Well, this is the question everyone's asking right now. With the recent implementation of widespread reciprocal tariffs, including a 10% baseline on almost all imports and much higher rates on goods from countries like China, the EU, and Japan, the air is thick with worry. Will these new tariffs crash the stock market and economy?

The short answer, based on what we're seeing and what history tells us, is a strong yes, there's a very real risk of significant damage to both. The sheer scale and breadth of these tariffs are unlike anything we've seen in a long time, and the initial reactions from the markets and economists are painting a concerning picture. Let's dig deeper into why this could be the case.

Will the New Tariffs Crash the Stock Market and Economy?

Understanding the Scope and Intent Behind Trump's Tariffs

President Trump has made it clear that these tariffs are meant to be a powerful tool. He frames them as a way to bring back American manufacturing, reduce our trade deficit (which stood at a massive $1.2 trillion in 2024), and ultimately make America the dominant economic force once again. This isn't a surgical approach like some of his earlier tariffs on steel or specific Chinese goods. This time, it's a much wider net, hitting imports from almost every corner of the globe.

The idea behind what his administration calls “reciprocal tariffs” is to mirror the trade barriers that they believe other countries unfairly impose on American goods. They're targeting not just direct tariffs but also things like currency manipulation and different regulations that they see as hurdles for U.S. exports. Beyond the economic arguments, some of the earlier tariffs this year, like those on Canada and Mexico, were even tied to issues like immigration and the flow of illegal drugs.

Listening to President Trump's announcements, you hear a strong sentiment that America has been taken advantage of for too long. He talks about other countries “looting” and “plundering” our economy. His promise is a revitalization of American manufacturing and a new economic “boom” fueled by these tariffs. While that's a compelling vision, the immediate response from the financial world and the expert analysis suggest that the path to that boom might be paved with significant trouble.

The Stock Market's Wild Reaction: A Sign of Deeper Concerns

Since President Trump's election in late 2024, the stock market has been on a rollercoaster. Initially, there was a wave of optimism, fueled by promises of deregulation and tax cuts that are typically seen as good for business. We saw the S&P 500 and Nasdaq reaching new highs. However, that initial enthusiasm has definitely faded as these tariff threats have become reality.

The day after these broad reciprocal tariffs were announced on April 2nd, 2025, was a stark reminder of the market's anxieties. The S\&P 500 plunged by 4.8%, the biggest single-day drop since the early days of the pandemic in June 2020. That one day alone wiped out a staggering $2.4 trillion in market value. The Nasdaq took an even bigger hit, falling by 6%, and Dow futures were down by over 1,000 points. By March 11th, the S\&P 500 had erased all its gains since the election, officially entering correction territory (a drop of 10% or more from its recent peak).

Looking at specific companies gives you a clearer picture of the impact. Major multinational corporations like Nike, Apple, and Stellantis, which rely heavily on global supply chains, saw significant drops in their stock prices. Retailers like Five Below and Dollar Tree, which depend on imported goods to keep their prices low, were hit even harder. Even tech giants like Nvidia and Tesla, despite their more domestic focus, weren't immune.

Why this sell-off? Well, tariffs essentially increase the cost of bringing goods into the country. This squeezes the profit margins of companies unless they can successfully pass those higher costs onto consumers. But if they do that, it risks reducing demand for their products. Adding to this is the unpredictable nature of President Trump's trade policy.

The constant shifts and threats create a huge amount of uncertainty, and as David Bahnsen, a chief investment officer at the Bahnsen Group, rightly pointed out, “The market volatility is much less about the bad news of tariffs and much more about the uncertainty.” Investors hate not knowing what's coming next, and these tariffs have definitely delivered a heavy dose of unpredictability.

The Broader Economic Implications: Growth, Inflation, and the Shadow of Recession

The worries extend far beyond just the stock market. Economists generally agree that tariffs act like a tax on imports, and ultimately, those costs get passed on to businesses and consumers in some way. The Tax Foundation, even before these latest tariffs, estimated that President Trump's earlier proposal of a universal 20% tariff could shrink the U.S. GDP by 0.7% and cost the average American household around $1,900 per year, before any retaliation from other countries. Given that these new tariffs average around 16.5% across all imports – the highest we've seen since 1937 – the potential economic damage could be even more severe.

