The California housing market is always a hot topic, and right now, it's showing some interesting shifts. In short, while we've seen a nice jump in home sales compared to last year, sales are still below what we'd consider normal levels, and prices are showing a mixed bag, depending on where you look. It's a market with lots of moving parts, and I'm here to break it all down for you in a way that's easy to understand. Let's dive in and see what's shaping the current housing scene in the Golden State.

Current California Housing Market Trends: What's Happening

Home Sales

Okay, let's talk about home sales first. I always find this one interesting because it gives us a sense of how much activity is happening in the market. According to the California Association of Realtors® (C.A.R.), November 2024 saw the largest annual increase in home sales since June 2021. That’s definitely a positive sign!

- November 2024: A total of 267,800 existing single-family homes were sold at a seasonally adjusted annualized rate.

- Compared to October 2024: That’s a 1.1% increase.

- Compared to November 2023: We're looking at a significant 19.5% jump!

That's a huge leap, right? However, and this is important: Even with this jump, the number of homes being sold is still below the pre-COVID norm of about 400,000 units. So, while things are picking up, we aren't back to where we were before the pandemic. It's like we're trying to catch up, but we're not there yet.

Here's a quick table to illustrate the recent sales trends:

| Time Period | Annualized Sales (Existing Single-Family Homes) |

|---|---|

| November 2023 | 224,140 |

| October 2024 | 264,870 |

| November 2024 | 267,800 |

The interactive chart above offers a comprehensive visual summary of key real estate metrics in California for Nov 2023 and Nov 2024. To explore different metrics in the chart, hover over the bars to see specific data points like home sales, median home prices, days on the market, sales-price-to-list-price ratio, and price per square foot. You can click on the category names in the rectangles above to strike through and temporarily remove that metric from the chart. This allows you to focus on the remaining metrics for a clearer comparison.

Home Prices

Now, let’s get to the topic that most people are curious about: home prices! This is where things get a little more nuanced. While the sales data shows a good jump from last year, price data tells a slightly different story.

Here's what C.A.R. reported:

- November 2024 Median Price: $852,880.

- Compared to October 2024: Prices actually decreased by 4%.

- Compared to November 2023: However, there was a 3.8% increase from $821,710.

This is where I think it's really important to remember that the real estate market is not a monolith. Prices aren’t going to behave the same way everywhere. The significant month-to-month drop from October to November is partially due to a shift in the types of homes that were selling. More lower-priced homes sold, while fewer higher-end properties moved, pulling down the overall median price. Higher-end home sales still contributed to the overall price growth compared to 2023.

Here's a snapshot of the price changes:

| Time Period | Median Home Price |

|---|---|

| November 2023 | $821,710 |

| October 2024 | $888,740 |

| November 2024 | $852,880 |

Regional Price Variations:

It’s also important to note that prices are not rising or falling at the same rate all over the state. Here's a glimpse of how prices fared across major regions compared to November 2023:

- Central Coast: 7.9% increase

- San Francisco Bay Area: 5.3% increase

- Central Valley: 4.3% increase

- Southern California: 3.1% increase

- Far North: 0% increase.

As you can see, the Central Coast and Bay Area are experiencing the most significant price hikes. This is often due to their desirable locations, proximity to job centers, and limited housing stock.

County-Level Price Changes

Now, let's zoom in further to the county level. The median sales price actually went up in 38 of 53 counties. And here are a couple of notable examples:

- Santa Barbara: A whopping 51.9% increase, mainly due to high-end property sales.

- Lassen: A significant 48.3% price jump.

- Del Norte: A substantial decrease of 23.9%.

It's quite clear the market is behaving very differently from county to county and region to region. I believe this underscores the importance of doing your research and speaking to a local real estate professional if you're considering buying or selling.

Housing Supply

Now, let's talk about another critical piece of the puzzle: housing supply. The number of homes for sale has a huge impact on prices and how competitive the market is.

Here's what the data shows:

- Unsold Inventory Index (UII): Improved compared to both the prior month and last year.

