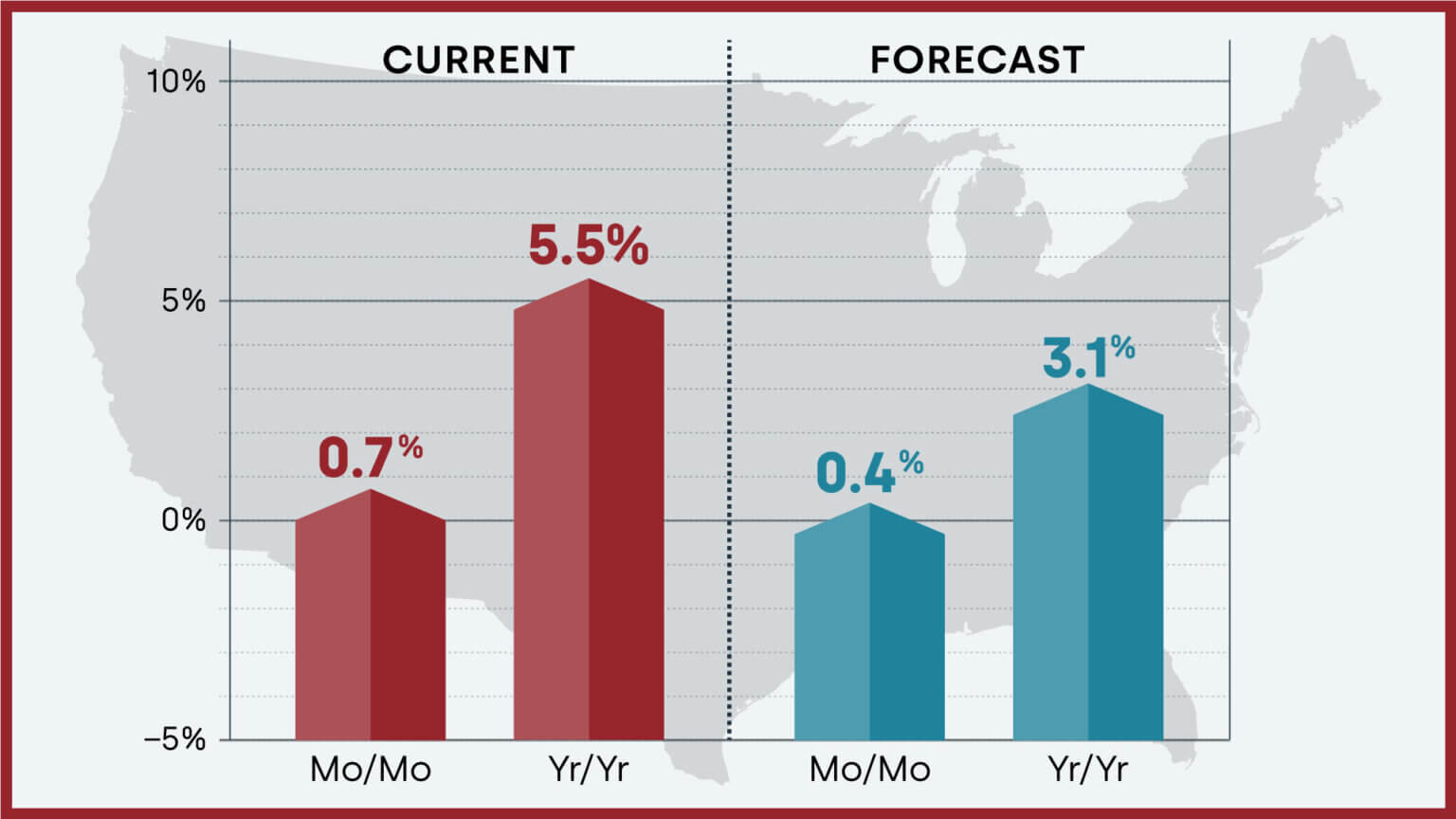

Real estate enthusiasts and homeowners alike are keeping a keen eye on the housing market, with recent data providing insights into the trajectory of home prices across the United States. According to the latest statistics from CoreLogic, home prices nationwide, inclusive of distressed sales, experienced a commendable year-over-year increase of 5.5% in February 2024 compared to the same period in 2023. Moreover, on a month-over-month basis, there was a 0.7% growth from January 2024, indicating a promising trend in the market.

Home Prices Set to Rise by 3.1% by February 2025

The CoreLogic Home Price Index (HPI) Forecast offers valuable insights into the future of home prices. It predicts a 0.4% increase from February to March 2024, followed by a 3.1% year-over-year rise from February 2024 to February 2025.

The consistent year-over-year home price growth of above 5% observed in February underscores the resilience of the housing market. While there has been a slight deceleration attributed to the waning impact of comparing gains with the subdued home prices of 2022, the market remains robust. CoreLogic anticipates that this slower pace of growth will persist throughout 2024, offering increased certainty for potential homebuyers.

Dr. Selma Hepp, Chief Economist for CoreLogic, notes that the recent increase in for-sale inventory is a welcome development for buyers. This surge in listings is anticipated to provide more options and alleviate the intense competition that has characterized the market in recent years. Despite concerns regarding affordability, driven in part by elevated mortgage rates, the demand for homes persists, particularly in sought-after coastal markets.

Regional Insights

The CoreLogic HPI also offers a granular view of home price trends at the state level. Nationally, home prices surged by 5.5% year over year in February 2024. Notably, Idaho was the only state to experience a marginal annual decline, while states such as South Dakota, New Jersey, and Rhode Island witnessed substantial increases.

These regional variations underscore the diverse dynamics at play in the housing market, influenced by factors such as local economic conditions, demographic trends, and housing supply. Prospective buyers and investors are encouraged to conduct thorough research and seek expert guidance to navigate these nuances effectively.

HPI Top 10 Metros Change

The CoreLogic Home Price Index (HPI) provides valuable insights into the real estate market across various segments, including large metropolitan areas. Here's a glimpse of the year-over-year home price changes in 10 prominent U.S. metros as of February:

- Miami: Leading the pack is Miami, which witnessed a remarkable 10.2% gain compared to the previous year.

- Other Notable Metros: While Miami takes the top spot, other metros also experienced noteworthy changes in home prices. Detailed data for each metro allows prospective buyers and investors to assess market trends and make informed decisions.

Markets to Watch: Potential Declines in Home Prices

While many markets are experiencing growth, it's essential to acknowledge those at risk of potential declines in home prices. The CoreLogic Market Risk Indicator (MRI) assesses the health of housing markets and identifies areas with elevated risk. Among the markets at very high risk of a decline in home prices over the next 12 months are:

- Palm Bay-Melbourne-Titusville, FL: With a probability exceeding 70%, this area is flagged as being at significant risk.

- Other High-Risk Markets: Joining Palm Bay-Melbourne-Titusville are Atlanta-Sandy Springs-Roswell, GA; Deltona-Daytona Beach-Ormond Beach, FL; Spokane-Spokane Valley, WA; and North Port-Sarasota-Bradenton, FL. These markets warrant careful observation and strategic planning for those involved in real estate transactions.

Bottom Line: As we look ahead, the outlook for the US housing market appears promising, with home prices poised for continued growth albeit at a more sustainable pace. While challenges such as affordability persist, the evolving market dynamics present opportunities for both buyers and sellers to achieve their real estate objectives.

Whether you're a first-time homebuyer, a seasoned investor, or a homeowner contemplating a sale, staying informed about market trends is paramount. By leveraging the latest data and insights, you can make well-informed decisions tailored to your specific needs and goals.