Is the dream of Florida living fading? The short answer, and what you need to know right away, is: yes, the Florida housing market is indeed on the brink. After years of explosive growth and soaring prices, the Sunshine State is facing a complex mix of affordability crises, a shaky insurance market, and infrastructure strains that are making many wonder if paradise is becoming unaffordable, unsustainable, and even uninsurable. The allure of low taxes and warm weather that once drew millions is now being tested by a harsh reality: the Florida dream might be slipping out of reach for many.

Is the Florida Housing Market on the Verge of Collapse or a Crash?

For years, I've watched Florida blossom, transforming from a sleepy retirement haven into a bustling hub attracting people from all walks of life. Snowbirds escaping winter's chill, families seeking opportunity, and younger professionals priced out of other markets – Florida seemed to have it all.

Between 2021 and 2023, nearly 2.76 million people flocked here, turning Florida into the third most populous state in the nation. It was a boomtown, pure and simple. But recently, the vibe has shifted. The sunny optimism has been tempered by a growing unease, a feeling that the rapid growth is starting to crack under its own weight.

The whispers are getting louder. Are home prices too high? Is insurance cripplingly expensive? Are the roads and schools becoming overwhelmed? And are the very hurricanes that define Florida now posing an existential threat to its housing market?

These aren't just casual concerns anymore; they're the questions echoing across kitchen tables and community forums throughout the state. And honestly, based on what I’m seeing, they're not just whispers – they're warning signs blinking red.

Has Paradise Lost its Price Point?

Florida's rise has been nothing short of meteoric. Think back just a few decades. It was the place you went to escape high taxes and the crazy costs of states up north. It was the land of sunshine, beaches, and relatively affordable living. That image fueled a massive influx of people, and it worked incredibly well for a long time. But somewhere along the way, the script flipped.

As Cotality Chief Economist Selma Hepp aptly points out, “The last 25 years have seen home prices, homeowners’ insurance, and property taxes surge in Florida.” She’s not wrong. It’s a triple whammy that’s hitting Floridians hard.

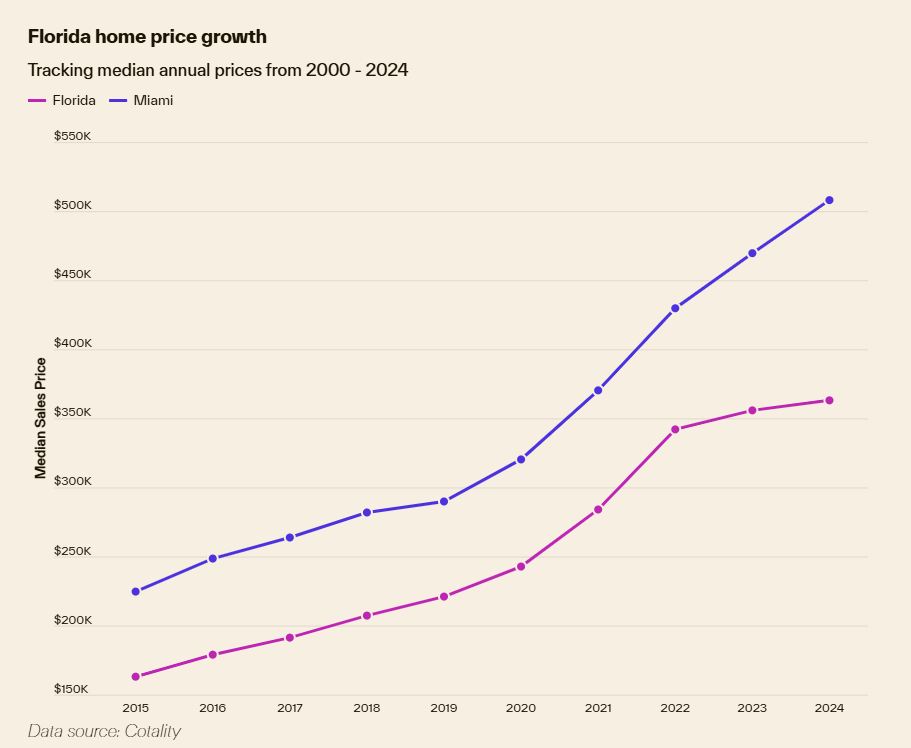

It's not just the raw numbers; it's the speed at which things have changed. Looking back at the data, it's almost dizzying. Florida home prices have not just crept up; they've galloped ahead, outpacing the national average. And Miami? Miami is in a league of its own, with home prices a staggering 60% above the Florida average. Let that sink in for a moment. Sixty percent! It’s like we’re talking about two different states entirely.

| Metric | Florida Median Home Price (Oct 2024) | Miami Median Listing Price (Oct 2024) |

|---|---|---|

| Median Home Price | $393,500 | $629,575 |

| Difference from State Avg | – | +60% |

And it's not just buying; renting is becoming just as painful. In Miami, the median rent for a single-family home hit nearly $3,000 in August 2024. Combine that with general inflation and the fact that housing is still scarce, and you have a perfect storm for affordability issues. Nearly a third of Floridians are renters, and they are feeling this squeeze intensely.

