It seems like the economic ride might be getting a little bumpy. Just recently, investment giant Goldman Sachs raised its 12-month US recession probability quite significantly, jumping from a previous estimate of 20% all the way up to 35%. This isn't exactly comforting news, and it's got a lot of us wondering what's going on and what it might mean for our wallets. The big finger seems to be pointing at President Donald Trump's tariff policies, announced around March 31, 2025, as the main culprit behind this increased worry.

Now, I'm no Wall Street guru, but I've been keeping a close eye on the economy, just like many of you. When a big player like Goldman Sachs starts talking about a higher chance of recession, it's usually worth paying attention. Their analysts have access to a ton of data and expertise, so their revised outlook suggests some real concerns are brewing beneath the surface of our economy.

Goldman Sachs Significantly Raises Recession Probability by 35%

Why the Sudden Jump in Recession Fears?

So, what exactly made Goldman Sachs change their tune so drastically? From what I gather, the main worry stems from the potential fallout of these new tariffs. Think about it like this: when the government puts taxes on goods coming into the country, it can lead to a chain reaction that nobody really wants.

Here are some of the key concerns that likely fueled Goldman Sachs's increased recession probability:

- Inflation Might Get Worse: Tariffs basically make imported goods more expensive. Businesses that rely on these imports might have to raise their prices to cover the extra cost, and guess who ends up paying more? That's right, us consumers. Higher prices for everyday things can really squeeze household budgets and lead to less spending overall.

- Other Countries Might Hit Back: International trade is a two-way street. If we slap tariffs on goods from other countries, they might decide to do the same to our exports. This kind of tit-for-tat can hurt American businesses that sell their products overseas, leading to lower profits and potentially even job losses. This is what economists call trade retaliation, and it's a serious worry.

- Slower Economic Growth Looks More Likely: When businesses face higher costs and the risk of retaliatory tariffs, they might become hesitant to invest in new projects or hire more workers. Consumers, facing higher prices, might also tighten their belts and spend less. This slowdown in both business and consumer activity is a recipe for weaker economic growth, and if it gets bad enough, it can tip us into a recession.

Looking at the Numbers: What the Data Tells Us

It's not just Goldman Sachs ringing alarm bells, either. Some of the recent economic data also paints a somewhat concerning picture. For instance, the Conference Board's Leading Economic Index (LEI), which is designed to predict future economic activity, actually declined slightly in February 2025. This suggests that there might be some headwinds facing the economy in the months ahead.

Now, it's important to remember that economic forecasts aren't set in stone. They're based on the best information available at the time, but things can change quickly. For example, Deloitte Insights put out a forecast for 2025 that had a baseline expectation of 2.6% real GDP growth. That sounds pretty decent, right? However, they also looked at a scenario where these trade tensions really escalate into what they called “trade wars,” and in that case, they predicted growth could drop to just 2.2%. That small difference might not sound like much, but it can have a significant impact on the overall health of the economy.

Think of it like driving a car. If the road ahead is clear, you can cruise along at a good speed. But if you see storm clouds gathering and the road starts to get a little slippery, you're probably going to ease off the gas pedal. That's kind of what these economic indicators are suggesting – the road ahead might be getting a bit more challenging.

My Take on the Situation: More Than Just Numbers

As someone who tries to understand how these big economic shifts affect everyday life, this news from Goldman Sachs makes me a little uneasy. It feels like we're entering a period of greater uncertainty, and that can have a real impact on how people feel about their jobs, their savings, and their future.

I've always believed that international trade, when done fairly, can be a good thing for everyone. It allows businesses to access a wider range of goods and services, and it can create opportunities for growth and innovation. When we start throwing up barriers in the form of tariffs, it disrupts these established relationships and creates new costs and risks.

It's also worth remembering that these policies don't exist in a vacuum. Other countries are going to react, and those reactions can have unintended consequences for us here at home. We've seen this play out in the past, and it's rarely a smooth or painless process.

