Mortgage rate predictions for the next two years indicate a general trend of declining rates, following a period of high rates due to inflation and Federal Reserve policies. Here’s a comprehensive overview based on the latest forecasts.

Mortgage rates have fluctuated recently, with a notable decrease as markets anticipate further cuts from the Federal Reserve. As of November 14, 2024, the average interest rate for a 30-year fixed mortgage is approximately 6.55%, reflecting a slight increase from earlier in the month. The average interest rate for a 15-year fixed mortgage remains stable at 5.91%, while the average for a 5/1 adjustable-rate mortgage (ARM) is around 6.70%.

These figures represent a snapshot of the current state of the mortgage market, influenced by various economic factors, including inflation trends, Federal Reserve policies, and broader financial conditions. The Federal Reserve has recently cut its benchmark interest rate by 25 basis points in November, following a significant cut in September, which may provide some relief to homebuyers in the coming months.

Current Mortgage Rates:

30-year fixed: The average rate stands at 6.55%, up from 6.24% in October.

15-year fixed: This option averages at 5.91%, providing a faster payoff strategy.

5/1 adjustable-rate mortgage (ARM): Currently averages at 6.70%.

Table of Contents

Mortgage Rate Predictions for the Next Two Years:

- Mortgage Bankers Association (MBA): Projects an average of 6.5% for the 30-year fixed-rate mortgage in Q4 2024, with expectations of further declines into early 2025.

- Fannie Mae: Expects rates to average around 6.2% in Q4 2024 and drop to about 6.0% in Q1 2025.

- loanDepot: Suggests that rates could fall below 6% by the end of 2024 if the Fed continues its aggressive rate cuts.

- Market Dynamics: The anticipated decline in rates is influenced by easing inflation and potential cuts in Federal Reserve interest rates. This could reinvigorate the housing market, making home purchases more affordable and stimulating demand.

Mortgage Rate Predictions for 2025

Current insights from financial institutions like the Mortgage Bankers Association (MBA) and Fannie Mae offer a range of predictions. According to a recent article from the Miami Herald, Fannie Mae forecasts that the average mortgage rate for a 30-year fixed mortgage could hover around 6.1% by 2025, while the MBA anticipates an even lower average of 5.9%.

The National Association of Home Builders (NAHB) also shares a similar sentiment, predicting rates to settle around 6.01%. This trend reflects a broader expectation that rates will gradually decrease as the Federal Reserve may ease its aggressive increase in rates due to stabilizing inflation and economic conditions.

Factors Influencing Mortgage Rates in 2025

- Inflation Control: Inflation has been a driving force behind the Fed's rate hikes. If inflation continues to show signs of moderation, we can expect the Fed to adopt a more accommodating monetary policy, which could lead to lower mortgage rates.

- Economic Recovery: The pace of economic recovery, particularly in the housing market, will play a crucial role. A strong labor market and increased consumer confidence may lead to more home purchases, influencing demand for mortgages.

- Consumer Sentiment: Buyer confidence could bolster demand for homes, particularly if rates begin to trend downward. If the market sees a surge in activity, it may counterbalance the expected declines in rates.

- Global Market Influences: Geopolitical events and global economic conditions may also affect mortgage rates. Fluctuations in oil prices, trade relations, and foreign investment dynamics can all lead to shifts in how lenders perceive risk and set rates.

Experts are optimistic that favorable conditions will lead to a housing market that continues to recover in 2025, making it a potentially advantageous year for both first-time homebuyers and those looking to refinance.

Mortgage Rate Predictions for 2026

Stepping further into the future, the mortgage rate predictions for 2026 indicate a continued downward trend. As analysts look ahead, the consensus is that mortgage rates could potentially fall below the 6% mark, offering brighter prospects for those entering the housing market or refinancing existing loans.