- Year-over-year Increase in Listings: There’s been a double-digit jump in available listings.

- Active Listings: These surged by nearly 27% year-over-year.

In fact, November marked the ninth consecutive month of double-digit increases in for-sale properties. This is a significant change compared to the low-inventory conditions we've been experiencing over the last few years. In my view, this rise in supply is a major contributing factor to the slower price increases we've seen lately. More homes on the market mean buyers have more choices, which can lead to less intense bidding wars.

Here’s what we can gather about the increase in listings at the county level:

- Sutter: A massive increase of 73.7%.

- Calaveras: A jump of 66.9%.

- San Joaquin: A substantial rise of 51.7%.

- San Mateo: A decrease of 12.5%

- San Francisco: A 7.5% drop

- Trinity: A decline of 7.4%.

This paints a pretty clear picture: While most areas have seen more homes for sale, there are a few exceptions. Again, local markets vary so widely in California.

Property Tax Rates in the California

California's property tax landscape is unique, shaped by Proposition 13 and subsequent legislation. This system, while aiming to protect homeowners from volatile market fluctuations, can be complex to understand.

Let's break it down:

Firstly, California's property tax rate is capped at 1% of the assessed value of your property. This assessed value, however, is not necessarily the market value. When you buy a home in California, the purchase price becomes the initial assessed value. From then on, your assessed value can only increase by a maximum of 2% per year, regardless of how much your home's market value may rise. This 2% cap, thanks to Proposition 13, provides homeowners with a sense of predictability and protection from dramatic tax hikes.

However, this also means that homeowners who have lived in their homes for a long time might be paying significantly less in property taxes than newer homeowners with similar properties. This disparity in property tax burdens is a key point of discussion surrounding Proposition 13.

Beyond the 1% base rate, there are additional local taxes and bonds that are added to your property tax bill. These vary depending on your specific location and are used to fund local services like schools, parks, and libraries. Consequently, even though the base rate is fixed, your total property tax rate can fluctuate based on local needs and voter-approved initiatives.

Market Trends

Okay, let's step back and look at the big picture. What trends are we seeing in the California housing market right now?

- Increased Sales, but Still Below Pre-COVID Levels: As I mentioned earlier, while sales are up significantly compared to last year, we're still below the pre-pandemic norm. This suggests the market is improving, but there’s still room for recovery.

- Moderating Price Growth: Although median home prices are higher than last year, they have been falling month to month in the past couple of months.

- More Choices for Buyers: The consistent rise in housing supply means buyers are starting to have more options. This can alleviate some of the pressure of the hyper-competitive market we’ve seen in the last few years, and this means more time to make purchase decisions.

- Regional Variations: As the data above shows, each region and county is experiencing a different trend in sales activity and prices.

- Longer Time on Market: The median time a house is staying on the market is up from 21 days to 26 days compared to November 2023. This is another indicator that the urgency is easing and buyers are not in a hurry to purchase.

I believe these trends reflect a market that’s slowly shifting. We're moving away from the frenzied conditions of the past and toward a more balanced market, but it’s a slow and steady change, and the speed of change will be different everywhere.

Is California a Buyer's or Seller's Housing Market?

This is the million-dollar question, right? The answer, as you might expect, isn’t simple. In my opinion, it’s leaning away from a sellers market but it has not completely transitioned into a buyer's market.

- For sellers, you might not be getting quite the offers you would've gotten two years ago but you are still likely to sell your home at a profit and above the listing price in most areas of California, albeit not by a huge percentage. The market favors you more if you sell in Central Coast or the Bay Area, and less in the Far North.

- For buyers, there's a little breathing room. More inventory means more choices, and prices, while still high, are not rising as dramatically in most regions of California. I think there’s a window of opportunity if you're prepared to take it.

It's not a complete shift to a buyer's market, but conditions are becoming more favorable to buyers compared to the intense seller's market we had not long ago.

Are California Home Prices Dropping?

