The housing market is experiencing a shift this fall, with new listings showing a slight increase. However, the elevated mortgage rates are causing many potential buyers to retreat. Let's delve into the details of this evolving housing market scenario.

Current Trends in the Housing Market

According to a new report by Redfin, new listings have increased by 2% since the beginning of September, offering a slightly larger inventory for potential buyers. Despite this uptick, the total number of homes for sale is down by 14% from the previous year, suggesting a persistent seller's market. The median sale price is showing a steady 3% year-over-year increase.

Advice for Home Sellers

For sellers, the current market presents an opportunity to take advantage of rising prices. Despite the low demand, the median sale price has experienced a 3% increase. However, due to the increasing number of homes with a price drop and the impact of high mortgage rates on buyers' budgets, setting a fair price is crucial. Redfin agents recommend pricing homes fairly to attract buyers.

Advice for Homebuyers

On the other hand, potential homebuyers are hesitating to enter the market as mortgage rates reach their highest point in more than two decades. The median monthly mortgage payment has climbed close to $3,000. Despite the challenges, there's hope for buyers to make a move, especially with the slight increase in new listings. Shopping around for mortgage rates and considering buying down a mortgage rate are viable strategies to navigate the current market.

Key Housing-Market Data – October 2023

Here's a comprehensive analysis of the key data points and what they indicate about the housing market for the week ending October 8, 2023.

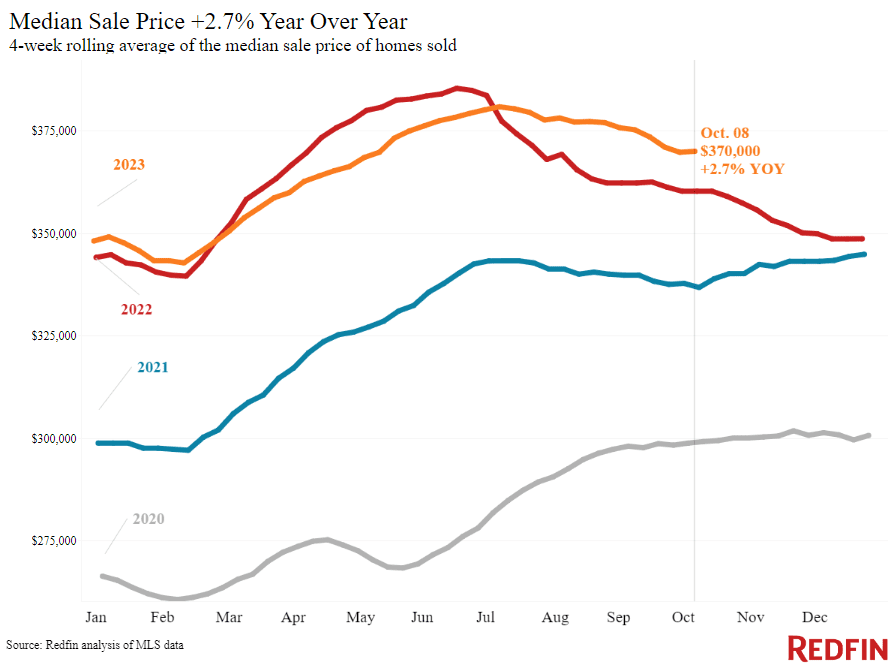

1. Median Sale Price: $370,000 (2.7% YoY increase)

The median sale price represents the middle point of all home sale prices. A 2.7% year-over-year increase in this value suggests a general upward trend in home prices, indicating demand and appreciation in property values.

2. Median Asking Price: $388,223 (5.2% increase, the biggest in a year)

The median asking price is the middle point of all homes listed for sale. A significant 5.2% increase in the median asking price, especially the highest in a year, signals a robust demand in the housing market, potentially indicating a seller's market.

3. Median Monthly Mortgage Payment: $2,736 at a 7.49% mortgage rate (10% increase)

The median monthly mortgage payment is influenced by both home prices and mortgage rates. A 10% increase indicates higher costs for homeowners, potentially impacting the purchasing power of prospective buyers and affecting overall market demand.

4. Pending Sales: 73,943 (-11.6%)

Pending sales represent the number of homes that have a signed contract but are yet to close. An 11.6% decrease in pending sales suggests a decline in immediate buyer interest, possibly due to factors like high mortgage rates or economic uncertainties.

5. New Listings: 81,964 (-3.9%, smallest decline since July 2022)

The number of new listings entering the market is a vital indicator of market activity. A smaller decline of 3.9%, especially the smallest since July 2022, indicates a potential stabilization or improvement in the supply of homes for sale.

6. Active Listings: 827,406 (-14%, tied with the previous week for the smallest decline in four months)

Active listings represent the total number of unsold homes available in the market. A 14% decrease, even if it's the smallest decline in four months, still indicates a lower inventory of homes, contributing to a seller's market environment.