Think about specific industries. The auto industry, with its deeply interconnected supply chains across North America, could see a big impact from the 25% tariff on Canadian and Mexican goods. Experts estimate this could add around $3,000 to the price of a car. Our grocery bills could also rise significantly.

Mexico supplies over 60% of the vegetables we import and nearly half of our imported fruits and nuts. Tariffs on these goods will likely translate to higher prices at the supermarket. Even the housing market, already struggling with material shortages, could become more expensive with tariffs on things like Canadian lumber and Mexican gypsum. As Erica York of the Tax Foundation put it, “No matter what channel the price impact takes, it’s Americans who are hurt.”

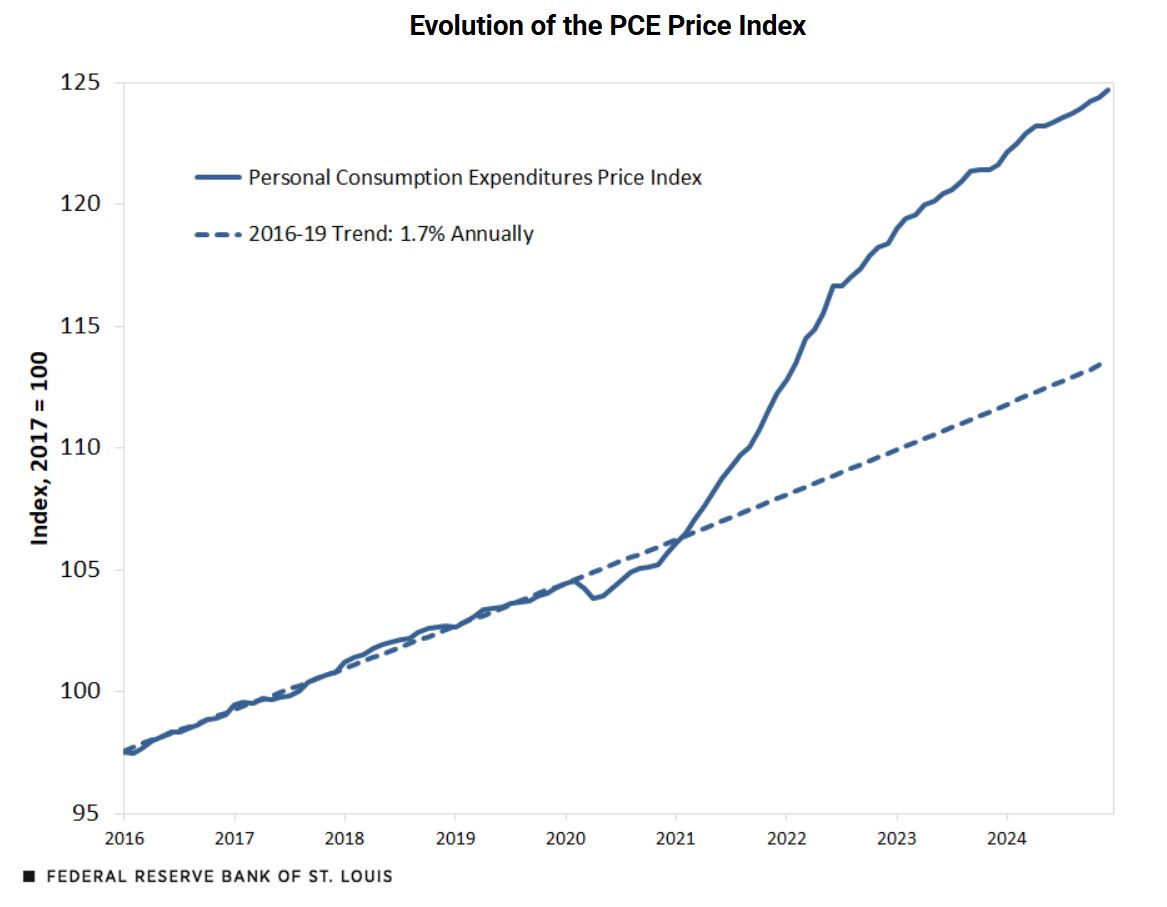

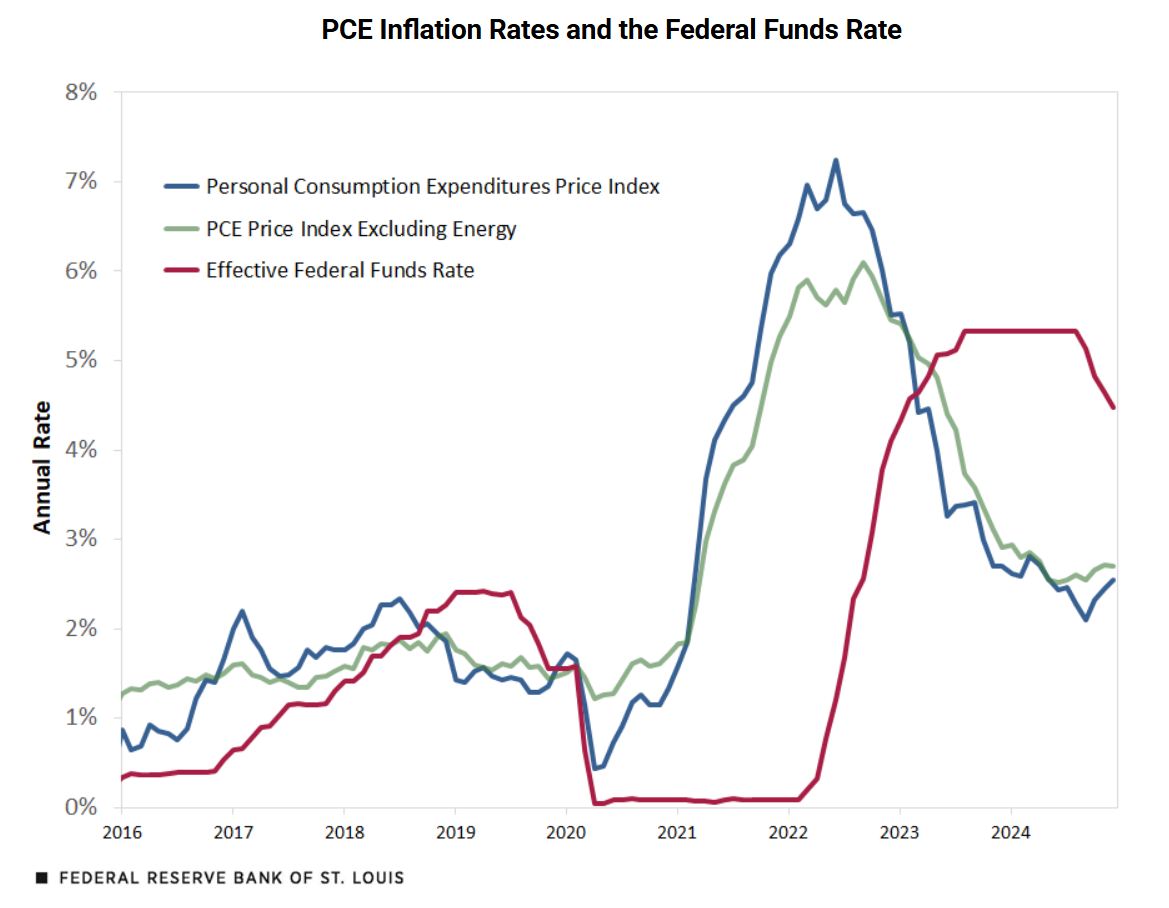

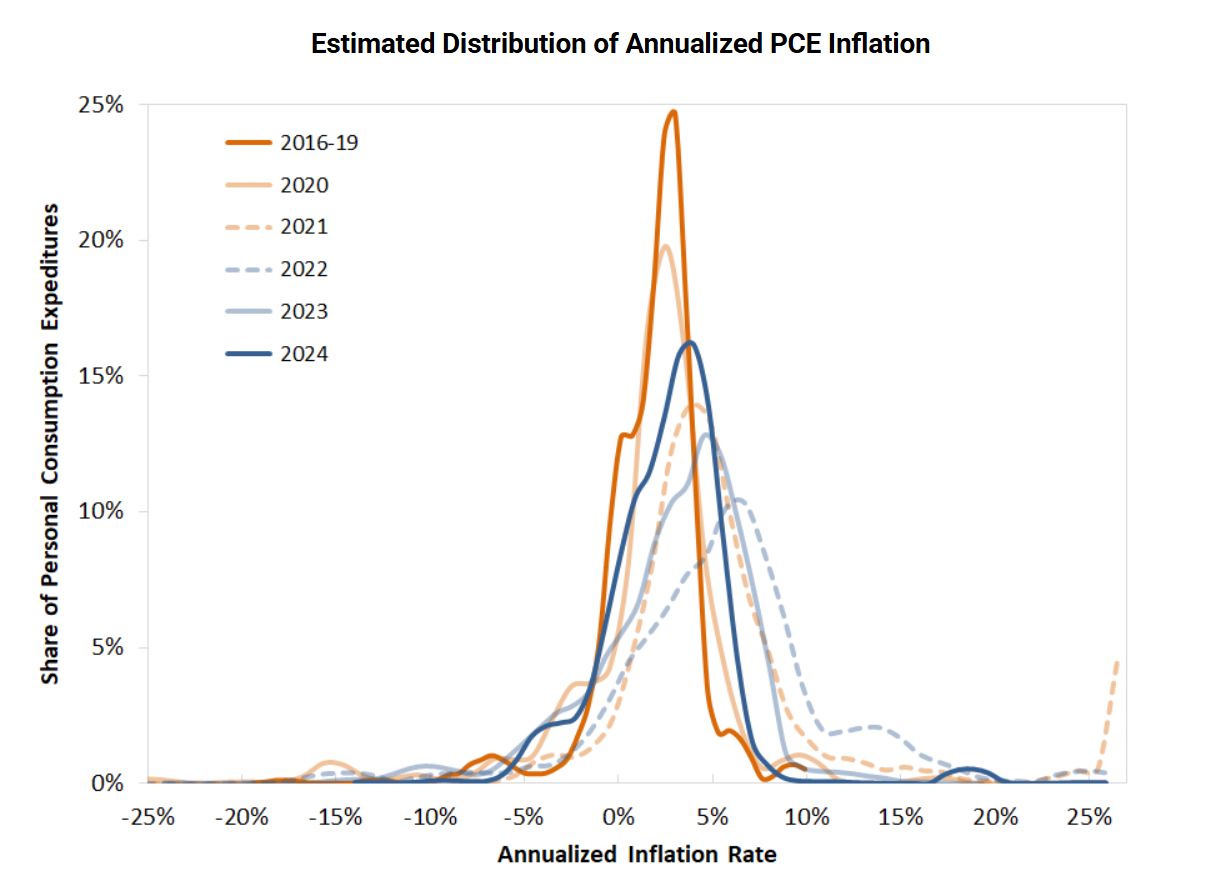

Then there's the very real threat of inflation. A survey by the University of Chicago earlier this year found that consumers expected the prices of imported goods to rise