The big question on everyone’s mind: Are home prices actually dropping in California? The answer is nuanced.

- Overall: Yes, prices did drop by 4% from October to November 2024. This is a significant monthly drop.

- However: When we zoom out, the median price is still 3.8% higher than in November 2023. So, prices are still up year-over-year, but that increase is moderating.

- Regional Nuances: As we have seen, the drop is not uniform. Some areas may see actual price drops, while others may only see a slower pace of price growth.

In summary, while we saw a drop from October to November, it might be a little too early to say whether this is a long-term trend. The market is still quite dynamic, and the change will be different for different parts of California. In my experience, the market often experiences a seasonal slow down in the Fall and early winter months, so it remains to be seen what will happen during the Spring homebuying season in 2025.

Other Interesting Data Points

Here are a few more data points I think are worth mentioning:

- Sales-to-List-Price Ratio: In November 2024, the sales-to-list-price ratio was 99.4%. This means that, on average, homes are selling slightly below their original listing price, a shift compared to 2023 when this figure was 100.0%.

- Median Price per Square Foot: This rose to $429 in November 2024, up from $420 in November 2023, reflecting the overall increase in home values.

- Mortgage Rates: The 30-year fixed mortgage interest rate averaged 6.81% in November 2024, down from 7.44% the previous year. This is a good sign, as lower rates can encourage more buyers to enter the market.

My Concluding Thoughts

The California housing market is like a complex puzzle, and many factors are influencing it right now. In my view, it's a market in transition. Sales are up from last year, but still not at normal levels. Prices are still up compared to last year but are showing signs of moderating, and inventory is rising. It’s not quite a buyer's market yet, but conditions are improving for those looking to purchase.

Why is the California Housing Market So Expensive?

We all know that California is the most expensive housing market in the country. Its reign as the most expensive housing market in the United States is a complex issue rooted in a confluence of factors that have built up over decades. While many point to the state's booming economy and desirable lifestyle, the reasons run far deeper.

A primary driver is the simple principle of supply and demand. California consistently ranks among the most populous states, attracting millions with its renowned climate, diverse culture, and ample job opportunities, particularly in high-paying sectors like technology and entertainment.

The state has more than 39 million residents as of 2022, constituting 11.7 percent of the U.S. population. This constant influx of new residents, coupled with a historically slow pace of housing construction, has created a significant imbalance, driving up prices as demand consistently outpaces supply.

This housing shortage is further exacerbated by stringent regulations and bureaucratic hurdles that make building new homes in California a costly and time-consuming endeavor. Zoning laws, environmental regulations, and lengthy permitting processes all contribute to delays and increased expenses for developers, costs which are ultimately passed on to buyers in the form of higher prices.

Beyond these fundamental factors, California's unique geography plays a role. Hemmed in by the Pacific Ocean to the west and mountain ranges to the east, the state faces natural limitations on its land available for development. This scarcity of buildable land, especially in desirable coastal areas, further intensifies competition and inflates prices.

Furthermore, California's robust economy, while attracting residents and driving up demand, also contributes to higher housing costs. High-paying industries and a thriving job market result in greater disposable income among residents, empowering them to afford more expensive homes and further fueling the upward pressure on prices.

This economic prosperity, while beneficial in many ways, unfortunately, creates a cycle where housing becomes increasingly inaccessible to those not earning top salaries.

Addressing California's housing crisis demands a multifaceted approach. Increasing supply through streamlined regulations and incentives for developers is crucial, as is exploring innovative housing solutions like increased density and more affordable housing options.

What to Expect in the California Housing Market in 2025?

1. Mortgage Rates Will Play a Key Role

- The recent dip in interest rates has been a breath of fresh air for buyers.

- While no one can predict the future with certainty, most experts believe rates will remain relatively stable for the rest of the year, hovering around the 6-7% range.

- This could incentivize more buyers to enter the market, especially if prices continue to moderate.

2. Inventory Will (Slowly) Improve

- The increase in active and new listings is a positive sign.

