Are you thinking about buying a new home? Well, you're in luck, because right now, the new home sales market is showing some really interesting trends. In short, it’s looking like a good time to explore new construction, with increasing sales, improving inventories, and some relief from those dreaded mortgage rates potentially on the horizon. Let’s dive deep into what’s happening in the world of new home sales and what it could mean for you.

New Home Sales, commonly referred to as “new residential sales,” is an economic indicator that tracks the sale of newly constructed residences. It is extensively watched by investors since it is seen as a lagging signal of real estate market demand and, thus, a factor influencing mortgage rates. Household income, unemployment, and interest rates are all variables that influence it.

The United States Census Bureau releases two versions of the New Home Sales metric: a seasonally adjusted figure and an unadjusted one. The adjusted value is shown as a yearly total, whereas the unadjusted figure is presented as a monthly total. These numbers are provided for several areas and the entire nation.

New home sales are completed when a sales contract or deposit is signed or accepted. In any stage of construction, the home might be: not yet started, in the process of being built or fully finished. About 10% of the US housing market is made up of new house sales. Preliminary numbers for new single-family home sales are subject to major changes because they are mostly based on data from construction permits.

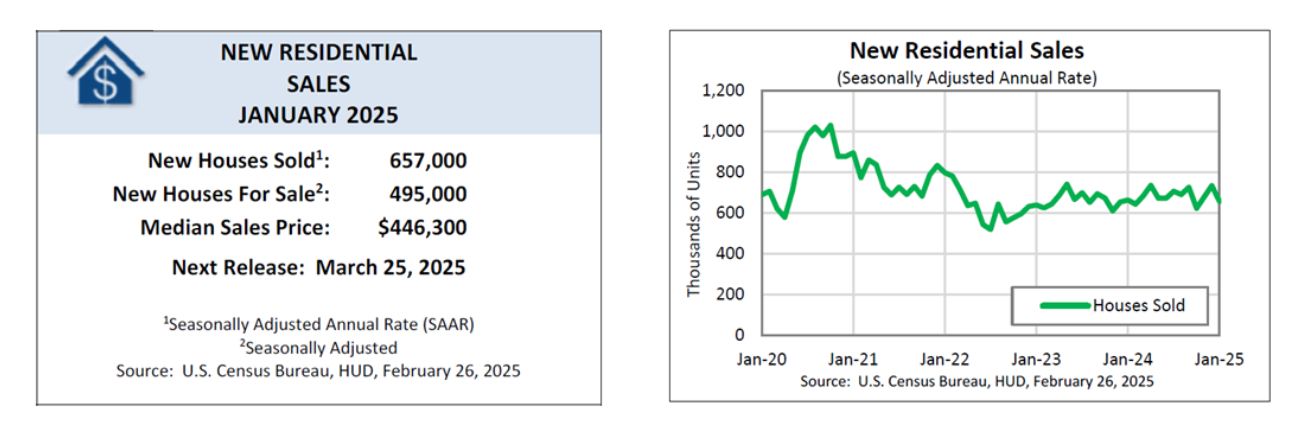

New home sales in January 2025 dipped, dropping to a seasonally adjusted annual rate of 657,000. While this figure represents a slight decrease from both the previous month and the year prior, several factors are at play, painting a complex picture of the housing market in 2025. Let's dive into the details and explore what this means for buyers, builders, and the economy as a whole.

New Home Sales Slump? What to Expect in 2025

The latest data, jointly released by the U.S. Census Bureau and the Department of Housing and Urban Development, reveals a few key points about new home sales in January 2025:

- Sales Volume: As mentioned above, the seasonally adjusted annual rate was 657,000. This is a 10.5 percent decrease from December 2024's revised rate and a 1.1 percent decrease from January 2024.

- Sales Price: The median sales price of a new home in January 2025 was $446,300. The average sales price was $510,000.

- Inventory: At the end of January, there were an estimated 495,000 new houses for sale, representing a 9.0-month supply at the current sales rate.

