For most people, it is difficult to read through a financial newspaper or watch late night television without seeing repeated (possibly obnoxious) exhortations to invest in commodities such as gold or silver. The logic of these advertisements is frequently sound, since it is certainly true that government irresponsibility is leading toward a currency collapse and massive inflation.

For most people, it is difficult to read through a financial newspaper or watch late night television without seeing repeated (possibly obnoxious) exhortations to invest in commodities such as gold or silver. The logic of these advertisements is frequently sound, since it is certainly true that government irresponsibility is leading toward a currency collapse and massive inflation.

What frequently gets left out of the analysis are the other options available for investment that offer far greater prospects for return than gold or silver.

We are in absolute agreement over the prospect for commodity price inflation in the future. We are in absolute agreement over the massive deficits, crushing debt, and lax monetary policy of the government being a harbinger of runaway inflation over the coming decades. We are also in agreement over the dimming long-term prospects for the stock market, since there doesn't appear to be a new pool of investment capital to propel the stock market into an upward spiral like the one experienced over the last 25 years.

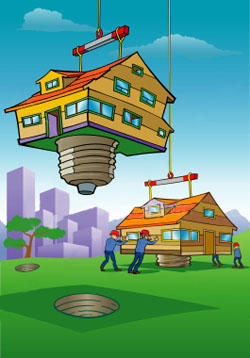

The strategy that we advocate is to use the attributes of rental real estate to invest in the commodities used for home construction. By following this strategy, we gain ownership of valuable commodities such as wood, concrete, petroleum products, and other building materials with the advantage of leverage from the bank and tax advantages from the government. We affectionately refer to this phenomenon as ‘packaged commodity' investing because the commodity products are packaged into a residential home instead of sitting in a warehouse. The culmination of this strategy lies in the fact that commodities packaged into real estate investments can be rented to tenants. As an investor, this allows you to purchase commodity products while outsourcing the interest payments to a tenant and hedge against inflation with fixed rate debt, while delaying the payment of taxes through a section 1031 exchange.