Are you curious about the new housing construction trends that are transforming the residential real estate market? The housing market is constantly evolving, and builders are responding to changing demographics, lifestyles, and technological advancements.

New housing construction trends are influencing everything from the size and design of homes to the materials used and the technologies incorporated. In the recent months, we have seen the new housing construction starts fall in the United States.

Housing Starts refer to the number of new residential construction projects that have begun during any particular month. Estimates of housing starts include units in structures being rebuilt on an existing foundation.

Building permits, on the other hand, are issued by local governments to allow builders to begin the construction of a new home or to make significant renovations to an existing home. Building permits are usually required for any new construction or remodeling that involves changes to the structural or mechanical systems of a home.

Housing construction refers to the actual building of the residential structure, which includes everything from laying the foundation to framing the walls, installing electrical and plumbing systems, and finishing the interior and exterior of the building.

The sequence of new housing construction events typically goes as follows:

A builder obtains a building permit from the local government, which allows them to start construction on a new housing unit.

Once construction begins, it is counted as a housing start. The construction process continues until the housing unit is completed and ready for occupancy, at which point it is considered part of the housing stock.

So, building permits come first, followed by housing starts, and then housing construction. However, it is important to note that not all permits lead to starts and not all starts to lead to completed construction. Some permits may expire before construction begins, and some starts may be delayed or canceled due to various reasons such as changes in market conditions or financing issues.

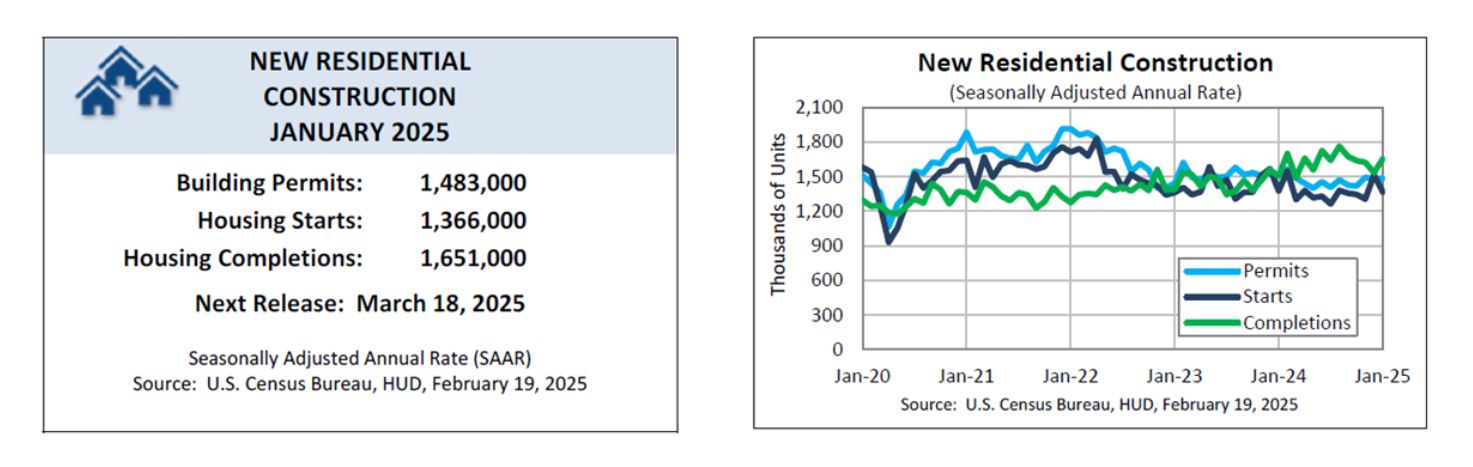

New Residential Construction Trends – January 2025

The beginning of 2025 brought a bit of a slowdown in housing construction. January's numbers revealed an overall decrease of 9.8% in housing starts, landing at a seasonally adjusted annual rate of 1.37 million units. Think of it like this: if builders kept building at the same pace as they did in January, they'd start about 1.37 million new homes over the next year.

But here's the breakdown:

- Single-family homes: Starts decreased by 8.4% to a 993,000 annual rate. That's also 1.8% lower than what we saw a year ago.

- Multifamily buildings: This sector, which includes apartments and condos, saw a bigger drop, decreasing by 13.5% to a 373,000 pace.

What's behind this slowdown? Well, it's a mix of things.

The Affordability Factor: High Costs Squeeze the Market

One of the biggest factors impacting construction is affordability. High construction costs, elevated mortgage rates, and the overall cost of buying a home are making builders more cautious. It makes perfect sense – if people can't afford to buy, builders are less likely to start new projects.

Think about it: if the price of lumber goes up, that gets passed onto the homebuyer. The same goes for higher labor costs or increased fees for permits. When these costs add up, it puts pressure on the entire market. As a result, the National Association of Home Builders (NAHB) is reporting that their members are approaching the market with caution.