by 10% and domestic goods by 14% within a year under a hypothetical 20% tariff. If businesses do pass on these higher costs, it could reignite inflation, making the Federal Reserve's job of managing prices even harder.

And let's not forget about retaliatory tariffs. China, the EU, and other trading partners have already announced or threatened to impose their own tariffs on American goods. This would hurt U.S. exporters, like our farmers selling soybeans and corn, and manufacturers of things like aircraft and machinery.

The big question looming over everything is whether these tariffs could push the U.S. economy into a recession. Kathy Bostjancic of Nationwide predicts that with retaliation, U.S. GDP growth could fall to just 1% in 2025, down from 2.5% in 2024. JP Morgan is now putting the odds of a global recession by the end of the year at 60%, up from 40%.

Businesses facing higher costs and a lot of uncertainty might decide to hold off on hiring new people or investing in their operations. Consumers, seeing higher prices and feeling less secure, might cut back on their spending. As Peter Ricchiuti of Tulane University wisely said, “It’s a self-fulfilling prophecy. If you think a recession is coming, you stop capital expenditures, you don’t hire, and then you work yourself into one.”

The Counterargument: Tariffs as a Tool for Economic Leverage

Of course, President Trump and his supporters argue that these fears are overblown. They often point to his first term, where tariffs on steel, aluminum, and some Chinese goods, they say, led to increased domestic investment (like the $15.7 billion in new steel facilities) and job creation without causing runaway inflation. A 2024 study by the Economic Policy Institute even claimed “no correlation” between those earlier tariffs and overall price increases.

Commerce Secretary Howard Lutnick argues that by opening up foreign markets to American goods, these tariffs will actually lead to lower grocery prices in the long run. Vice President JD Vance frames the tariffs as a matter of national security, essential for rebuilding our domestic manufacturing capabilities.