Will the Federal Reserve Come to the Rescue?

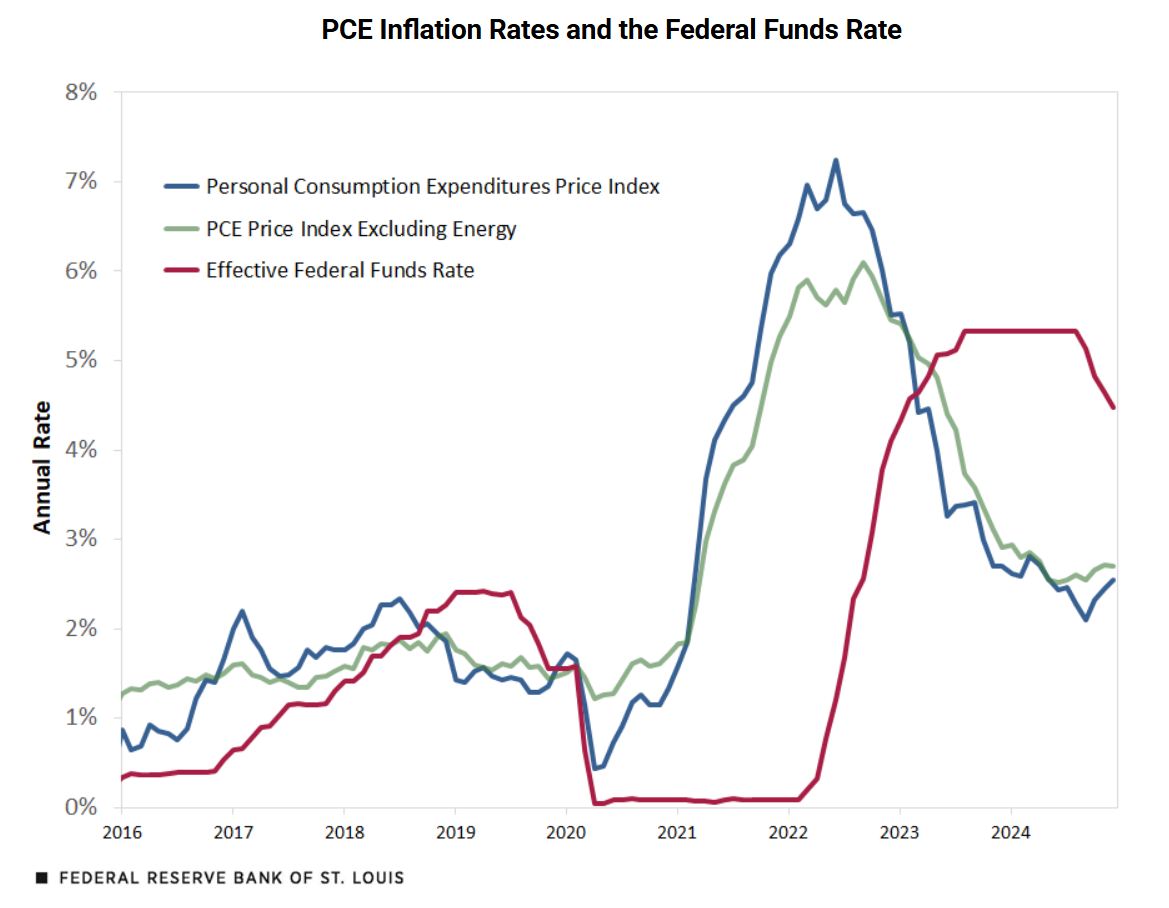

One interesting aspect of Goldman Sachs's report is their expectation that the Federal Reserve (also known as the Fed) will likely step in to try and cushion the blow. They're now predicting that the Fed will cut interest rates three times in 2025, which is more aggressive than their previous forecast of two cuts.