The Migration Magnet – But For How Long?

Despite the rising costs, people are still coming. In 2023, nearly a million people moved to Florida. Why? Well, the low-tax, pro-growth policies are still a powerful draw. Florida, especially under the recent political climate, has become a magnet for businesses and individuals seeking a different economic and political environment. Miami, in particular, has transformed into a “Magic City” – flush with tech investments, billionaires, and global icons like Lionel Messi and Jeff Bezos. Miami-Dade County alone accounted for over 15% of the state's GDP in 2022. That's serious economic power.

But here’s the rub: this influx of wealth is a double-edged sword. These newcomers bring innovation and jobs, but they also bring deeper pockets, further distorting the housing market. Baby boomers with retirement savings and high-income earners from other states are competing for the same homes as younger, middle-income Floridians. The result? Affordability is becoming a distant memory for many.

Consider this: between 2018 and 2022, Florida’s housing market was on fire. Sales volume exceeded even the peak of the 2005 housing boom. Demand was insatiable, pushing prices to levels that are now simply out of reach for many long-term residents. It’s a classic case of too much demand chasing too little supply, amplified by the allure of the Florida lifestyle.

Miami's Magic – Fading Fast for Locals?

Miami is the poster child for this boom and bust cycle. It's become an economic engine for the state, no doubt. But living in Miami now requires serious cash. Basic goods are 20% more expensive than they were in early 2020, and housing costs have skyrocketed by 29%. Meanwhile, wages in Miami haven't kept pace, increasing by only 21% during the same period. This math just doesn’t add up for many people.

There’s a growing divide in Miami. Newcomers are often high-income earners, making 59% more on average than the city's median income. They can absorb these higher prices. But for long-term residents, the squeeze is unbearable. They are getting priced out of the very city they helped build. Pete Carroll from Cotality puts it perfectly: “The influx of high-income residents to Miami… has fueled economic growth, real estate development, and infrastructure investments, but it has also driven up housing costs and deepened income gaps, making it harder for long-time residents to afford living in the city.”

This is driving a secondary migration within Florida itself. Between 2019 and 2023, over 500,000 people moved within Florida to cheaper markets like Tampa, Jacksonville, and Orlando. People are desperately searching for affordability, even if it means staying in the same state.

| City | 2019-2020 Growth | 2020-2021 Growth | 2021-2022 Growth | 2022-2023 Growth |

|---|---|---|---|---|

| Jacksonville | 51,175 | 28,760 | 34,588 | 36,911 |

| Orlando | 72,218 | 18,469 | 64,057 | 54,916 |

| Tampa | -12,292 | 42,246 | 61,267 | 51,622 |

However, even these “cheaper” cities are feeling the pressure. Prices in Tampa and Jacksonville have jumped by 50% or more in just the last five years. Orlando, despite its huge employment base driven by Disney, has seen prices rise by 50% between 2020 and 2024. The search for affordable havens within Florida is becoming a game of whack-a-mole; as soon as one area becomes attractive, prices skyrocket, pushing affordability further out of reach.

The Construction Conundrum and Infrastructure Inadequacy

New construction was once seen as the solution to Florida's housing woes. Build more homes, and prices will stabilize, right? Unfortunately, it's not that simple anymore. Permitting activity actually fell in both 2022 and 2023. Why? A cocktail of factors: labor shortages, rising material costs, and regulatory delays are all conspiring to slow down construction. Tariffs on imported materials are just adding fuel to the fire, making developers hesitant to start new projects.

This lack of new construction is exacerbating the price problem. It’s basic economics: limited supply and high demand will always lead to higher prices. And it’s not just homes that are lagging; Florida’s infrastructure is also struggling to keep pace. Every year, Florida adds the population equivalent of a city the size of Tampa. But the roads, schools, and utilities are not expanding at the same rate.

Think about your daily commute. Roads are more congested than ever. Commute times in Florida have increased by over 11% in the last decade, despite massive investments in road expansions. In Miami and Orlando, traffic congestion costs commuters an extra $1,000 per driver every year – just to sit in traffic!

Schools are also showing their age. The average school building in Florida is now 31 years old. Funding for renovations is scarce, leading to a rise in private school enrollment, which further drains resources from the public system. Families are faced with a tough choice: accept aging public schools or pay extra for private education, further straining already tight budgets.

And let’s not forget water. Drinking water infrastructure is aging and inadequate. Unlike traffic jams and crowded schools, failing water systems pose a direct threat to public health. The cost of upgrading these systems is enormous, and cities are struggling to balance these critical needs with other budget demands.

