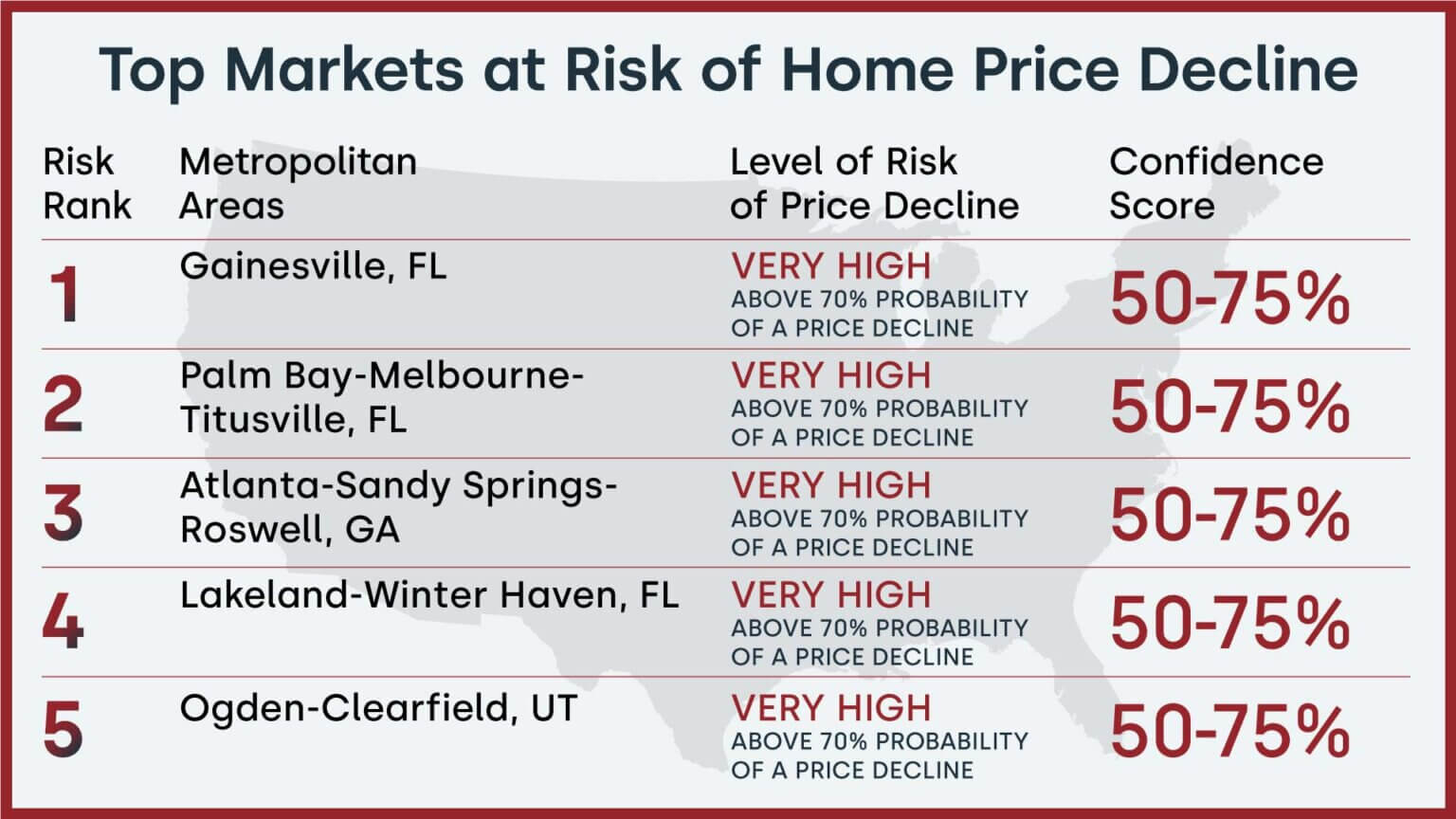

As the U.S. housing market continues its precarious dance with economic forces, Florida finds itself at the epicenter of a potential real estate upheaval. Recent data from CoreLogic's Market Risk Indicator (MRI) has shed light on an alarming trend: three major Florida metropolitan areas are at a very high risk of experiencing significant home price declines over the next 12 months. This article explores the factors contributing to this looming crisis and what it means for homeowners, buyers, and investors in these vulnerable markets.

