The California housing market showed surprising resilience in 2024, ending the year on a strong note despite the many hurdles it faced. Existing, single-family home sales saw a notable increase, and the median home price also experienced growth, marking a positive close to a year that began with many uncertainties. It's not a perfect picture, but definitely a brighter one than many of us expected a few months ago.

California Housing Market Closes the Year 2024 Strong Despite Challenges

I've been keeping a close eye on the real estate scene in California for years, and I have to say, 2024 was a rollercoaster. From fluctuating mortgage rates to those devastating wildfires that hit Southern California, there was a lot to navigate. However, the market's ability to not only withstand these pressures but also show signs of growth is, frankly, impressive. It's a testament to the enduring appeal of the Golden State and the underlying demand for housing here.

Sales Numbers: A Welcome Surprise

Let's dive into the numbers a bit. According to the California Association of Realtors (C.A.R.), sales of existing single-family homes in December 2024 reached a seasonally adjusted annualized rate of 268,180. Now, what does that mean in plain English? It means that if the December sales pace continued for the entire year, that's how many homes would be sold. This figure is adjusted to take into account that home sales naturally slow down in some parts of the year.

Here’s the exciting part: this December number was up 0.1% from November and a significant 19.8% from December 2023. That's a big leap, especially considering the struggles we saw in the market last year. While it's important to note that the 2023 December figures were very low, this jump is still really positive. For the whole of 2024, sales were also up by 4.3% compared to 2023, a much-needed boost for the market that hadn't seen a year of growth for three years.

Key Sales Highlights:

- December 2024 (Annualized Rate): 268,180 homes

- Month-over-Month Increase: 0.1% (from November 2024)

- Year-over-Year Increase: 19.8% (from December 2023)

- Overall 2024 Sales Increase: 4.3% (compared to 2023)

Prices on the Rise

It wasn't just sales that saw an increase. The median price of a single-family home in California also climbed to $861,020 in December. That's a 1% increase from November and a 5% increase compared to December of the previous year. I’ve seen firsthand how frustrating the pricing wars have been for buyers, but for sellers, the good news is that price growth has been steady, if not spectacular. This continuous rise in the median price is a big deal, marking the 18th consecutive month of year-over-year increases. The increase, in my opinion, speaks to the underlying strength of the California housing market.

For the entire year, the median home price across the state also saw an uptick. It ended up being 6.3% higher in 2024 as compared to the previous year.

Key Price Highlights:

- December 2024 Median Price: $861,020

- Month-over-Month Increase: 1% (from November 2024)

- Year-over-Year Increase: 5% (from December 2023)

- Overall 2024 Median Price Increase: 6.3% (compared to 2023)

Regional Differences: Not All Areas Are Created Equal

While the statewide picture is positive, the story isn't the same everywhere in California. Some regions saw much bigger gains than others. For me, this is a crucial part to understand. Here's a quick breakdown:

- The Central Coast experienced the biggest jump in sales with a 20.5% year-over-year increase. This area seems to be really catching the eyes of buyers.

- Southern California followed closely behind with a 16.3% sales increase. Despite those devastating wildfires, this area has shown a remarkable bounce back.

- The Central Valley and the San Francisco Bay Area also saw substantial increases, with 15.1% and 14.6% sales growth respectively. The Bay Area numbers are especially interesting given the high prices.

- The Far North region had more moderate growth at 6.3%, showing that not every region is experiencing the same level of demand.

On the price front, Southern California again led the way, recording a 7.6% year-over-year price increase. The Central Valley was next, posting a 6.5% increase. The remaining three regions saw a lower price increase, with the Central Coast at 1.6%, the San Francisco Bay Area at 1.5% and the Far North at 1.4%.

It's clear that some areas are experiencing a stronger recovery than others. These regional differences are something I keep in mind when working with my clients.

The High-End Market's Impact

Here's where it gets interesting, and perhaps a bit unequal. The high-end market, or the price segment of $1 million or more, continues to have a significant impact on the overall median price. Sales in this category increased by a staggering 28.7% year-over-year in December. Meanwhile, the sub-$500,000 market saw a 0.4% decrease in sales. This dynamic has implications for first-time home buyers, as they often tend to compete in this lower segment.

What this says to me is that, while the market is showing signs of recovery, some of the gains are primarily concentrated at the top end of the market. This isn’t necessarily a problem, but it does make the housing landscape in the state a bit more complex, especially as affordability remains a major concern. I personally believe the housing market needs to cater to everyone, not just the wealthy.