- However, don't expect a sudden surge in inventory. California has a chronic undersupply of housing, and it will take time to bridge the gap.

3. Price Growth Will Continue, But at a Slower Pace

- Double-digit price appreciation is likely a thing of the past (for now, at least).

- Most analysts predict more sustainable, single-digit price growth for the remainder of 2024.

- Don't expect a crash – the fundamentals of the California economy remain strong, supporting continued demand for housing.

4. Regional Variations Will Persist

- As always, California's vastness means there's no one-size-fits-all trend.

- The Bay Area, with its robust tech sector, will likely continue to see strong demand, even with some cooling.

- Coastal communities, highly desirable for their lifestyle, will also remain competitive.

Factors Impacting the California Housing Market

Several factors have contributed to the challenges facing the California housing market. Here are some key factors that interact with each other, creating a complex and dynamic housing market in California.

1. High Demand and Limited Supply:

California has a high population density and strong economic growth, leading to a high demand for housing. However, there is a limited supply of available housing, particularly in desirable areas. This imbalance between supply and demand has driven up housing prices, making it difficult for many prospective buyers to afford homes.

2. Affordability Issues:

The high cost of housing in California has made homeownership less attainable for many residents. The median home price in the state is significantly higher than the national average. The combination of high home prices, rising interest rates, and stringent mortgage qualification rules has created affordability challenges for prospective buyers.

3. Strict Zoning and Land Use Regulations:

California has some of the most stringent zoning and land use regulations in the country. These regulations often restrict new construction and development, making it difficult to increase the housing supply to meet demand. This has resulted in a housing shortage and contributed to the rising prices.

4. Lack of Affordable Housing:

California faces a severe shortage of affordable housing, particularly in major cities. The cost of constructing affordable housing and the complex process of obtaining approvals and permits have hindered the development of affordable units. This has exacerbated the affordability crisis and led to a growing population of renters.

5. Economic Factors:

Economic conditions, such as job growth, wages, and interest rates, can significantly impact the housing market. Slowing economic growth or stagnant wages can dampen demand for housing, while rising interest rates can increase borrowing costs and dissuade potential buyers. These factors, in combination with high housing prices, have made it challenging for many Californians to enter the housing market.

6. Impact of Natural Disasters:

California is prone to natural disasters, including wildfires and earthquakes, which can damage or destroy homes and disrupt the housing market. Rebuilding efforts and insurance costs following these events can impact housing availability and affordability in affected areas.

7. Migration Patterns:

Migration patterns also play a role in the housing market. California has experienced both domestic and international migration, leading to increased demand for housing. However, in recent years, there has been a trend of net outmigration, with some residents leaving the state due to affordability concerns, congestion, and other factors. This can impact the supply and demand dynamics of the housing market.

