The California housing market is known for its high costs and fierce competition, but it's also a dynamic and ever-changing environment. As of February 2025, the market is showing signs of rebounding with increased home sales and fluctuating mortgage rates. While the median home price stands at $829,060, understanding the nuances of this market is crucial whether you're a buyer, seller, or simply curious about the real estate trends. Let's dive deep into what's happening, where the opportunities lie, and what the future might hold.

Current California Housing Market Trends:

Why is California Housing So Unique?

California's housing market isn't just expensive; it's complex. Several factors contribute to its distinctive character:

- High Demand, Limited Supply: California's desirable climate, thriving tech industry, and cultural attractions draw people from all over the world. However, geographical constraints (mountains, coastlines) and strict zoning regulations limit the amount of buildable land.

- Strong Economy: The state's robust economy, particularly in tech hubs like Silicon Valley, creates high-paying jobs, fueling demand for housing.

- Stringent Environmental Regulations: While beneficial for the environment, these regulations can slow down the construction process and increase development costs.

- Proposition 13: This 1978 law limits property tax increases, which can discourage existing homeowners from selling, further restricting supply.

- “Not In My Backyard” (NIMBY)ism: Resistance to new housing developments from existing residents is a common obstacle to increasing housing density.

February 2025: A Snapshot of the Market

According to the California Association of REALTORS® (C.A.R.), February 2025 brought some interesting shifts:

- Home Sales Rebound: Existing, single-family home sales reached a seasonally adjusted annualized rate of 283,540, the highest in over two years. This is a significant 11.6 percent increase from January and a 2.6 percent rise compared to February 2024.

- Median Home Price: The statewide median home price was $829,060, a 1.2 percent decrease from January but a 2.8 percent increase from February 2024.

- Inventory Increase: Total active listings grew at the fastest pace in two years, marking the 13th consecutive month of annual gains in housing supply.

Key Takeaway: The California housing market is showing signs of life after a period of sluggishness. Increased sales and rising inventory offer a glimmer of hope for buyers who have been struggling to find affordable options.

Regional Differences: It's Not Just One Market

California is a vast state, and the housing market varies significantly from region to region.

- San Francisco Bay Area: Still the most expensive region, the Bay Area saw a 0.5 percent price decline year-over-year, the first in five months. However, sales increased by 3.5 percent. Places like Solano and Sonoma which are more affordable markets in the region saw strong sales.

- Southern California: This region experienced a 4.8 percent price increase and a 3.0 percent sales decrease.

- Central Coast: The Central Coast saw the largest price growth at 9.4 percent, with sales increasing by 1.6 percent.

- Central Valley: The Central Valley experienced a 3.5 percent price increase but sales declined by 3.5 percent.

- Far North: The Far North region saw a 1.8 percent price increase and a 4.9 percent sales decrease.

Here's a quick table summarizing the regional performance:

| Region | Price Change (Year-over-Year) | Sales Change (Year-over-Year) |

|---|---|---|

| San Francisco Bay Area | -0.5% | 3.5% |

| Southern California | 4.8% | -3.0% |

| Central Coast | 9.4% | 1.6% |

| Central Valley | 3.5% | -3.5% |

| Far North | 1.8% | -4.9% |

Personal Opinion: I believe the Bay Area's slight price dip could indicate a potential shift. The rise of remote work might be making some people reconsider the high cost of living in the area, leading to a cooling effect.

County-Level Insights: Digging into the Details

Looking at individual counties provides even more granular insights:

- Santa Barbara: Experienced the biggest price growth at 55.2 percent, primarily due to a sales surge in the South Coast.

- Imperial: Saw a significant sales jump of 33.3 percent.

- Tehama: Registered the biggest sales drop at 43.5 percent, potentially due to severe weather conditions.

- Trinity: Fell the most at 58.9 percent.

Important Note: County sales data is not adjusted for seasonal factors, so it's essential to consider external factors like weather when interpreting these numbers.

Inventory and Days on Market: What Buyers Need to Know

- Unsold Inventory Index (UII): The statewide UII was 4.0 months in February, down from 4.1 months in January but up from 2.9 months in February 2024. This indicates that the supply of homes on the market is increasing.

- Days on Market: The median number of days to sell a home was 26 days in February, up from 22 days in February 2024.

What does this mean for buyers?

- More Choices: Increased inventory means buyers have more options to choose from.

- Slightly Less Competition: A higher UII suggests slightly less competition, potentially giving buyers more negotiating power.

- Patience is Key: The increase in days on market indicates that homes are taking a bit longer to sell, so buyers shouldn't feel rushed.

Mortgage Rates and Affordability: The Elephant in the Room

Mortgage rates play a crucial role in housing affordability. In February 2025, the 30-year, fixed-mortgage interest rate averaged 6.84 percent, up from 6.78 percent in February 2024.

The Impact:

- Higher Monthly Payments: Even slight increases in mortgage rates can significantly impact monthly payments, making homeownership less affordable for many.

- Buyer Hesitation: Rising rates can discourage potential buyers, leading to a slowdown in sales.

