California is known for its beautiful landscapes, sunny beaches, and booming tech industry. However, it also has its fair share of dangerous cities with high crime rates. While some cities in California are known for their safety and security, others have a reputation for being dangerous and crime-ridden. In this context, we have compiled a list of the top 10 most dangerous cities in California based on various sources.

These cities have high rates of violent crime, property crime, poverty, and unemployment. Some of the factors that contribute to high crime rates in California include population growth, economic inequality, gang activity, lack of economic opportunity, underreporting of crime, demography, and law enforcement resources. By understanding the factors contributing to these cities' high crime rates, we can work towards creating safer communities for all Californians.

Top 10 Most Dangerous/Ghetto Cities in California

Based on the search results, here are the top 10 most dangerous cities in California according to different sources:

1. Emeryville

Emeryville has been labeled the most dangerous city in America according to a SafeWise report. The report analyzed the most recent and complete 2016 FBI crime data for cities with a population of 10,000 or higher. Emeryville hovers near 12,000 residents according to the most recent census data. The increase in “violent” crime is largely fueled by robberies at shopping centers.

The majority of robberies consist of shoplifts by force and therefore occur in commercial areas (versus residential). Emeryville has a crime rate of 132 per one thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 125 and a property crime rate of 1 in 8.

2. Oakland

Oakland has consistently been listed as one of the most dangerous large cities in the United States. The city has struggled with persistently high rates of homicide and violent crime. In 2021, homicides were up more than 50%, with more than 100 murders for the first time in a decade.

Oakland has a crime rate of 70 per one thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 80 and a property crime rate of 1 in 17. Much of the violence could be attributed to “homegrown groups and gangs from Oakland.”

3. Stockton

Stockton is the most dangerous city in California, according to reports. It has a violent crime rate of 1,397 per 100,000 residents. The reason Stockton is so dangerous is the lack of economic opportunity and high unemployment rates. The city has a poverty rate of 21.41%.

4. San Bernardino

San Bernardino is considered one of the most dangerous cities in California. It has large areas of people living in poverty due to a depressed economy and is prone to the worst air quality in Southern California, and therefore the nation. The city has a violent crime rate of 1 in 104 and a property crime rate of 1 in 29. The city filed for bankruptcy and can't support itself.

5. Compton

Compton has a reputation for being a dangerous city due to its high crime rates. The city has a violent crime rate of 1 in 136 and a property crime rate of 1 in 22. The city has a history of gang violence and drug trafficking.

6. Richmond

Richmond has a crime rate of 45 per thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 109 and a property crime rate of 1 in 28. Richmond has a history of gang violence and drug trafficking.

7. Vallejo

Vallejo has a crime rate of 44 per thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 104 and a property crime rate of 1 in 29. Vallejo has a history of gang violence and drug trafficking.

8. Modesto

Modesto has a crime rate of 45 per thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 120 and a property crime rate of 1 in 23. Modesto has a history of gang violence and drug trafficking.

9. Merced

Merced has a crime rate of 45 per thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 120 and a property crime rate of 1 in 23. Merced has a history of gang violence and drug trafficking.

10. Huntington Park

Huntington Park has a crime rate of 45 per thousand residents, which is one of the highest crime rates in America compared to all communities of all sizes. The city has a violent crime rate of 1 in 120 and a property crime rate of 1 in 23. Huntington Park has a history of gang violence and drug trafficking.

It's important to note that different sources may have different rankings based on their methodology and criteria. Additionally, it's worth mentioning that crime rates can vary within different neighborhoods of a city, and not all areas of these cities are equally dangerous. It's always a good idea to exercise caution and be aware of your surroundings, regardless of where you are.

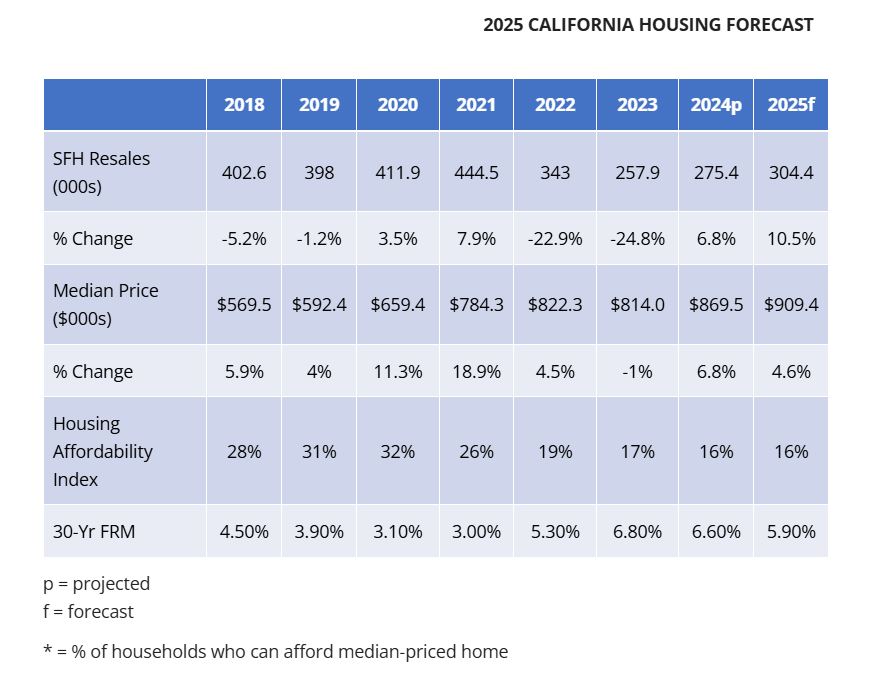

Also, the California housing market is a complex and dynamic market that is affected by various factors, including interest rates, supply and demand, and regional trends. Despite the challenges, the California housing market remains strong, with high demand from potential buyers.

Factors Contributing to High Crime Rates in California

There are several factors that contribute to high crime rates in California. According to the search results, some of the factors include:

Population Growth

California is the most populous state in the United States, and its population has grown significantly since 1980. This population growth has put a strain on the state's criminal justice system, leading to overcrowded prisons, overburdened courts, and understaffed law enforcement agencies.

Economic Inequality

California has a high poverty rate, particularly in urban areas. This poverty, along with a lack of opportunities for low-income individuals, can contribute to an increase in crime. When people struggle to make ends meet, they may turn to illegal activities to support themselves or their families.

Gang Activity

Many of the most dangerous cities in California have a history of gang violence and drug trafficking. Gang activity can lead to an increase in violent crime, such as homicides and aggravated assaults.

Lack of Economic Opportunity

Some of the most dangerous cities in California, such as Stockton and San Bernardino, have high unemployment rates and a lack of economic opportunity. This can lead to a sense of hopelessness and desperation, which can contribute to an increase in crime.

Underreporting of Crime

Inconsistent reporting and short-term snapshots can obscure real trends in crime rates. Additionally, many crimes go unreported, leading to flawed statistics that suggest a concerning trend in California's crime rates.

Demography

Areas with larger populations of young men tend to have higher crime rates. Urban areas also tend to have higher crime rates than rural areas.

Law Enforcement Resources

Variations in county crime rates are probably explained by factors such as law enforcement resources. Areas with fewer law enforcement resources may have higher crime rates.

It's important to note that these factors may interact with each other in complex ways and that crime rates can vary within different neighborhoods of a city. It's always a good idea to exercise caution and be aware of your surroundings, regardless of where you are.