Leading forecasts suggest that by 2026, the average mortgage rate could drop to around 5.0% according to various sources, including the predictions shared by financial analysts on platforms such as Morningstar. They suggest a gradual decline will continue, culminating in rates around 4.5% to 4.25% by 2027. This shift is linked to anticipated improvements in economic stability and inflation control measures that have been implemented over the preceding years.

Key Influences on 2026 Predictions

- Fed Policy Modifications: A cooling inflation rate and a positive economic forecast might allow the Federal Reserve to cut rates, contributing significantly to lower mortgage rates.

- Long-Term Economic Stability: Sustained job growth, rising wages, and an increasing supply of homes are factors that could foster a more balanced housing market. This equilibrium can support lower interest rates as lenders become less risk-averse.

- Homebuyer Behavior: Should mortgage rates approach the lower 5% range, we could see a renewed surge in home purchases, invigorating the housing market and possibly influencing rates based on demand.

- Technological Advancements in Lending: As the mortgage industry continues to adapt and embrace new technologies, the efficiency of the lending process may improve, resulting in competitive rate offerings by lenders.

In summary, while there is uncertainty inherent in predicting the future of mortgage rates, the signs suggest a more favorable environment for homebuyers in 2025 and 2026, with rates potentially moving to a more manageable level. The interplay of economic indicators, consumer sentiment, and federal policies will determine the ultimate trajectory of mortgage rates in the coming years.

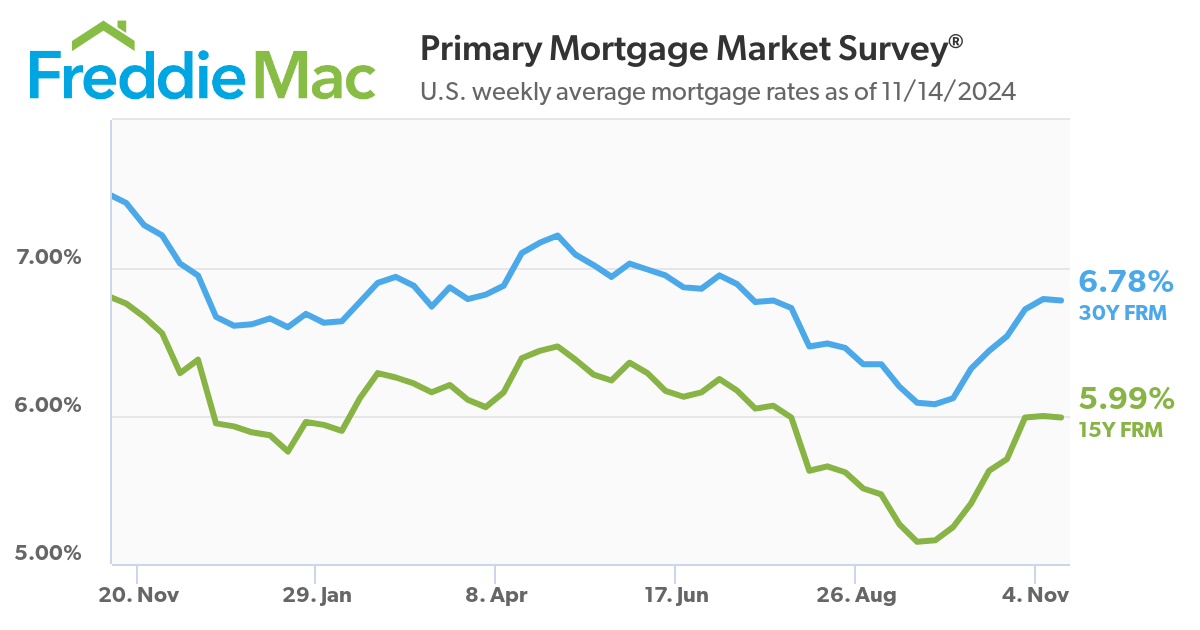

This chart shows the trend of the 30-year & 15-year FRM Averages from Nov 2023 to Nov 2024.