California Housing Market Forecast 2025-2026

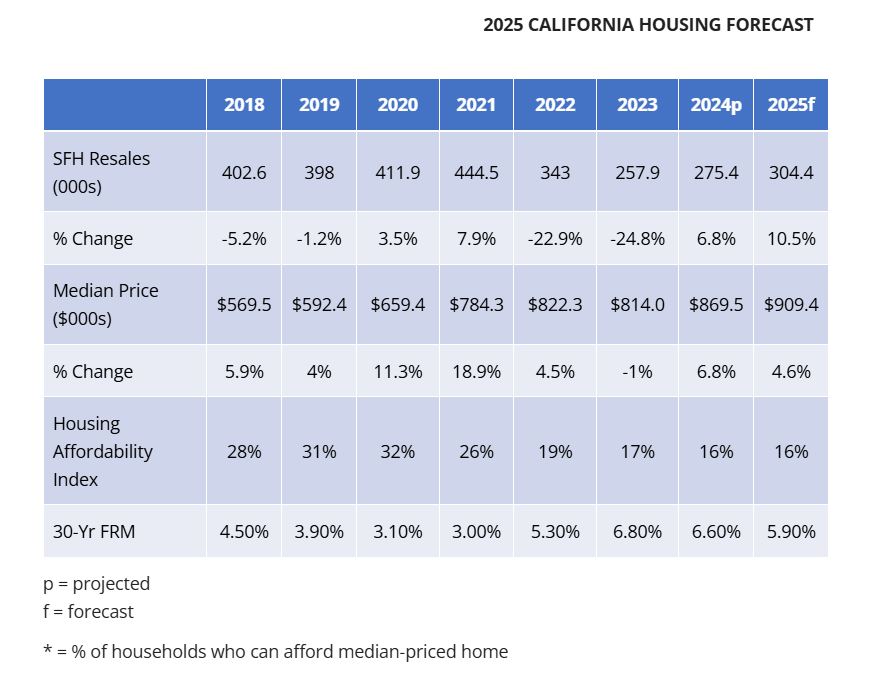

The California‘s housing market forecast for 2025 anticipates a rise in both home sales and prices, with the median home price potentially reaching $909,400. This positive outlook is fueled by a projected improvement in housing supply and a more favorable interest rate environment, attracting more buyers and sellers back to the market.

A Brighter Outlook for California's Housing Market

Over the past few years, the California housing market has been a roller coaster ride. We've seen dramatic swings in interest rates, a shortage of homes available for sale, and a significant impact on affordability. However, based on recent data and projections, it seems that we are entering a period of relative stability and potential growth.

The California Association of Realtors (C.A.R.) has released its 2025 forecast, and the general consensus is optimistic. They project that existing single-family home sales will increase by 10.5% in 2025, reaching 304,400 units. This increase is a significant shift from the recent downward trends caused by high-interest rates and limited inventory.

Factors Driving the California Housing Market Forecast 2025

Several key factors are contributing to this projected growth in the California housing market:

- Lower Interest Rates: The forecast predicts that the average 30-year fixed-rate mortgage will decline from 6.6% in 2024 to 5.9% in 2025. This reduction in borrowing costs will make it easier for buyers to qualify for a mortgage and could spark increased demand. I feel it's a great opportunity for first-time homebuyers to enter the market as it will bring the rates closer to pre-pandemic levels.

- Improved Housing Inventory: Although the housing supply will still be below historical averages, there's an expectation of a moderate increase in active listings. Homeowners who were hesitant to sell due to the “lock-in effect” (when homeowners are hesitant to sell due to existing low interest rates) may be more inclined to list their homes as interest rates decrease and offer more selling flexibility.

- Returning Buyers and Sellers: The combined effect of lower interest rates and a less restrictive inventory situation will likely lead to increased activity from both buyers and sellers.

- Continued Demand: While the rate of price growth is projected to moderate, the demand for housing in California remains high. This strong demand, coupled with limited inventory, will continue to push prices upward.

The California Median Home Price Forecast

The C.A.R. forecast predicts the California median home price will increase by 4.6% to reach $909,400 in 2025. This is following a projected 6.8% increase in 2024 to $869,500 from the 2023 level of $814,000. While this signifies continued price growth, it's important to note that the pace of this growth is anticipated to be slower than in recent years.

My personal take on this is that the housing shortage will continue to impact affordability, even with the predicted increase in inventory. This continued shortage creates a competitive environment that will keep prices elevated in the majority of California's cities.

Housing Affordability: A Persistent Challenge

Housing affordability is a crucial issue for California residents, and the forecast suggests that it will remain a concern in 2025. The affordability index is projected to stay at 16%, meaning that the median-priced home is only affordable to 16% of households. It's a concern that needs to be addressed.

Economic Outlook and Impact on the California Housing Market

The California housing market is not isolated from broader economic trends. The forecast anticipates a slight slowdown in the U.S. and California economies in 2025.

- GDP Growth: The U.S. GDP is projected to slow to 1.1% in 2025, compared to 1.9% in 2024.

- Job Growth: California's nonfarm job growth is expected to decline to 1.1% in 2025 from 1.5% in 2024.