Expert Opinion: C.A.R. Senior Vice President and Chief Economist Jordan Levine believes that mortgage rates are expected to stabilize later in 2025, which could lead to continued improvement in the housing market.

What's Driving the Market?

Several factors are shaping the California housing market in 2025:

- Declining Mortgage Rates (Early in the Year): Lower borrowing costs at the beginning of the year spurred buyer activity.

- Increased Inventory: More homes on the market are easing competitive pressures.

- Economic Uncertainty: Concerns about a potential recession and financial market volatility could negatively impact housing sentiment.

- Consumer Confidence: Ongoing policy and economic uncertainties weigh on consumer confidence, creating instability.

The Condo/Townhome Market: An Alternative Option

While the single-family home market grabs most of the headlines, the condo/townhome market also plays a significant role. In February 2025:

- The median price of a California condo/townhome was $675,000, up 4.0 percent from January and 2.3 percent from February 2024.

Why consider a condo/townhome?

- Lower Price Point: Generally more affordable than single-family homes.

- Lower Maintenance: Often includes maintenance services like landscaping and exterior repairs.

- Urban Living: Typically located in urban areas, offering convenient access to amenities.

Looking Ahead: Predictions and Possibilities

Predicting the future of the California housing market is always a challenge. However, based on current trends and expert opinions, here are some possibilities:

- Continued Recovery: If mortgage rates stabilize, the market is likely to see continued improvement through the second and third quarters of 2025.

- Regional Variations: The pace of recovery will likely vary across different regions, with some areas experiencing stronger growth than others.

- Increased Inventory: The trend of increasing inventory is expected to continue, providing more options for buyers.

- Affordability Challenges: Despite improvements in the market, affordability will remain a significant challenge for many Californians.

My Final Thoughts: I believe that now is a crucial time for both buyers and sellers to stay informed and make strategic decisions. Buyers should carefully assess their financial situation and be prepared to act quickly when they find a suitable property. Sellers should price their homes competitively and highlight their unique features to attract potential buyers. Also, in the long term, California needs to address its housing shortage by increasing density and streamlining the development process.

California Housing Market Forecast 2025-2026

The California‘s housing market forecast for 2025 anticipates a rise in both home sales and prices, with the median home price potentially reaching $909,400. This positive outlook is fueled by a projected improvement in housing supply and a more favorable interest rate environment, attracting more buyers and sellers back to the market.

A Brighter Outlook for California's Housing Market

Over the past few years, the California housing market has been a roller coaster ride. We've seen dramatic swings in interest rates, a shortage of homes available for sale, and a significant impact on affordability. However, based on recent data and projections, it seems that we are entering a period of relative stability and potential growth.

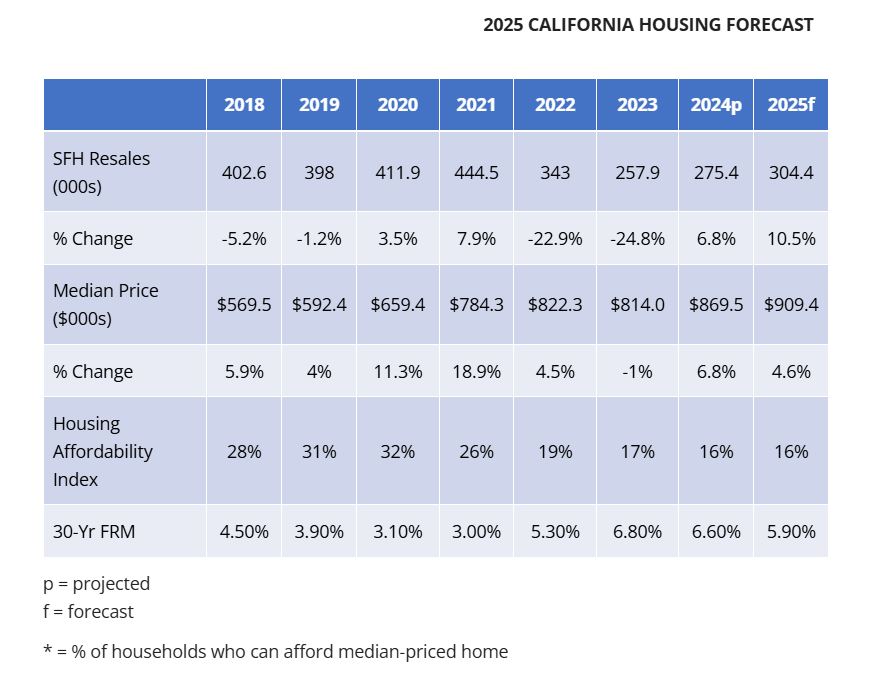

The California Association of Realtors (C.A.R.) has released its 2025 forecast, and the general consensus is optimistic. They project that existing single-family home sales will increase by 10.5% in 2025, reaching 304,400 units. This increase is a significant shift from the recent downward trends caused by high-interest rates and limited inventory.