As of November 14, 2024, the average interest rate for a 30-year fixed mortgage is 6.78%, reflecting a slight decrease from 6.79% the previous week. The average interest rate for a 15-year fixed mortgage is now 5.99%, down from 6.00% last week. These figures mark the end of a six-week upward trend in mortgage rates.

30-Year Fixed Mortgage:

- Current Rate: 6.78%

- 1-Week Change: -0.01%

- 1-Year Change: -0.66%

- 4-Week Average: 6.71%

- 52-Week Average: 6.75%

- 52-Week Range: 6.08% to 7.29%

15-Year Fixed Mortgage:

- Current Rate: 5.99%

- 1-Week Change: -0.01%

- 1-Year Change: -0.77%

- 4-Week Average: 5.92%

- 52-Week Average: 6.00%

- 52-Week Range: 5.15% to 6.67%

These rates are influenced by several economic factors, including the yield on U.S. Treasury bonds, which lenders use as a benchmark for pricing mortgages. Recent reports indicate that bond yields have been rising due to positive news regarding inflation and economic performance, which could affect future mortgage rates.

Factors Influencing Mortgage Rates Over the Next 2 Years

As we look toward the next two years, several key factors are poised to influence the direction of mortgage rates in the United States.

- Federal Reserve Policies: The Federal Reserve's monetary policy is a primary driver of mortgage rates. Decisions on interest rates, influenced by economic data and inflation targets, directly impact the cost of borrowing. The Fed's signaled interest rate cuts could lead to a decrease in mortgage rates, fostering a more favorable borrowing environment.

- Inflation: Inflation remains one of the most significant factors affecting mortgage rates. Efforts to curb inflation could result in adjustments to interest rates, with higher inflation typically leading to higher mortgage rates to counteract the economy's overheating.

- Economic Growth: The overall health of the economy plays a crucial role. Strong economic indicators might push rates up as demand for credit increases, while signs of a slowdown could lead to decreases in an effort to stimulate borrowing and investment.

- Housing Market Dynamics: The balance of supply and demand in the housing market will also impact rates. A surplus of homes could lead to lower rates to encourage buying, whereas a shortage might drive rates up as competition for available homes increases.

- Global Events: International events, such as geopolitical conflicts or global economic downturns, can affect investor confidence and lead to fluctuations in mortgage rates as investors seek safer assets like U.S. Treasury bonds, influencing yields and borrowing costs.

- Government Policies: Fiscal policies, including tax laws and housing regulations, can influence mortgage rates. For example, policies that stimulate housing construction can increase supply, potentially leading to lower mortgage rates.

- Consumer Behavior: The demand for mortgages is also shaped by consumer confidence and demographic trends. Changes in homebuyer preferences or shifts in population growth can affect the demand for mortgages and, consequently, the rates.

- Bond Market Movements: Mortgage rates are closely tied to the bond market, particularly the 10-year Treasury yield. As investors' perceptions of risk change, so do bond yields, which can lead to corresponding changes in mortgage rates.

- Banking Sector Health: The financial stability and lending practices of banks can influence mortgage rates. A robust banking sector may offer more competitive rates, while a struggling one might tighten lending and increase rates.

- Technological Advancements: The rise of fintech and online lending platforms has introduced more competition into the mortgage industry, which could lead to more favorable rates for consumers as companies vie for business.

Summary: Experts from various financial institutions and housing associations have weighed in, providing a consensus that, while the rates may not see a dramatic drop, there is an expectation of a downward trend in the next two years. While forecasts can provide a general direction, the actual rates will depend on how these factors evolve.

Also Read:

- Mortgage Rates Predictions 2024: Will Rates Go Down?

- Mortgage Rate Predictions for Next 3 Years: Double Digit Rise

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for the Next 2 Months

- Will Mortgage Rates Go Below 7% in 2024? Latest Predictions

- Mortgage Rates HIT NEW LOW: Predictions &: What it Means for You