7. Months of Supply: 3.2 months (+0.2 pts.)

Months of supply is the estimate of how long it would take to sell the current inventory of homes at the current sales pace. An increase of 0.2 points to 3.2 months suggests a slight easing of the market, but it still remains within the range of a seller's market.

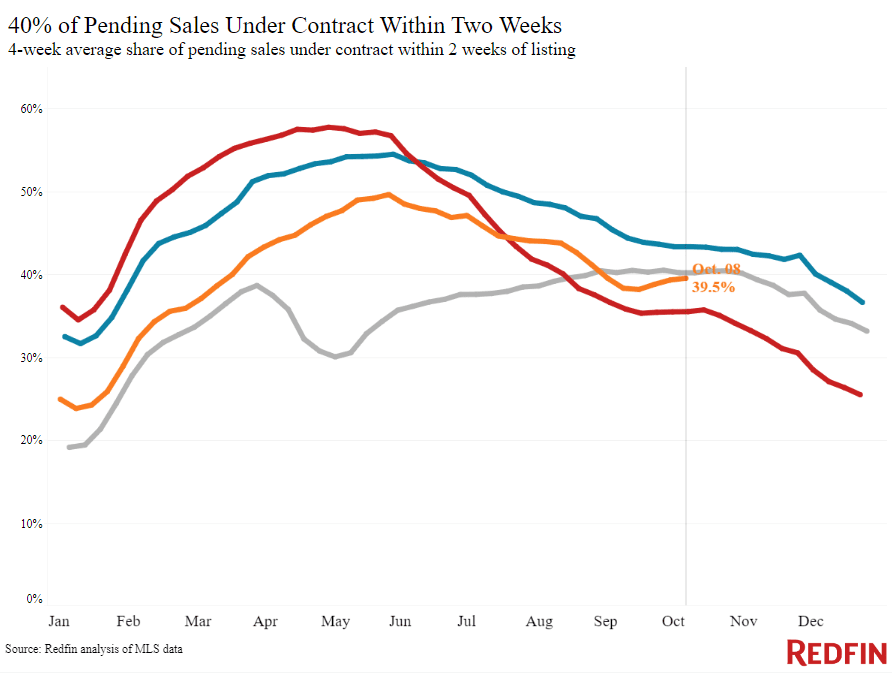

8. Share of Homes Off Market in Two Weeks: 39.5% (up from 36%)

This metric reflects the proportion of homes that are off the market within two weeks of being listed. A higher percentage (39.5%) suggests that a significant number of homes are being sold quickly, indicating a competitive market.

9. Median Days on Market: 32 (-2 days)

The median days on market represent the average time it takes for a property to be sold. A decrease of 2 days to 32 days indicates a relatively fast-paced market with homes selling quicker.

10. Share of Homes Sold Above List Price: 30.7% (up from 30%)

An increase in the percentage of homes sold above the list price (30.7%) suggests strong demand and competition among buyers, potentially resulting in bidding wars and higher selling prices.

11. Share of Homes with a Price Drop: 6.8% (+0.2 pts., highest level in a year)

A higher percentage of homes with a price drop (6.8%) and its increase indicates that some properties may be overpriced or the market is becoming more price-sensitive, encouraging sellers to adjust their prices to attract buyers.

12. Average Sale-to-List Price Ratio: 99.3% (+0.3 pts.)

The average sale-to-list price ratio measures the difference between the listed price and the actual sale price. An increase to 99.3% suggests that, on average, homes are selling very close to their listed prices, showing a strong seller's position in negotiations.

Overall, the housing market data portrays a dynamic scenario with sellers benefiting from rising prices and a seller's market environment, while buyers face challenges due to increased mortgage costs and stiff competition.

Additional Insights

Despite the challenges posed by the high mortgage rates, there are opportunities for both buyers and sellers in this evolving market:

Opportunities for Sellers

1. **Leveraging Rising Prices:** Sellers can take advantage of the continued rise in median sale prices, showcasing their properties at competitive rates.

2. **Strategic Pricing:** Sellers should carefully consider the pricing of their homes, aiming for a fair and attractive price to entice potential buyers.

3. **Prompt Sales:** Well-priced, move-in ready homes are still selling quickly in many parts of the country, indicating a demand for properties that meet buyers' expectations.

Opportunities for Buyers

1. **Choosing the Right Moment:** Despite the high mortgage rates, buyers can look for moments of reprieve to enter the market, keeping an eye on the small increase in new listings and slight decreases in daily average rates.

2. **Exploring Mortgage Options:** Buyers should shop around and explore different lenders to secure the best mortgage rates, ensuring they make an informed decision that aligns with their financial capabilities.