Inventory and Time on Market

The unsold inventory index, which indicates how many months it would take to sell all the homes currently on the market, has moved down from 3.3 in November to 2.7 months in December but still it is a bit higher than 2.6 months in December 2023. This suggests that while more homes are being sold, the inventory has not decreased much. This could be due to the mortgage interest rates that are still high, resulting in fewer buyers in the market. It has gone down month over month, but it is still up from the previous year.

Also, the median time it took to sell a house increased slightly from 26 days in December 2023 to 31 days in December 2024. The statewide sales-to-list price ratio also went down slightly to 98.7% in December 2024 from 99.0% in December 2023. The price per square foot, on the other hand, went up from $397 in December 2023 to $413 in December 2024.

What these numbers tell me is that the market is still somewhat balanced. Homes are selling, but they are taking a little longer. There's still room for negotiation and things are not as lopsided as they were a year ago.

Challenges Ahead in 2025: The Real Estate Rollercoaster Isn't Over

While 2024 ended on a positive note, I'm not completely popping the champagne yet. The California housing market still has plenty of challenges ahead in 2025, here are some concerns I have.

- Mortgage Rates: Mortgage rates are still quite volatile and I don't think they'll settle down anytime soon. Although they dropped in December, they are still at their highest levels since July. This directly impacts buyer affordability.

- Inflation: Inflation is proving to be more stubborn than expected. With high inflation, it becomes hard for the Fed to lower the interest rates, which will directly impact the housing market.

- Insurance Crisis: The ongoing insurance crisis in California is making it more costly for homeowners and buyers. I've seen some properties simply become uninsurable which presents major challenges to people looking to buy a home.

- Policy Changes: The new White House administration's policies could bring both uncertainties and potentially new opportunities.

- Wildfires: The recent wildfires in Southern California could slow down the market for a bit. While we've seen a strong recovery in 2024, these events can have a lasting impact.

- Economic Slowdown: A possible economic slowdown may impact the job market and result in decreased buyer confidence. This could lead to lower demand in the near term.

- Affordability Crisis: I think the rising prices are only going to worsen the affordability crisis that the state is facing. There needs to be more focus on making housing accessible to all, not just the affluent.

- Uneven Recovery: The uneven recovery I talked about earlier, with gains concentrated in the higher end, needs to be addressed. We need a housing market that works for everyone.

My Take: Optimism Tempered with Caution

Overall, I'm optimistic about the California housing market's trajectory, but I remain cautious. The market has shown resilience in 2024. But, given all of the challenges mentioned earlier, I'm not expecting smooth sailing. It’s going to be another year of ups and downs. The rise in sales and prices is certainly encouraging, but we need to keep an eye on the affordability issue and ensure that the benefits of any growth are shared by all segments of the market.

For those of you looking to buy or sell, please do your research. Stay informed. Be realistic with your expectations. The coming months will require both adaptability and a good dose of patience. If you are selling, don’t be greedy. And if you are buying, don’t give up. With a little bit of perseverance, you will hopefully find what you are looking for.

Key Takeaways:

- Strong Finish: The California housing market closed 2024 with strong sales and price gains.

- Regional Variations: Different regions of California are experiencing varying degrees of recovery.

- High-End Dominance: The high-end market is playing a crucial role in price growth.

- Challenges Ahead: The market still faces significant challenges in 2025, including high mortgage rates, inflation, and the insurance crisis.

- Balanced Outlook: A balanced approach of optimism and caution is required for the coming year.

Detailed Data Tables:

Here are some tables that show a more detailed breakdown of the data:

Median Sold Price of Existing Single-Family Homes (December 2024)

