Thinking about the value of your home or planning to buy one? Well, buckle up, because the housing market is looking a bit different for 2025. Experts are saying that home price appreciation for 2025 is forecast to remain lower than in 2024. This doesn't mean prices will suddenly crash, but the big increases we might have seen in the recent past are likely to slow down. Let's dive into why this is happening and what it could mean for you.

Home Price Growth in 2025 is Forecast to Lag Behind 2024's Pace

What the Numbers Are Telling Us

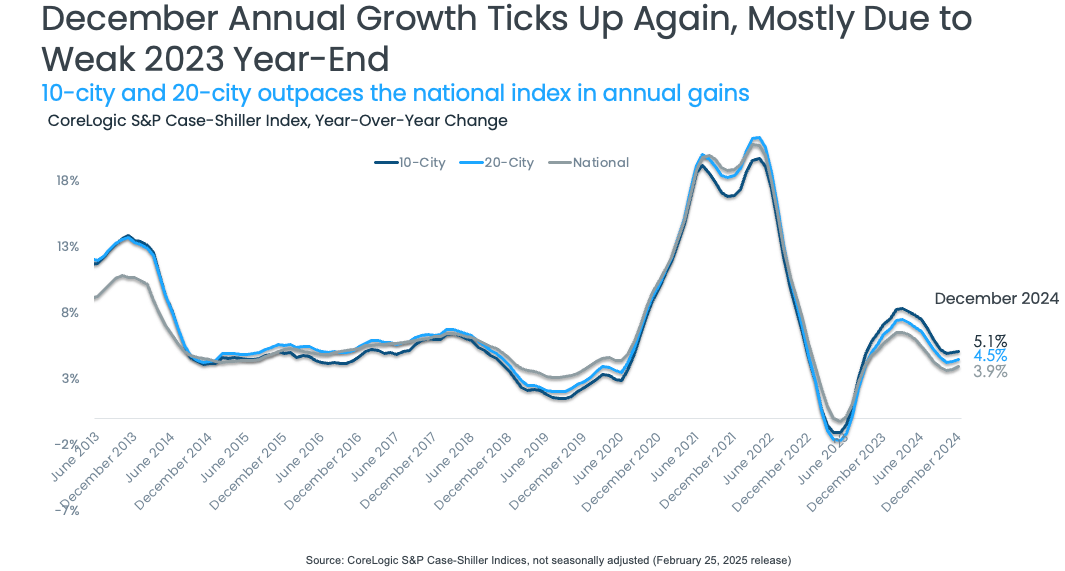

Based on the latest data from CoreLogic, a company that really knows its stuff when it comes to housing, the pace at which home prices are going up is expected to ease in 2025. While we saw some pretty strong gains earlier in 2024, reaching a peak of 6.5% annual price growth in February and March, the forecast for 2025 suggests an average appreciation of around 2.8% nationwide. To put it plainly, the rocket ship of home price increases is starting to gently glide back down.

Even towards the end of 2024, we saw some interesting shifts. December actually marked the second month where the annual price growth ticked upwards slightly, reaching 3.9%. This might seem like things are speeding up again, but it's more of a small bump in the road. Looking closer at the monthly changes, home prices actually declined for five months straight before this little December rise. This shows an underlying cooling trend.

Why the Slowdown? Let's Break It Down

So, what's causing this anticipated slowdown in home price growth? It's not just one thing, but a combination of different factors that are influencing both buyers and sellers.

- The Shadow of High Mortgage Rates: Let's be honest, mortgage rates have been higher than what many of us have gotten used to. This directly impacts how much house people can afford. When it costs more to borrow money, the pool of potential buyers shrinks, and those who are still in the market tend to be more cautious about how much they're willing to pay. This increased cost of borrowing acts like a brake on rapid price increases.

- Buyer Fatigue and Caution: After a period of intense competition and rapidly rising prices, many potential homebuyers have simply become more hesitant. They're seeing more homes on the market, giving them more choices and less pressure to jump into a deal at any cost. Economic worries and uncertainty about the future are also making people think twice before making such a big financial commitment. I've talked to many people who are taking a “wait and see” approach, hoping for more favorable conditions.

- More Homes on the Market: Remember when it felt like there were barely any houses for sale? That's been changing. As we moved through 2024, the number of available homes started to increase in many areas. More inventory gives buyers more power. When there are more options, sellers can't always command the sky-high prices they might have gotten before. The end of 2024 even saw a significant rise in de-listings, meaning some sellers decided to take their homes off the market, perhaps sensing a shift in buyer demand.

- Comparing to a Hot 2024: It's also important to remember what happened in 2024. We saw some really strong price gains, especially in the spring. When we look at the year-over-year numbers for 2025, we're comparing them to those relatively high points from the previous year. This makes the growth rate in 2025 naturally appear lower, even if prices aren't actually falling dramatically.