NAHB Concerns:

- High construction costs

- Elevated mortgage rates

- Challenging housing affordability conditions

The Permit Puzzle: A Mixed Bag of Signals

While housing starts were down, building permits offered a slightly more complex picture. Overall permits edged up by 0.1% to a 1.48 million unit annual rate. Permits are important because they show future construction plans. It's like builders saying, “Okay, we're getting ready to start these projects.”

Here's a closer look at permits:

- Single-family permits: Remained almost unchanged at a rate of 996,000.

- Multifamily permits: Increased by 0.2% to an annualized 487,000 pace.

The fact that permits remained relatively stable (or even slightly increased) suggests that builders aren't completely giving up, but they might be waiting to see how the market plays out before starting new projects.

Completions: A Silver Lining?

Now, here's a bit of good news. Housing completions in January were actually up by 7.6%, reaching a seasonally adjusted annual rate of 1.651 million. That's 9.8% higher than the year before!

- Single-family completions: Increased by 7.1% to 982,000.

- Multifamily completions: Jumped significantly to 652,000.

What does this mean? Well, even though fewer homes are being started, more are being finished. This suggests that builders are focused on completing existing projects, which can help add to the overall housing supply.

Regional Differences: Where's the Action?

The housing market isn't the same everywhere. Different regions are experiencing different trends. Here's a quick look at how housing starts varied across the country in January:

- Northeast: Down 27.6%

- Midwest: Down 10.4%

- South: Down 23.3%

- West: Up 42.3%

These regional differences can be influenced by a lot of factors, including local economies, population growth, and government policies.

Permits saw regional fluctuations as well:

- Northeast: Down 6.1%

- Midwest: Up 1.8%

- South: Down 0.1%

- West: Up 2.3%

Apartment Construction: A Closer Look

The multifamily sector deserves a closer look because it plays a crucial role in providing housing, especially for renters. We've already seen that multifamily starts and permits have been somewhat volatile.

Interestingly, for every apartment starting construction, about 1.8 apartments are completing the construction process. This indicates a strong push to finish existing apartment projects.

Inventory Check: Homes Under Construction

Another important factor to consider is the number of homes currently under construction:

- Single-family homes under construction: Down 6.3% from a year ago, at 641,000 units.

- Multifamily units under construction: Down 22.1% from a year ago, at 768,000 units.

The decline in homes under construction suggests that builders are being careful about starting new projects until they see more stability in the market.

New Housing Construction Forecast 2025

So, what does all this mean for the rest of 2025? Here are a few key takeaways and factors to watch:

- Interest Rate Sensitivity: The housing market is extremely sensitive to interest rate changes. If rates stay high, affordability will remain a challenge, potentially dampening demand and construction activity.

- Construction Costs: Builders are always keeping an eye on the cost of materials and labor. If these costs continue to rise, it could put further pressure on housing prices and construction timelines.

- Government Policies: Government policies related to zoning, regulations, and incentives can have a big impact on housing construction. For example, streamlining the permitting process can help builders get projects off the ground more quickly.

- Tariffs: There have been discussions on tariffs on materials, especially from countries like China and Canada. These tariffs would further increase the cost of construction and decrease production.

- Regulatory Reforms: Regulatory reforms can help decrease the cost to builders and therefore help reduce home prices.

My Thoughts

Having followed the housing market for several years, I believe we're at a bit of a turning point. The days of rapid price appreciation and frenzied buying seem to be behind us, at least for now.

Here are a few of my observations:

- The need for affordable housing is critical. We need innovative solutions to make housing more accessible to a wider range of people. This could include things like smaller homes, accessory dwelling units (ADUs), and more efficient building techniques.

- Builders need to adapt to changing consumer preferences. Buyers are increasingly interested in energy-efficient homes, smart home technology, and flexible living spaces. Builders who can meet these demands will be better positioned for success.

- Local governments play a crucial role in shaping the housing market. By streamlining the permitting process, reducing unnecessary regulations, and investing in infrastructure, local governments can create a more favorable environment for housing construction.

Policy Paths: A Call for Action

Given the persistent affordability concerns, reducing inefficient regulatory costs offers the best policy path to improve attainable housing supply and bring down shelter inflation. This requires a collaborative effort from policymakers, builders, and community stakeholders. We have to find creative solutions that address the challenges facing the housing market.

Conclusion:

The new housing construction trends and forecast for 2025 suggest a market that's still finding its footing. While there are challenges, there are also opportunities. By understanding the key trends and factors at play, you can make informed decisions about buying, selling, or investing in real estate. I believe that a balanced approach, combining thoughtful planning with innovative solutions, is essential to navigating the dynamic housing market of 2025 and beyond.

Recommended Read:

- New Home Sales Trends and Forecast 2025

- Pending Home Sales Trends and Forecast 2025

- Historical Home Sales Data in the United States

- Single-Family Homes Construction Surges in September 2024

- High Mortgage Rates Impact New Construction: Builders Pull Back

- Benefits of Investing in New Construction Real Estate