Factors Driving the California Housing Market Forecast 2025

Several key factors are contributing to this projected growth in the California housing market:

- Lower Interest Rates: The forecast predicts that the average 30-year fixed-rate mortgage will decline from 6.6% in 2024 to 5.9% in 2025. This reduction in borrowing costs will make it easier for buyers to qualify for a mortgage and could spark increased demand. I feel it's a great opportunity for first-time homebuyers to enter the market as it will bring the rates closer to pre-pandemic levels.

- Improved Housing Inventory: Although the housing supply will still be below historical averages, there's an expectation of a moderate increase in active listings. Homeowners who were hesitant to sell due to the “lock-in effect” (when homeowners are hesitant to sell due to existing low interest rates) may be more inclined to list their homes as interest rates decrease and offer more selling flexibility.

- Returning Buyers and Sellers: The combined effect of lower interest rates and a less restrictive inventory situation will likely lead to increased activity from both buyers and sellers.

- Continued Demand: While the rate of price growth is projected to moderate, the demand for housing in California remains high. This strong demand, coupled with limited inventory, will continue to push prices upward.

The California Median Home Price Forecast

The C.A.R. forecast predicts the California median home price will increase by 4.6% to reach $909,400 in 2025. This is following a projected 6.8% increase in 2024 to $869,500 from the 2023 level of $814,000. While this signifies continued price growth, it's important to note that the pace of this growth is anticipated to be slower than in recent years.

My personal take on this is that the housing shortage will continue to impact affordability, even with the predicted increase in inventory. This continued shortage creates a competitive environment that will keep prices elevated in the majority of California's cities.

Housing Affordability: A Persistent Challenge

Housing affordability is a crucial issue for California residents, and the forecast suggests that it will remain a concern in 2025. The affordability index is projected to stay at 16%, meaning that the median-priced home is only affordable to 16% of households. It's a concern that needs to be addressed.

Economic Outlook and Impact on the California Housing Market

The California housing market is not isolated from broader economic trends. The forecast anticipates a slight slowdown in the U.S. and California economies in 2025.

- GDP Growth: The U.S. GDP is projected to slow to 1.1% in 2025, compared to 1.9% in 2024.

- Job Growth: California's nonfarm job growth is expected to decline to 1.1% in 2025 from 1.5% in 2024.

- Unemployment Rate: California's unemployment rate is anticipated to tick up to 5.6% in 2025, compared to a projected 5.4% in 2024.

However, the economic outlook is still considered relatively healthy, which should provide support to the housing market.

California Housing Market Forecast 2025: Historical Data

Here is a table that outlines the key metrics of the California housing market over the past few years and the projections for the coming years.

| Year | SFH Resales (000s) | % Change | Median Price ($000s) | % Change | Housing Affordability Index | 30-Yr FRM |

|---|---|---|---|---|---|---|

| 2018 | 402.6 | -5.2% | 569.5 | 5.9% | 28% | 4.50% |

| 2019 | 398 | -1.2% | 592.4 | 4% | 31% | 3.90% |

| 2020 | 411.9 | 3.5% | 659.4 | 11.3% | 32% | 3.10% |

| 2021 | 444.5 | 7.9% | 784.3 | 18.9% | 26% | 3.00% |

| 2022 | 343 | -22.9% | 822.3 | 4.5% | 19% | 5.30% |

| 2023 | 257.9 | -24.8% | 814.0 | -1% | 17% | 6.80% |

| 2024p | 275.4 | 6.8% | 869.5 | 6.8% | 16% | 6.60% |

| 2025f | 304.4 | 10.5% | 909.4 | 4.6% | 16% | 5.90% |

The California housing market forecast for 2025 indicates a potential rebound in both sales and prices. The projected improvement in inventory and lower interest rates is likely to attract more buyers and sellers. While the pace of price growth is expected to slow down, the underlying demand and limited supply conditions will likely continue to put upward pressure on home prices.

I believe that 2025 could present both challenges and opportunities for those looking to buy or sell in the California housing market. It's crucial to stay informed about current market conditions and to consult with real estate professionals to make well-informed decisions.

What to Expect in the California Housing Market in 2025?

1. Mortgage Rates Will Play a Key Role

- The recent dip in interest rates has been a breath of fresh air for buyers.

- While no one can predict the future with certainty, most experts believe rates will remain relatively stable for the rest of the year, hovering around the 6-7% range.

- This could incentivize more buyers to enter the market, especially if prices continue to moderate.

2. Inventory Will (Slowly) Improve

- The increase in active and new listings is a positive sign.

- However, don't expect a sudden surge in inventory. California has a chronic undersupply of housing, and it will take time to bridge the gap.

3. Price Growth Will Continue, But at a Slower Pace

- Double-digit price appreciation is likely a thing of the past (for now, at least).

- Most analysts predict more sustainable, single-digit price growth for 2025.

- Don't expect a crash – the fundamentals of the California economy remain strong, supporting continued demand for housing.

4. Regional Variations Will Persist

- As always, California's vastness means there's no one-size-fits-all trend.

- The Bay Area, with its robust tech sector, will likely continue to see strong demand, even with some cooling.

- Coastal communities, highly desirable for their lifestyle, will also remain competitive.

Related Articles:

- California Housing Market Predictions 2025

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash in 2024?

- Will the US Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?