions have a considerable impact on mortgage rates, even if indirectly. Recently, the Fed decided to maintain the federal funds rate at its current level, signaling caution about the economic outlook ahead of its next meeting. This pause hints at a strategy to balance economic growth against inflation rates, which are still higher than desired.

In 2024, the Fed lowered rates three times in an effort to boost economic activity amid rising inflation pressures. Many economists expect that the Fed may only cut rates moderately in 2025, which could prevent significant drops in mortgage rates. The expected trajectory could keep average mortgage rates within the range of 5.75% to 7.25% this year.

Recommended Read:

Mortgage Rates Trends for January 28, 2025

Mortgage Rate Predictions Next Week: Jan 27 to Feb 2, 2025

Current Refinancing Landscape

With rates hovering around 6.67%, many homeowners are contemplating refinancing their existing mortgages to capitalize on lower rates. Refinance rates vary just slightly from purchase rates, creating an appealing option for those looking to reduce monthly payments or access home equity.

| Refinance Type | Average Rate Today |

|---|---|

| 30-Year Fixed | 6.69% |

| 15-Year Fixed | 6.05% |

| 20-Year Fixed | 6.38% |

| 7/1 ARM Refinance | 7.29% |

| 5/1 ARM Refinance | 7.28% |

| 30-Year FHA | 6.13% |

| 30-Year VA | 6.09% |

Consideration for Refinancing: It’s generally advised to refinance if you can lower your rate by at least a full percentage point. Homeowners also need to evaluate whether the reduction in monthly payments offsets the closing costs associated with refinancing.

Future Mortgage Trends: 2025 and Beyond

As we move forward into 2025, experts predict that the direction of mortgage rates will be influenced by several intertwined economic factors:

- Slow Inflation: As inflation appears to stabilize, there may be room for mortgage rates to ease slightly, but it is expected that they won't return to the lows experienced during the pandemic.

- Geopolitical Instability: Any factor affecting global oil prices or political tensions can introduce volatility into bond markets, influencing mortgage rates.

- Consumer Confidence: If economic indicators show improved consumer sentiment and spending, that could lead to an increase in borrowing and, subsequently, an uptick in rates.

Overall, housing market dynamics are also key. The ongoing supply shortages in many areas may exert upward pressure on both home prices and demand for mortgages, keeping the rates fluctuating throughout the year.

Summary:

Today’s mortgage environment presents both challenges and opportunities for homebuyers and existing homeowners looking to refinance. With rates sitting at around 6.67% for a 30-year mortgage, potential buyers should carefully assess their options while keeping an eye on the economic factors that influence mortgage rates.

By gaining a better understanding of how these rates are shaped by broader economic trends, buyers can make informed decisions that best suit their financial goals. As always, shopping around for different lenders and comparing offers will help you secure the most favorable terms for your new mortgage or refinancing venture.

Work with Norada in 2025, Your Trusted Source for

Real Estate Investing

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Mortgage Rates Predictions for 2025: Expert Forecast

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for 2025: Expert Forecast

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?