The administration also emphasizes that there are exemptions in place, such as for goods compliant with the USMCA trade agreement and for certain critical minerals. President Trump himself tends to dismiss any market downturns, confidently predicting a future economic boom: “The markets are going to boom, the stock is going to boom, and the country is going to boom.” His supporters see these tariffs as a necessary negotiating tactic, putting pressure on both allies and adversaries to lower their own trade barriers or face the consequences.

The Global Reaction: Trade Wars and Shifting Alliances

The ultimate impact of these tariffs will depend heavily on how the rest of the world responds. We're already seeing China retaliate with tariffs on American goods like soybeans and pork, a familiar move from the previous trade tensions. The European Union, facing a 20% tariff, is considering its own countermeasures but seems to prefer negotiation, with Ursula von der Leyen calling the tariffs “a blow to the world economy.” Canada's Justin Trudeau and Mexico's Claudia Sheinbaum have also hinted at potential tit-for-tat actions. Even Japan, despite a 24% tariff, seems to be taking a more cautious approach for now, likely wary of upsetting its crucial alliance with the U.S.

The danger here is a full-blown trade war. This could significantly reduce the volume of international trade and slow down global economic growth. Smaller economies that rely heavily on exports to the U.S., like Lesotho in textiles, could face severe economic hardship. Even our allies, like South Korea and Taiwan (hit with 25% and 32% tariffs respectively), might start to reconsider their strategic relationships if they feel unfairly targeted. Alienating key partners could also undermine President Trump's broader geopolitical goals, especially when it comes to countering China's growing influence.

My Take: A Risky Gamble with Potentially High Costs

Looking at all the evidence, it's hard for me to be optimistic about the economic impact of these new tariffs. While the goal of strengthening American manufacturing and reducing trade imbalances is understandable, this broad, aggressive approach feels like a very risky gamble.

In the short term, I expect the stock market to remain volatile. The uncertainty alone is enough to keep investors on edge. We've already seen significant drops, and further retaliatory actions from other countries will likely add to the downward pressure. While markets can recover from shocks, the level of disruption these tariffs could cause is substantial.

Economically, the risks seem even greater. Higher prices for consumers are almost inevitable, which could put a strain on household budgets that are already dealing with inflation. Businesses will face increased costs, which could lead to reduced investment and hiring. The threat of a recession is definitely looming larger with these new trade barriers in place.

While the argument that tariffs can be a useful negotiating tool has some merit, the scale and scope of these tariffs feel more like a sledgehammer than a finely tuned instrument. The potential for unintended consequences and the risk of escalating trade disputes with multiple countries simultaneously are significant.

Ultimately, whether these tariffs will “crash” the stock market and economy is difficult to say with absolute certainty. There are many factors at play. However, based on the initial market reaction, the analysis from numerous economists, and historical precedents of trade wars, the probability of significant negative impacts is high. For everyday Americans, this could mean higher prices and a more uncertain economic future. For investors, navigating this period will likely require caution and a long-term perspective. This is a high-stakes experiment, and I'm worried that the costs could outweigh any potential benefits.

Work With Norada – Build Wealth

With economists warning of stagflation and weak Q1 GDP due to tariffs, now is the time to invest in stable, income-generating real estate for financial security.

Norada’s turnkey rental properties provide consistent cash flow and long-term wealth, no matter the economic climate.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Read More:

- Stagflation Alert: Economist Survey Predicts Weak Q1 GDP Due to Tariffs

- Goldman Sachs Significantly Raises Recession Probability by 35%

- 2008 Crash Forecaster Warns of DOGE Triggering Economic Downturn

- Stock Market Predictions 2025: Will the Bull Run Continue?

- Stock Market Crash: Nasdaq 100 Tanks 3.5% Amid AI Concerns

- Stock Market Crash Prediction With Huge Discounts on Bitcoin, Gold, Houses

- S&P 500 Forecast for the Next Year: What to Expect in 2025?

- Stock Market Predictions for the Next 5 Years

- Echoes of 1987: Is Today’s Stock Market Crash Leading to a Recession?

- Is the Bull Market Over? What History Says About the Stock Market Crash

- Wall Street Bear Predicts a Historic Stock Market Crash Like 1929

- Economist Predicts Stock Market Crash Worse Than 2008 Crisis

- Next Stock Market Crash Prediction: Is a Crash Coming Soon?

- Stock Market Crash: 30% Correction Predicted by Top Forecaster