Why would the Fed do this? Lowering interest rates can make it cheaper for businesses to borrow money and invest, and it can also make it cheaper for consumers to take out loans for things like cars or houses. This can help to stimulate economic activity and potentially offset some of the negative effects of the tariffs.

However, the Fed is in a tough spot. They're also trying to keep inflation under control. If they cut rates too aggressively, it could actually make inflation worse. It's a delicate balancing act, and there's no guarantee that rate cuts alone will be enough to prevent a recession if the trade situation deteriorates significantly.

What This Means for You and Me

So, what does all this mean for the average person? While a 35% chance of recession doesn't mean it's a certainty, it does mean that the risks have definitely increased. Here are a few things that might happen if the economy starts to slow down:

- Job Market Could Weaken: Businesses might become more cautious about hiring, and in a recession, some companies might even have to lay off workers. This can lead to higher unemployment rates, which is tough for everyone.

- Investments Could Take a Hit: The stock market often doesn't do well during periods of economic uncertainty or recession. If you have investments in stocks or mutual funds, you might see their value decline. Goldman Sachs themselves have even lowered their year-end target for the S&P 500 stock index, suggesting they expect more volatility and potentially lower returns.

- Consumer Spending Might Decrease: If people are worried about their jobs or the economy in general, they tend to cut back on spending. This can create a negative feedback loop, where less spending leads to lower business revenues, which can then lead to more job cuts.

Navigating the Uncertainty Ahead

Look, nobody has a crystal ball, and it's impossible to say for sure what the future holds. But when smart people who analyze the economy for a living start raising red flags, it's a good time to pay attention and maybe think about how you can prepare.

For me, this kind of news reinforces the importance of having a solid financial foundation. That means things like:

- Having an Emergency Fund: It's always a good idea to have some money set aside to cover unexpected expenses or a potential job loss. Aiming for three to six months' worth of living expenses is a common guideline.

- Managing Debt Carefully: High levels of debt can become a real burden if your income is affected by an economic downturn. Now might be a good time to review your debts and see if there are ways to pay them down.

- Thinking Long-Term About Investments: While market downturns can be scary, it's important to remember that investing is usually a long-term game. Trying to time the market is often difficult, and it's generally better to stay focused on your long-term goals.

Final Thoughts:

The fact that Goldman Sachs has raised its 12-month US recession probability to 35% is definitely something to take note of. While it's not a guarantee of a downturn, it signals that the risks have increased, largely due to the uncertainty surrounding President Trump's tariff policies. As an individual, the best thing I can do is stay informed, be mindful of my financial situation, and prepare for potential challenges. The economy is always evolving, and being ready for different scenarios is always a smart move.

Work With Norada – Secure Your Investments in 2025

With Goldman Sachs raising recession probability by 35%, now is the time to shift towards stable, cash-flowing real estate investments that provide financial security.

Norada’s turnkey rental properties offer passive income and resilience, even during economic downturns.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Read More:

- 2008 Crash Forecaster Warns of DOGE Triggering Economic Downturn

- Stock Market Predictions 2025: Will the Bull Run Continue?

- Stock Market Crash: Nasdaq 100 Tanks 3.5% Amid AI Concerns

- Stock Market Crash Prediction With Huge Discounts on Bitcoin, Gold, Houses

- S&P 500 Forecast for the Next Year: What to Expect in 2025?

- Stock Market Predictions for the Next 5 Years

- Billionaire Warns of Stock Market Crash If Harris Wins Elections

- Stock Market is Predicted to Surge Regardless of the Election Outcome

- Echoes of 1987: Is Today’s Stock Market Crash Leading to a Recession?

- Is the Bull Market Over? What History Says About the Stock Market Crash

- Wall Street Bear Predicts a Historic Stock Market Crash Like 1929

- Economist Predicts Stock Market Crash Worse Than 2008 Crisis

- Stock Market Forecast Next 6 Months

- Next Stock Market Crash Prediction: Is a Crash Coming Soon?

- Stock Market Crash: 30% Correction Predicted by Top Forecaster