These infrastructure strains aren't evenly distributed across the state, but with Tampa, Orlando, and Jacksonville all booming, the pressure is mounting. Overburdened infrastructure is not just an inconvenience; it's a quality of life issue, and it's becoming a major deterrent for people considering Florida as a long-term home.

Hurricane Hazard and Insurance Havoc

And then there's the elephant in the room – hurricanes. Florida is hurricane alley. And with climate change intensifying these storms, they are becoming a more frequent and severe threat. Hurricane Milton's near miss in Tampa in 2024 was a stark reminder of just how vulnerable even the less-storm-prone west coast of Florida is.

As Selma Hepp explains, “While Florida’s metros have topped the list of hottest appreciating housing markets in recent years, the increasing costs of persistent natural disasters and consequent pressure on insurance expenses and rebuilding costs are starting to weigh on home prices in west Florida.” She points to Cape Coral as an example, where home prices actually declined last year due to these issues.

Hurricane damage is devastating, and the financial fallout is immense. Many homeowners are underinsured, especially lower-income families. Policies often don’t cover the full replacement value of a home, or extras like pools and fences. And if you have to evacuate, flood insurance often doesn't cover additional living expenses. This can push families into foreclosure, leaving neighborhoods vulnerable to wealthier buyers looking for bargain properties – albeit risky ones.

The insurance market in Florida is in crisis. Premiums have skyrocketed – up 60% on average between 2019 and 2023. It’s not just homeowners feeling the pain; insurance companies are also under immense pressure. The frequency and severity of storms have led to a surge in claims, just as material and labor costs for repairs have also soared post-pandemic.

Florida has seen 18 billion-dollar hurricane disasters since the start of this decade. And the future looks even riskier. Cotality analysis shows that Monroe County in the Florida Keys will be the fourth-riskiest place to live in the US for natural disasters in the next 30 years, primarily due to hurricane risk. Miami and Naples are among the top cities with the most homes facing a “triple threat” – flood, wind, and hurricane risk combined.

This escalating risk is causing insurance companies to flee. Farmers Insurance, Bankers Insurance, and Lexington Insurance (AIG subsidiary) have all pulled back or withdrawn from Florida in recent years. AAA is also non-renewing some policies. They cite the rising costs of reinsurance, increased claims due to inflation, and excessive litigation as reasons for their retreat.

Where does this leave homeowners? Many are forced to rely on state and federal programs like the National Flood Insurance Program (NFIP). But even these programs are facing questions about their long-term sustainability given the rising costs of disasters. Florida alone received over $15 billion in FEMA aid between 2017 and 2019, and over $1 billion for recent hurricanes.

Building Codes: A Partial Shield, Not a Silver Bullet

While there's no magic wand to fix the insurance crisis, stronger building codes are helping. Florida has some of the best building codes in the country, and they have undoubtedly saved homes and billions of dollars. However, these codes aren't retroactive. Millions of older homes remain vulnerable. Retrofitting older homes to meet modern codes is expensive, further adding to the cost burden in an already pricey market.

Jay Thies from Cotality highlights the balancing act: “Building codes require a balancing act between costs and resilience… In some cases… the extra costs are unquestionably worth it… In other cases, ambiguity exists between the high costs and measurable benefits. In these instances, favoring affordable construction can be a beneficial choice to keep housing accessible to a wider range of buyers.”

The question becomes: Do we prioritize affordability today, potentially at the cost of future resilience? It’s a tough choice, but mitigating future hurricane losses is critical to stabilizing the insurance market and the long-term viability of Florida living.

The Great Florida Migration – Coming Undone?

Is Florida losing its shine? It’s no longer just the place people are flocking to; it’s starting to become a place people are looking to leave. While Florida still sees more arrivals than departures, the balance is shifting. Mortgage applications from both inside and outside the state are declining. More Floridians are applying for loans to buy homes outside of Florida, particularly in neighboring states.

Cotality analysis reveals that 48% of mortgage applications from outbound Floridians are for properties in Georgia, North Carolina, South Carolina, Tennessee, and Texas. These states offer relative affordability and less exposure to natural hazards compared to Florida.

| State | Share of FL Residents Applying for Loans |

|---|---|

| Georgia | 15% |

| North Carolina | 10% |

| Texas | 8% |

| Tennessee | 8% |

| South Carolina | 7% |

As Selma Hepp notes, “Florida’s rapid price appreciation combined with soaring home insurance prices and the threat of hurricanes has led people to start looking at other nearby states… they are seeking the ingredients that made Florida so prosperous in the first place.”

These neighboring states are starting to see the influx. Housing prices in most of them are already outpacing the national average. Texas, after a pandemic-era boom, is recalibrating, but it and the other southern states are attracting major businesses and job growth, further fueling their housing markets.