- Unemployment Rate: California's unemployment rate is anticipated to tick up to 5.6% in 2025, compared to a projected 5.4% in 2024.

However, the economic outlook is still considered relatively healthy, which should provide support to the housing market.

California Housing Market Forecast 2025: Historical Data

Here is a table that outlines the key metrics of the California housing market over the past few years and the projections for the coming years.

| Year | SFH Resales (000s) | % Change | Median Price ($000s) | % Change | Housing Affordability Index | 30-Yr FRM |

|---|---|---|---|---|---|---|

| 2018 | 402.6 | -5.2% | 569.5 | 5.9% | 28% | 4.50% |

| 2019 | 398 | -1.2% | 592.4 | 4% | 31% | 3.90% |

| 2020 | 411.9 | 3.5% | 659.4 | 11.3% | 32% | 3.10% |

| 2021 | 444.5 | 7.9% | 784.3 | 18.9% | 26% | 3.00% |

| 2022 | 343 | -22.9% | 822.3 | 4.5% | 19% | 5.30% |

| 2023 | 257.9 | -24.8% | 814.0 | -1% | 17% | 6.80% |

| 2024p | 275.4 | 6.8% | 869.5 | 6.8% | 16% | 6.60% |

| 2025f | 304.4 | 10.5% | 909.4 | 4.6% | 16% | 5.90% |

The California housing market forecast for 2025 indicates a potential rebound in both sales and prices. The projected improvement in inventory and lower interest rates is likely to attract more buyers and sellers. While the pace of price growth is expected to slow down, the underlying demand and limited supply conditions will likely continue to put upward pressure on home prices.

I believe that 2025 could present both challenges and opportunities for those looking to buy or sell in the California housing market. It's crucial to stay informed about current market conditions and to consult with real estate professionals to make well-informed decisions.

Should You Buy a House in California in 2025?

California's sunshine and laid-back lifestyle lock in many a homebuyer's sights. But is it a smart investment right now? Let's crunch the numbers and explore the current California housing market to help you decide if this is the golden moment to make your move.

Market on the Move: Boom or Bust?

California's housing market has a well-deserved reputation for soaring prices. The past decade has seen impressive appreciation, with some areas experiencing double-digit growth. However, the recent quarters have shown a shift. The breakneck pace has cooled, with some regions even experiencing slight dips. This could be a sign of a long-awaited correction or simply a temporary adjustment.

Numbers to Know: Crunch Time

So, what do the numbers tell us? Here's a reality check: while the recent price hikes may have eased, California homes are still expensive. The statewide median price recently hit a record high of over $900,000. Couple that with rising interest rates, and monthly mortgage payments can feel like a hefty weight on your wallet.

Beyond the Numbers: Considering Your Needs

The decision to buy a house in California goes beyond cold, hard numbers. It's about your long-term goals and financial health. Here are some key questions to ask yourself:

- Are you in it for the long haul? California real estate has historically been a good long-term investment. If you plan to stay put for at least five to seven years, you'll weather any market fluctuations and likely see your home value appreciate.

- Can you handle the upfront costs? Don't forget about the down payment, closing costs, and potential repairs. Having a healthy financial buffer will ease the initial strain.

- Is your job stable? Job security is crucial, especially in a state with a higher cost of living.

A Competitive Market: Be Prepared

California's housing market is competitive, especially in desirable locations. Inventory remains tight, so be prepared to act fast and make competitive offers. Having a strong pre-approval from a reputable lender will put you ahead of the pack.

The California housing market has its complexities. Teaming up with a qualified real estate agent who understands the local market nuances is wise. They can guide you through the process, negotiate on your behalf, and help you find the perfect place that fits your budget and lifestyle.

The Verdict: It Depends

There's no one-size-fits-all answer to the California housing question. If you've done your research, understand the market conditions, and are financially prepared, buying a house in California could be a great decision. But remember, it's a significant investment, and it's wise to approach it with both eyes open.

Related Articles:

- California Housing Market Predictions 2025

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash in 2024?

- Will the US Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?