| Region | Dec 2024 | Nov 2024 | Dec 2023 | Price MTM % Chg | Price YTY % Chg |

|---|---|---|---|---|---|

| California | $861,020 | $852,880 | $819,820 | 1.0% | 5.0% |

| Los Angeles Metro Area | $815,500 | $822,000 | $760,000 | -0.8% | 7.3% |

| Central Coast | $995,000 | $1,030,000 | $979,500 | -3.4% | 1.6% |

| Central Valley | $492,000 | $495,000 | $462,000 | -0.6% | 6.5% |

| Far North | $369,500 | $375,000 | $364,500 | -1.5% | 1.4% |

| Inland Empire | $594,950 | $600,000 | $570,000 | -0.8% | 4.4% |

| San Francisco Bay Area | $1,200,000 | $1,316,500 | $1,182,000 | -8.8% | 1.5% |

| Southern California | $850,000 | $850,000 | $790,000 | 0.0% | 7.6% |

County Level Median Price YoY Increase – Top 5

| County | Median Price YoY % Change |

|---|---|

| Imperial | 21% |

| Glenn | 20.2% |

| Santa Cruz | 19.5% |

| Lake | 18.4% |

| Trinity | 17.6% |

County Level Median Price YoY Decrease – Top 5

| County | Median Price YoY % Change |

|---|---|

| Mono | -43% |

| Del Norte | -21% |

| Mendocino | -15.3% |

| Lassen | -13% |

| Tuolumne | -7.7% |

County Sales YoY Increase – Top 5

| County | Sales YoY % Change |

|---|---|

| Mendocino | 76% |

| Del Norte | 50% |

| Napa | 49% |

| Lake | 48.6% |

| Calaveras | 44.1% |

County Sales YoY Decrease – Top 5

| County | Sales YoY % Change |

|---|---|

| Lassen | -59.1% |

| Plumas | -47.1% |

| Kings | -32.4% |

| Madera | -23% |

| Tuolumne | -14% |

Unsold Inventory Index and Median Time on Market (December 2024)

| Region | Unsold Inventory Index Dec 2024 | Unsold Inventory Index Dec 2023 | Median Time on Market Dec 2024 | Median Time on Market Dec 2023 |

|---|---|---|---|---|

| California | 2.7 | 2.6 | 31.0 | 26.0 |

| Los Angeles Metro Area | 2.9 | 2.7 | 33.0 | 27.0 |

| Central Coast | 2.9 | 3.0 | 31.0 | 19.0 |

| Central Valley | 2.7 | 2.6 | 29.0 | 25.0 |

| Far North | 4.4 | 3.2 | 42.0 | 37.0 |

| Inland Empire | 3.7 | 3.3 | 39.5 | 34.0 |

| San Francisco Bay Area | 1.6 | 1.5 | 26.0 | 23.0 |

| Southern California | 2.8 | 2.6 | 31.5 | 26.0 |

These tables provide a more granular look at how the market performed across different areas. I hope these data points help you better understand the complex situation of California's housing market.

Work with Norada, Your Trusted Source for

“Turnkey Investment Properties”

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Related Articles:

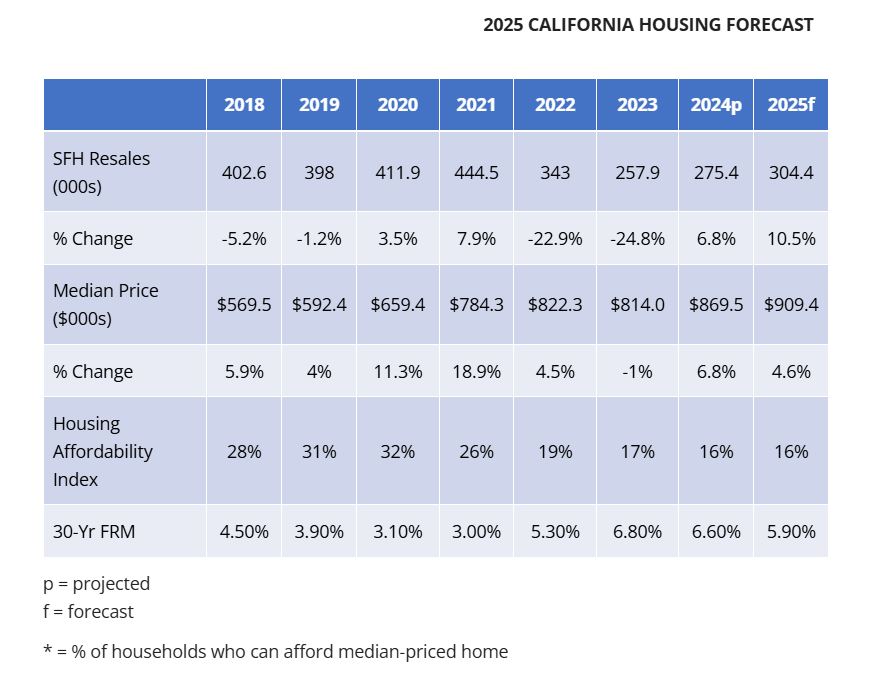

- California Housing Market Predictions 2025

- California Housing Market Roars Back: Biggest Sales Jump Since 2021

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash in 2024?

- Will the US Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?