Miami's cautionary tale should be a wake-up call. If Florida doesn't address affordability, infrastructure, and insurance, the trickle of outbound movers could become a flood. The state risks following California's path – a slow-boil exodus driven by unsustainable costs and quality of life issues.

California saw 6.5 million people leave in the decade leading up to 2023. Insurance premiums there rose by almost 90%, and housing prices skyrocketed. The median home price in California jumped from $380,501 in the mid-2000s to $621,501 by 2023. Natural disasters and soaring insurance costs pushed many over the edge.

Florida is showing similar trends. People are already moving to more affordable parts of Florida, like Port St. Lucie, Palm Bay, Jacksonville, and Orlando, seeking refuge from Miami's insane prices. But even these areas are becoming less affordable by the day.

Is There Still Time to Turn the Tide?

Florida's story isn't over yet. But the state is at a critical juncture. State lawmakers and businesses need to take these warning signs seriously. They need to find solutions to the affordability crisis, address the insurance market meltdown, and invest in infrastructure to support sustainable growth. Time is running out. People seeking a better quality of life, affordable homes, and reliable insurance can’t wait years for solutions.

The question isn't just whether Florida's housing market is on the brink, but whether the Florida dream itself is on the brink. Can the Sunshine State adapt and address these challenges, or will it become a cautionary tale of boom and bust, of paradise lost to its own success? The answer to that question will determine Florida’s future, and frankly, the future looks uncertain right now.

Work with Norada, Your Trusted Source for

Real Estate Investment in “Florida Markets”

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Read More:

- 3 Florida Cities at High Risk of a Housing Market Crash or Decline

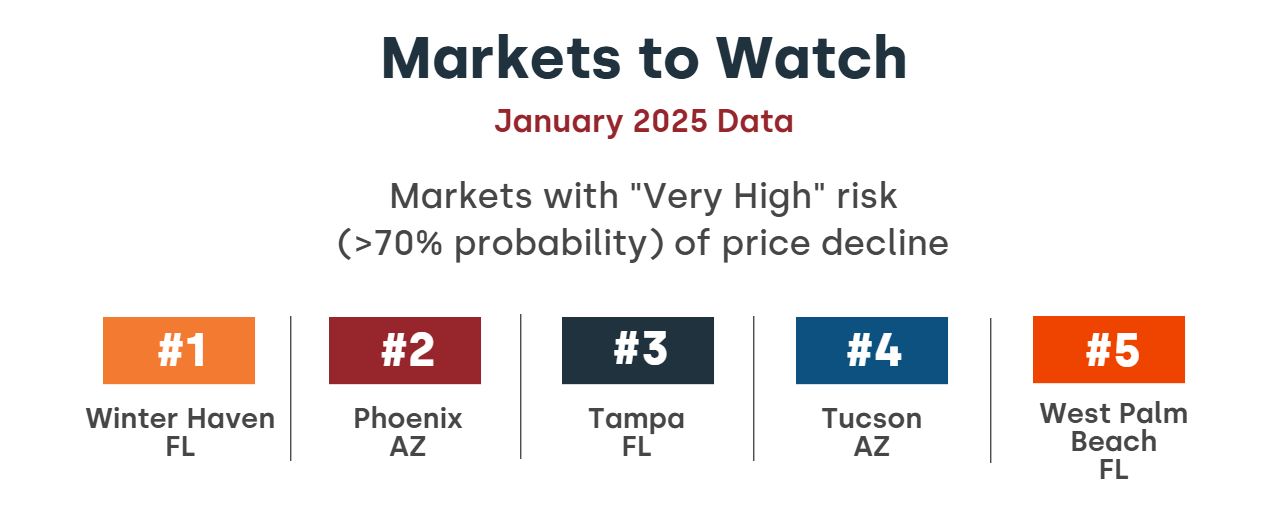

- 4 States Facing the Major Housing Market Crash or Correction

- Florida Housing Market: Record Supply Expected to Favor Buyers in 2025

- Florida Housing Market Forecast for Next 2 Years: 2025-2026

- Florida Real Estate Market Saw a Post-Hurricane Rebound Last Month

- Florida Housing Market: Predictions for Next 5 Years (2025-2030)

- Hottest Florida Housing Markets in 2025: Miami and Orlando

- Florida Real Estate: 9 Housing Markets Predicted to Rise in 2025

- Housing Markets at Risk: California, New Jersey, Illinois, Florida

- 3 Florida Housing Markets Are Again on the Brink of a Crash

- Florida Housing Market Predictions 2025: Insights Across All Cities

- Florida Housing Market Trends: Rent Growth Falls Behind Nation

- When Will the Housing Market Crash in Florida?

- South Florida Housing Market: Will it Crash?

- South Florida Housing Market: A Crossroads for Homebuyers