Regional Differences: Not All Markets Are the Same

One thing I've learned over the years is that the housing market isn't a single, unified entity. What's happening in one part of the country can be very different from what's going on somewhere else. The CoreLogic data highlights this quite clearly.

- Cooling in the Southeast: Some areas, particularly in the Southeast like Tampa and Atlanta, experienced a more significant slowdown in annual price gains towards the end of 2024. Tampa even saw an annual price decline of 1.1% in the 20-city index. This suggests that some markets that were hot may be seeing a correction.

- Continued Strength in the Northeast: On the other hand, cities like Boston, New York, and Chicago showed more resilience, leading the 20-city index with strong annual gains. These areas might have factors like limited inventory or strong local economies that are helping to support prices. I've noticed that in these areas, demand often outstrips supply, which keeps prices firmer.

- The Midwest Story: Markets in the Midwest, like Cleveland and Detroit, saw some cooling after a strong start to 2024. This shows that even areas that initially had an advantage can be influenced by broader market trends.

Here's a quick look at how some key metros were performing at the end of 2024:

| Metro Area | Annual Price Growth (December 2024) |

|---|---|

| New York | 7.2% |

| Chicago | 6.6% |

| Boston | 6.3% |

| National Average | 3.9% |

| Denver | (Lower than national average) |

| Dallas | (Lower than national average) |

| Tampa | -1.1% |

Looking Ahead to the Spring Buying Season

The spring is usually a busy time for the housing market, and everyone's watching to see what 2025 will bring. Early signs suggest it might look a lot like 2024. While there will likely be more homes available for sale, which is good news for buyers, those buyers are still expected to be cautious due to the economic climate and those persistent higher mortgage rates.

One interesting point is the level of inventory in different markets. Cities like Boston and Chicago, which are still seeing price pressure, have inventories that are significantly below pre-pandemic levels. This lack of supply can help keep prices elevated. In contrast, Western markets like Denver, San Diego, and Las Vegas had more inventory but still showed relatively steady pricing, particularly for mid-tier and high-tier homes. This suggests that even in markets with more choices, demand might still be strong for certain types of properties.

Recommended Read:

Warning of a Weak Housing Market: Are We Headed for Another Crisis?

Fannie Mae Lowers Housing Market Forecast and Projections for 2025

Housing Market Forecast 2025 by JP Morgan Research

Housing Predictions 2025 by Warren Buffett's Berkshire Hathaway

The Wild Cards: Uncertainty and Policy

As someone who follows the housing market closely, I know that there are always factors that can throw a wrench in even the most careful predictions. Right now, there's a fair amount of uncertainty floating around.

- Economic Policies: Potential policy changes can have a big impact on the economy, and by extension, the housing market. For example, talk of government layoffs could affect specific regions, particularly those with a large government presence like the Washington D.C. metro area. Job losses can definitely put downward pressure on housing demand and prices.

- Non-Fixed Homeownership Costs: It's not just the mortgage payment that homeowners have to worry about. Costs like insurance and property taxes are also on the rise in many areas. These increasing costs can make homeownership less affordable and could further dampen demand in some markets, like Tampa, which has already seen some weakening.

My Two Cents: A More Balanced Market Ahead?

If you ask me, the forecast for slower home price appreciation in 2025 isn't necessarily a bad thing. After the rapid increases of the past few years, a more balanced market could be healthier in the long run. It might mean that buyers have more time to make decisions, there's less intense bidding, and prices become more aligned with underlying economic fundamentals.

For sellers, it might mean adjusting expectations. While you might not see the same quick and substantial profits as in recent times, well-maintained and properly priced homes should still attract buyers.

For potential homebuyers, this slowdown could create more opportunities. While mortgage rates remain a factor, the increased inventory and potentially less frantic competition could make finding the right home more manageable.

Of course, the housing market is complex and influenced by a multitude of local and national factors. It's always a good idea to keep a close eye on what's happening in your specific area and consult with local real estate professionals for personalized advice.

In Conclusion:

While home prices are still expected to rise in 2025, the rate of appreciation is forecast to be lower than what we experienced in 2024. This is due to a combination of factors, including higher mortgage rates, increased inventory, buyer caution, and comparisons to a strong prior year. However, remember that real estate is local, and different markets will experience different trends. Staying informed and understanding the dynamics at play will be key for both buyers and sellers in the year ahead.

Work with Norada in 2025, Your Trusted Source for Investment

in the Top Housing Markets of the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Housing Market Price Forecast for 2025 and 2026 Increased by NAR

- Will the Housing Market Crash Due to Looming Recession in 2025?

- 4 States Facing the Major Housing Market Crash or Correction

- 5 Cities Where Home Prices Are Predicted To Crash in 2025

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- Housing Market Forecast 2025: Affordability Crisis Will Continue

- Lower Mortgage Rates Will Reignite the Housing Demand in 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for the Next 4 Years: 2025 to 2028

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?