Why the Dip in Sales? Digging Deeper

While the numbers tell one story, understanding the “why” behind them is crucial. Several contributing factors likely played a role in the January 2025 dip in new home sales:

- Weather: January 2025 saw severe winter weather across much of the United States. The weather likely disrupted buying activity. Sales declined in every region except the West, which experienced relatively mild weather.

- Mortgage Rates: Elevated mortgage rates remain a significant hurdle for potential homebuyers. Throughout much of January 2025, the average rate on a 30-year fixed mortgage hovered above 6.8%. While some had hoped for relief in the new year, Fannie Mae revised its forecast to project an average of 6.8% for the year, decreasing to 6.6% by year-end.

- Price Increases: The median sales price of new houses sold in January was $446,300, up 3.7% from a year earlier. Last month's typical sales price was the highest for any January on record, and the highest of any month since October 2022.

- Regional Variations: The West saw an increase in new home sales, while the Northeast experienced a sharp decline. This highlights the importance of considering regional economic factors when analyzing housing trends.

The Inventory Puzzle: Months' Supply

The 9-month supply of new homes for sale at the end of January suggests a relatively balanced market. However, it's important to note that this is a seasonally adjusted figure. In reality, the actual inventory levels and the pace at which homes are being built and sold can fluctuate throughout the year.

I believe a balanced inventory can be a good thing for buyers. It prevents bidding wars and gives them more time to make informed decisions. On the other hand, it can be a challenge for builders who are carrying unsold inventory.

New Home Sales Forecast for the Remainder of 2025: What to Expect

Predicting the future is always a tricky business, especially when it comes to the housing market. However, based on current trends and expert opinions, here's what I anticipate for new home sales in the rest of 2025:

- Continued Moderation: I expect new home sales to remain relatively stable throughout 2025, albeit with some month-to-month fluctuations. The factors that impacted January's sales – mortgage rates, weather, and economic uncertainty – are likely to persist.

- Mortgage Rate Sensitivity: The housing market remains highly sensitive to mortgage rate changes. Even small fluctuations in rates can significantly impact buyer demand. If rates begin to trend downward, we could see a boost in sales.

- Regional Differences: Expect significant variations in new home sales performance across different regions. Areas with strong job growth and affordable living costs are likely to outperform those with weaker economies.

- Construction Costs: Builders are facing ongoing challenges with the rising costs of materials and labor. This could lead to higher home prices and potentially dampen sales.

Despite the challenges, new construction remains a crucial part of addressing the nation's housing shortage. Freddie Mac estimates that there's a shortfall of 3.7 million housing units. While new home sales alone can't solve this problem, they can help to alleviate some of the pressure. Though January 2025 was a more challenging month for new-home shoppers and sellers than the last few months of 2024, the newly built segment is still an especially attractive one compared to the existing home segment.

Factors that Could Influence New Home Sales

Several key factors could significantly influence the direction of new home sales in 2025:

- Economic Growth: A strong economy with low unemployment typically leads to increased consumer confidence and higher demand for housing.

- Inflation: High inflation can erode purchasing power and make it more difficult for people to afford homes.

- Government Policies: Government policies related to housing, such as tax credits, subsidies, and zoning regulations, can have a major impact on the market.

- Builder Confidence: The National Association of Home Builders (NAHB) tracks builder confidence through its Housing Market Index (HMI). A high HMI indicates that builders are optimistic about the future and likely to increase construction activity.

New Home Sales Trend [Previous Months]

Here's the region-wise tabular data for new home sales from September 2023 to September 2024. The units displayed are in thousands and are the seasonally adjusted annual rate. The data estimates only include new single-family residential structures. Sales of multi-family units are excluded from these statistics.

NORTHEAST: Connecticut, Maine, Massachusetts New Hampshire New Jersey New York Pennsylvania Rhode Island Vermont

MIDWEST: Illinois, Iowa, Indiana, Kansas, Michigan, Minnesota, Missouri, Nebraska North Dakota Wisconsin South Dakota Ohio

SOUTH: West Virginia, Virginia, Texas, Tennessee, South Carolina, Oklahoma, North Carolina, Mississippi, Maryland, Louisiana, Kentucky, Georgia, Florida, Alabama, Delaware, District of Columbia, Arkansas

WEST: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming