Should you invest in the Aurora real estate market in 2020? Most people have never heard of the city, though they may have heard of nearby Boulder. Let’s learn more about Aurora, Colorado before explaining whether or not you should invest in the Aurora housing market.

Aurora is a fairly large city on the east side of Denver. Its proximity to Denver has long kept it in the realm of Denver suburb. However, the Aurora real estate market is noteworthy in its own right, since Aurora is the third largest city in the state. It is home to more than 350,000 people.

It is known for its cultural food, artistic exhibits and outdoor recreation. One reason to consider Aurora real estate investment is because this city is in easy reach of the entire Denver metro area, home to more than two and a half million people. Aurora real estate is considered to be relatively affordable as the median price of a home in Aurora is 22% lower than the Colorado average. However, if you are considering buying or selling a home in Aurora, you will certainly want to do plenty of research in advance. Regardless, there is no doubt that the more information you can have about real estate, the better off you will ultimately be.

Aurora real estate appreciation rate in the latest quarter was around 1.7%. However, it is quite unclear whether it would remain steady or not. Looking at the positive forecast, the annual appreciation rate is predicted to be between 6% to 7%. You can either choose to invest in your future, or market your home to potential buyers. Let’s find out more about it. Please note that there are many variables that can potentially impact the value of a home in Aurora (or any other market) and some of these variables are impossible to predict in advance.

Table of Contents

Aurora Real Estate Market Forecast 2020

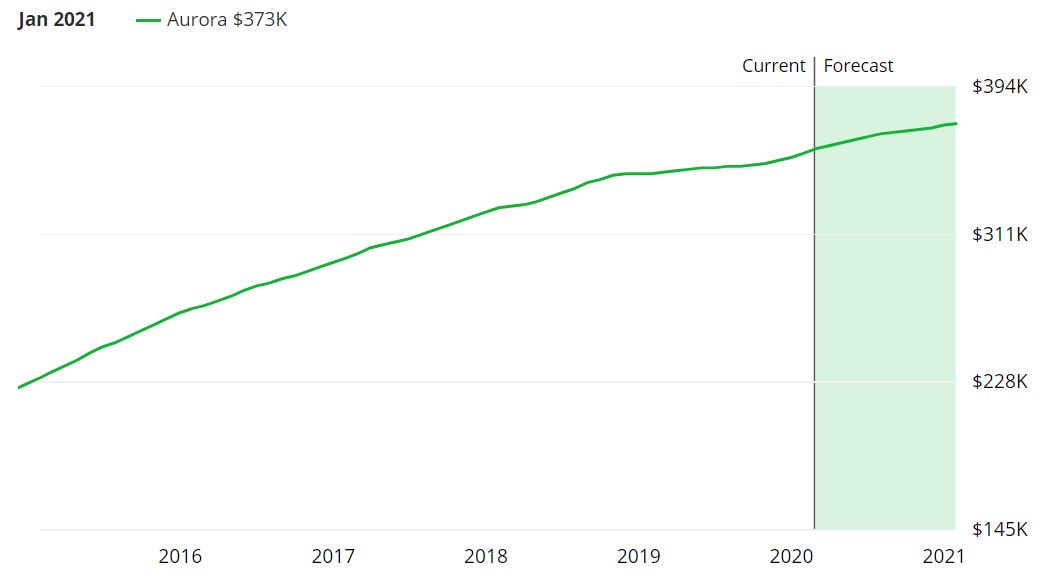

What are the Aurora real estate market predictions for 2020? Let us look at the price trends recorded by Zillow over the past few years. Since 2015, the median home price in Aurora have appreciated by 54.8% from $231,000 to $357,532. In the past year, the Aurora real estate market saw price appreciation of roughly 3.5%. The latest Aurora real estate market forecast is that home prices will continue increase by 4.6% in the next twelve months.

The latest real estate data from Zillow shows that the current median home value in Aurora is $357,532. Aurora is currently a buyer’s real estate market – which refers to a situation in which supply exceeds demand, giving purchasers an advantage over sellers in price negotiation.

Here is the Aurora, CO real estate price appreciation graph by Zillow. It shows us the current home price appreciation forecast of 4.6% till Jan 2021.

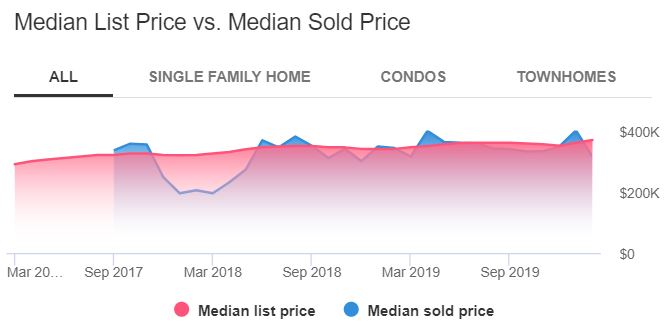

The median list price per square foot in Aurora is $224, which is lower than the Denver-Aurora-Lakewood Metro average of $265. Zillow reports that 12.7% of the listings in Aurora had a price cut in Jan 2020, which is a good thing for buyers. The median price of current listings in Aurora is $363,998 and the median price of homes that have been sold is $347,700. The median rent price in Aurora is $1,990, which is lower than the Denver-Aurora-Lakewood Metro median of $2,100.

Aurora Real Estate Market Trends

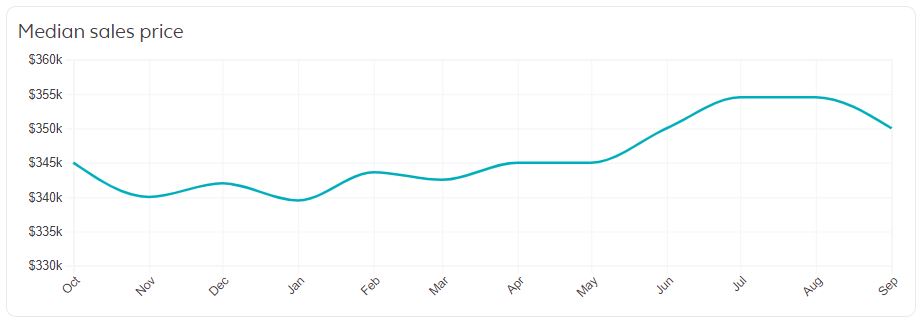

We shall now discuss some of the most recent housing trends in the Aurora area and compare it with past couple of years. We shall mainly discuss about median home prices, inventory, economy, growth and neighborhoods, which will help you understand the way the local real estate market moves in this region. Aurora has been one of the hottest real estate markets in the state of Colorado for many years. Trulia has currently 1021 resale and new homes for sale in Aurora, CO, including open houses, and homes in the pre-foreclosure, auction, or bank-owned stages of the foreclosure process. The median price of sold homes in Aurora housing market is $350,000 and homes are selling for about $226/sqft.

Following the housing market decline in 2007, single family rental properties became favorable options for investors, saving in construction or refurbishment prices. The quick turnaround for an owner to rent out their property means cash flow is almost immediate. Single family rental homes have grown up to 30% within the last three years. Almost all the housing demand in the US in recent years has been filled by single family rental units. With 2020 being, theoretically, in the middle of a boom, there’s still 4 years for residential construction to surge. Most likely, a housing shortage will remain in 2020, keeping home prices high.

As per the real estate company called Neigborhoodscout.com, the median house price in Aurora is $303,577, which indicates that home prices in Aurora are well above the national average for all cities and towns in the United States. Three and four bedroom single-family detached are the most common housing units in Aurora. Other types of housing that are prevalent in Aurora include large apartment complexes, duplexes, row houses and homes converted to apartments.

As compared to 2018, the inventory of Aurora single family homes was down by roughly 25% (Sep 2019), according to Colorado Association of Realtors. This low inventory is driving the real estate prices in Aurora. Aurora ended the year with available active listings down 30-40 percent compared to 2018. The Aurora’s median price in the end of 2019 was saw an increase of 5 to 7 percent. The Aurora home prices and rents are clearly increasing, and affordability is a big issue.

Currently, there are 792 single family homes for sale in Aurora, CO on Zillow. Additionally, there are 221 single family homes for rent in Aurora, CO. Under potential listings, there are about 0 Foreclosed and 153 Pre-Foreclosure homes. These are the delinquent properties that may be coming to the market soon but are not yet found on a multiple listing service (MLS).

In the past month, 1786 homes have been sold in Aurora, CO on Redfin.com. Additionally, there were also 81 condos, 117 townhouses, and 22 multi-family units for sale in Aurora last month.. The median listing price is around $210,000. According their statistics, the Aurora housing market is very competitive. Homes in Aurora receive 1 offers on average and sell in around 46 days. The average sale price of a home in Aurora was $185K last month, up 5.4% since last year. The average sale price per square foot in Aurora is $126, up 5.0% since last year.

Here is the latest Aurora housing market data for the month of Jan 2020 from Redfin.com. The sale to list price ratio shows us that it was a trending more like a seller’s real estate market in the past month.

Aurora Housing Market Trends |

|

| Median List Price | $210,000 |

| Avg. Sale / List | 97.6% |

| Median List $/Sq Ft | $132 |

| Median Sale Price | $185,000 |

| Median Sale $/Sq Ft | $126 |

Analyzing real estate data from multiple sources gives us a much broader perspective of the direction in which a market is moving. There are currently 1668 homes for sale in Aurora on Realtor.com. The asking price of single family homes can start from $189,900 and can go up to $12.9M for a luxury property located in Blackstone neighborhood in the city of Aurora, CO. Blackstone is a popular neighborhood with the median price of $628,000. Saddle Rock Golf Club has a median listing price of $561,700, making it the most expensive neighborhood in Aurora. City Center North is the most affordable neighborhood in Aurora, with a median listing price of $176,900.

Aurora has a mixture of owner-occupied and renter-occupied housing. There are currently 343 rental properties in Aurora and their rent prices range from $700 to $3,400 per month. The median rent price in Aurora is $1,600. According to Realtor.com, 200 homes were newly listed on the market within the last week. There are 591 new construction single family homes for sale in Aurora within a price range of $239,990 to $12.9M. You can find affordable new construction homes in Green Valley Ranch neighborhood. Green Valley Ranch neighborhood has low crime risk and a median price of $365,000.

According to their data, in January 2020, Aurora housing market was a buyer's market, which means there were roughly more active homes for sale than there were buyers. Ideally a buyer would prefer a sale to asking price ratio that’s closer to 90%. Despite Aurora being a buyer's real estate market, the sellers have managed to hold good leverage in these negotiations in the past month. On an average, they could sell homes for 98.47% of the asking price. A seller would always prefer scenarios which can yield a ratio of 100% or higher.

In January 2020, the median list price of homes in Aurora, CO was $369K, trending up 8.5% year-over-year. The median listing price per square foot was $186. The median sale price was $315K. On average, homes in Aurora, CO sell after 75 days on the market. The trend for median days on market in Aurora, CO has gone down since last month, and slightly down since last year. A hot listing in Aurora can sell for around list price and go pending in around 12 to 15 days.

In a healthy, balanced market, it would take about six months for the supply to dwindle to zero. In terms of months of supply, the Aurora market can tip to favor sellers if the supply drops to below six months of inventory. As per Zillow’s forecast, the prices may rise by 4.6% in the next 12 months. That can happen because when inventory drops, buyers start competing and enter into a bidding wars.

The median list price in Aurora, CO is $448,990 on Movoto.com. The median list price in Aurora went up 3% from January to February. Aurora's home resale inventories is 396, which decreased 10 percent since January 2020. The median list price per square foot in Aurora is $169.

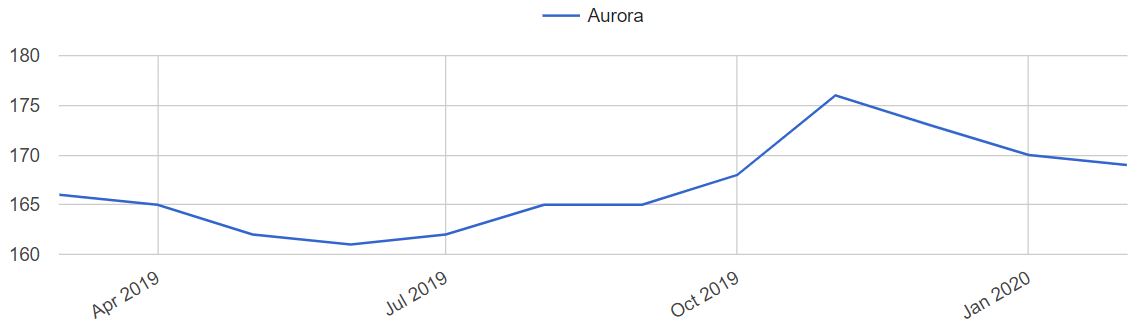

As you can see in the graph, the median price per sq ft in Aurora rose to its peak value in Nov 2019, when it was $176. In January 2020 it was $170. Distressed properties such as foreclosures and short sales remained the same as a percentage of the total market in February

Aurora is a minimally walkable city in Kane County with a population of approximately 195,478 people. If you are looking to invest in the Aurora real estate, you should that three most important factors when buying a real estate anywhere are location, location, and location. Location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Aurora investment real estate and you should be able flip it for a lump sum profit.

The neighborhoods in Aurora must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools and shopping malls. Some of the popular neighborhoods in Aurora are White Eagle Club, Country Lakes, Boulder Hill, Hometown, Boulevard District, Waubonsee, West Aurora, Seasons Ridge, Carillon Club, Columbia Station, Fox Valley, Lehigh Station, White Eagle, Eola Yards and West Side.

Here is a snapshot that shows the median home values in the some of the popular neighborhoods of Aurora.

Aurora, CO Foreclosures And Bank Owned Homes Statistics 2020

According to Zillow’s foreclosure statistics, in Aurora 0.4 homes are foreclosed (per 10,000). This is greater than the Denver-Aurora-Lakewood Metro value of 0.1 and also lower than the national value of 1.2. The percent of delinquent mortgages in Aurora is 0.5%, which is lower than the national value of 1.1%.

With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Aurora homeowners underwater on their mortgage is 4.5%, which is higher than Denver-Aurora-Lakewood Metro at 3.9%.

| Total No. of Foreclosures in Aurora | 300 (RealtyTrac) |

| Homes for Sale in Aurora | 126 |

| Recently Sold | 5029 |

| Median List Price | $350,000 (1% rise vs Dec 2018) |

There are currently 300 properties in Aurora, CO that are in some stage of foreclosure (default, auction or bank owned) while the number of homes listed for sale on RealtyTrac is 126. In January 2020, the number of properties that received a foreclosure filing in Aurora, CO was 8% lower than the previous month and 35% higher than the same time last year.

Is Aurora a Good Place to Invest In Real Estate?

Now that you know where Aurora is, you probably want to know why we’re recommending it to real estate investors. Investing in real estate is touted as a great way to become wealthy. Many real estate investors have asked themselves if buying a property in Aurora is good investment? You need to drill deeper into local trends if you want to know what the market holds for the real estate investors and buyers in 2020..

If you are looking to make a profit, you don’t want to buy the most expensive property on the Aurora real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Aurora that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Let’s look at the current state of the Aurora real estate market and learn more about its strengths and weaknesses.

Aurora Real Estate Prices

The average home in Denver costs around 450,000 dollars. Home prices in Denver were nearly flat in 2019, only increasing 0.4 percent that year. Home prices in the Denver area are expected to go up three to four percent in 2020. One point in favor of Aurora real estate investment is the relatively affordable home prices. The average price of property in the Aurora real estate market is roughly 360,000 dollars, nearly 100K below what you’d pay in Denver proper. That’s why the Aurora real estate market saw a 3.5 percent price increase in 2019 and is expected to see a nearly 5 percent price increase in 2020.

Another reason to consider Aurora real estate investment is the return on investment you’d get on a rental property. While homes are roughly 20 percent cheaper, the difference in rental rates is much less. For example, the median rent in the Aurora housing market is roughly 2000 dollars a month, only a hundred dollars less than the average for the Denver metro area. This implies a shortage of rental properties in the Aurora housing market, though two in five residents rent.

The relatively health real estate market does make it harder to find bargains. The number of delinquent mortgages is half the national average, and less than five percent have negative equity. However, homes take an average of two months to sell, so you may find people eager to close so they can get out from under their house payment. The Aurora housing market does present the opportunity of distressed relocating military members who need to get out from under a mortgage due to deployment or relocation.

The Legal Climate

Colorado is relatively landlord friendly. For example, the owner of an Aurora real estate investment property doesn’t need to give advanced notice to enter the property. The state doesn’t have rent control. The state has a ban on rent control, and a bill to remove that statewide ban failed in 2019. The state doesn’t require interest to be paid on renter’s deposits. Written rental agreements aren’t legally required unless the lease is more than 12 months, though any property owner in the Aurora housing market should have a lease agreement. There’s no limit on late fees or state level pet laws.

The Tax Climate

The overall Colorado tax burden is close to the national average. The state has a top corporate tax rate of just under five percent. Its business tax climate ranking was 18 out of the 50 states. It has a low sales tax rate, though that doesn’t affect property owners. Its property tax rate averages 0.53 percent, nearly half the national average. And note that the Aurora real estate market is cheaper than the Denver metro area average, so you’ll have a much lower tax bill on an Aurora investment property than one even thirty miles west. This makes Aurora a much better bargain than other growing metro areas in the western United States.

The Job Growth in Aurora, Colorado

Aurora’s economy is closely tied to that of Denver. The Denver metro area’s average salary is nearly 60,000 dollars a year, well above the national average of 50K. Unemployment hovers around three percent, roughly a full point below the national average. The combination of abundant and high paying jobs will buoy the value of any Aurora real estate investment you make, since it ensures a growing number of renters in the area as well as maintains the value of the property.

The number of renters in the area is also bolstered by the presences of Buckley Air Force base. Better yet, the Aurora area is expected to see faster job growth than the US as a whole over the next ten years. However, the value of properties in the Aurora real estate market is determined by more than the job market.

Quality of Life in Aurora

People rarely move cross-country for quality of life issues. However, the Aurora housing market like other suburbs does gain people fleeing the problems associated with larger, urban areas. For example, the Aurora area gets an A for its public schools. Housing is a B- according to Niche. However, housing is affordable by Colorado standards, and that draws people there from across the region.

Aurora does get a C on crime and safety. However, that doesn’t hurt the Aurora real estate market, because that is the same rating Denver gets. Instead, many move here to have families, because they can afford a three bedroom house with a yard in Aurora. That’s why more than a quarter of residents are under 18, and this will continue to drive property values in the Aurora real estate market for years to come.

Young professionals often move here to lower their rent, and this is driving the growth in retail and coffee shops. The mix of urban and suburban is a draw for many, too. For example, Aurora was ranked 56 out of the 228 biggest cities in the country on outdoor activities. The city is also one of the most bikeable communities in the U.S. Ironically, the high quality of life and (relatively) affordable real estate is why many tech firms are moving from Seattle and San Francisco to Aurora. That’s going to increase the number of renters short-term and the value of Aurora real estate over the long-term.

Investing in Aurora Real Estate or Not: The Conclusion

Maybe you have done a bit of real estate investing in Aurora but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Aurora, Colorado is more than a growing suburb. It is a large, thriving city in its own right. It has a bright future, and it is poised for rapid appreciation and increasing rental rates. This is a good time to make an investment in the Aurora real estate market.

A good cash flow from Aurora investment properties means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Aurora real estate investment opportunity would be a key to your success. If you invest wisely in the Aurora real estate, you could secure your future.

As with any real estate purchase, act wisely. Evaluate the specifics of the Aurora housing market at the time you intend to purchase. Hiring a local property management company can help in finding tenants for your investment property in Aurora. If it is your first time to invest in Aurora real estate, then you would have to be aware of common beginner’s mistakes. Beginners would usually follow the media, buy a property and wait for its value to increase. This could be risky. Real estate investing requires research. We recommend doing your own research or hiring a real estate investment specialist for guidance.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. If housing supply meets housing demand, real estate investors should not miss the opportunity since entry prices of homes remain affordable. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

The aim of this article was to educate investors who are keen to invest in Aurora real estate in 2020. Purchasing an investment property requires a lot of studies, planning, and budgeting. Not all deals are solid investments. We always recommend to do your own research and take help of a real estate investment counselor.

Other Good Markets To Invest in Real Estate in 2020

Bellevue is another hot market to choose for real estate investing. The Bellevue real estate market has a number of points in its favor. It has strong market fundamentals that justify its high prices. The question is whether you can afford to buy property in the Bellevue real estate market and can get a high enough return on the investment.

Bellevue gets points for quality of life. It received an A plus from Niche.com. And it has an excellent balance of attractions for single adults and families. It is safer than Seattle, which is important to everyone. Yet it has top tier schools and a great nightlife. For example, Bellevue has the third best public school district in the United States.

The other good place for real estate investment Kirkland. The Kirkland housing market saw a minor adjustment in housing prices in 2019. However, the Kirkland area is going to resume slow, steady appreciation for the next few years thanks to its expanding high-tech sector. It is also a better housing market for investors than other high-tech hubs.

Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, the Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

References:

About Aurora

https://en.wikipedia.org/wiki/Aurora,_Colorado

https://www.citytowninfo.com/places/colorado/aurora

Job market

https://realestate.usnews.com/places/colorado/denver/jobs

https://www.bestplaces.net/compare-cities/denver_co/aurora_co/jobs

https://www.buckley.af.mil/

Legal climate

https://www.mashvisor.com/blog/5-most-landlord-friendly-states

https://www.avail.co/education/laws/colorado-landlord-tenant-law https://www.denverpost.com/2019/04/16/colorado-rent-control-senate/

Tax climate

https://taxfoundation.org/state/colorado/

Quality of life

https://matadornetwork.com/read/10-things-didnt-know-aurora-co/

https://www.niche.com/places-to-live/aurora-arapahoe-co/

Latest Market Prices, Trends & Forecasts

https://www.redfin.com/city/29459/IL/Aurora/housing-market

https://www.zillow.com/aurora-co/home-values/

https://www.coloradorealtors.com/2019/12/11/new-listings-drop-30-percent-statewide-low-inventory-and-affordability-dominate-colorados-2019-housing-market-story/

Map

https://www.google.com/maps/place/Aurora,+CO/

Foreclosures

https://www.realtytrac.com/statsandtrends/co/denver-county/aurora/