3 Florida Housing Markets on the Brink of a Crash

- Gainesville, FL

- Palm Bay-Melbourne-Titusville, FL

- Lakeland-Winter Haven, FL

These three metropolitan areas have been identified as having a “very high” risk of price decline, with a probability exceeding 70%. Let's examine each market in detail:

1. Gainesville: The Educational Hub on Shaky Ground

Gainesville, home to the University of Florida, has long been considered a stable real estate market due to its consistent influx of students and faculty. However, it now sits atop the list of markets at risk of price decline. Several factors contribute to this precarious position:

- Overreliance on the student housing market

- Potential shifts in remote learning affecting local demand

- Overvaluation of properties in recent years

The combination of these factors has created a perfect storm for Gainesville's housing market, making it vulnerable to a significant correction.

2. Palm Bay-Melbourne-Titusville: Space Coast's Economic Uncertainty

Known as the Space Coast due to its proximity to Cape Canaveral, this area has seen substantial growth in recent years, driven by the resurgence of the space industry and technology sector. However, the market now faces challenges:

- Potential cutbacks in aerospace and defense spending

- Overheated market due to speculative buying

- Vulnerability to climate change and rising insurance costs

These factors have placed the Palm Bay-Melbourne-Titusville area in a high-risk category for price declines, threatening the equity of recent buyers and long-term residents alike.

3. Lakeland-Winter Haven: Central Florida's Overextended Market

Situated between Tampa and Orlando, Lakeland-Winter Haven has benefited from its strategic location and relatively affordable housing compared to its larger neighbors. However, this market is now facing its own set of challenges:

- Rapid price appreciation outpacing local wage growth

- Dependence on tourism and service industries affected by economic fluctuations

- Increased inventory as investors begin to sell off properties

The combination of these factors has put Lakeland-Winter Haven at risk of a significant market correction.

Understanding the Broader Context

To fully grasp the situation in these Florida markets, it's crucial to consider the national housing market trends:

- National home prices increased by 4.3% year-over-year in July 2024

- Monthly home price growth is slowing, with prices decreasing by 0.01% from June to July 2024

- CoreLogic forecasts a modest 2.2% price increase nationally from July 2024 to July 2025

Dr. Selma Hepp, Chief Economist for CoreLogic, notes that “Housing demand continued to buckle under the pressure of high mortgage rates and unaffordable home prices, leading to a considerable slowing of home price gains during the summer.”

The Florida Paradox

Interestingly, while these three Florida markets are at high risk of decline, Miami stands out as an anomaly. With a 9.1% year-over-year price increase as of July 2024, Miami demonstrates the diverse and complex nature of Florida's real estate landscape.

Factors Contributing to Florida's Vulnerable Housing Markets

- Interest Rate Sensitivity: Florida's real estate market is particularly sensitive to interest rate fluctuations, affecting both local buyers and out-of-state investors.

- Climate Change Concerns: Increasing awareness of climate risks, including hurricanes and flooding, is impacting long-term property values and insurance costs.

- Demographic Shifts: Changes in migration patterns, both domestic and international, are reshaping demand in various Florida markets.

- Economic Diversity: Markets heavily reliant on specific industries (e.g., tourism, education) are more vulnerable to economic shocks.

- Investor Activity: The high level of investor ownership in Florida makes certain markets more susceptible to rapid selling in a downturn.

Implications for Stakeholders

- Homeowners: Those in high-risk areas should be prepared for potential loss of equity and consider their long-term housing plans.

- Buyers: While price declines may present opportunities, buyers should be cautious and consider the long-term stability of their chosen market.

- Investors: Diversification and thorough market research are crucial in navigating Florida's varied real estate landscape.

- Local Governments: Policymakers may need to prepare for potential decreases in property tax revenues and implement strategies to maintain community stability.

Looking Ahead

While the risk of price declines in these Florida markets is significant, it's important to note that real estate is inherently local and cyclical. The potential for Federal Reserve rate cuts and the natural resilience of Florida's economy could mitigate some of these risks.

Dr. Hepp suggests that the key question is “whether the upcoming rate cut from the Fed and the expected continuation of falling mortgage rates will be sufficient to motivate potential homebuyers” in the face of economic uncertainties and the upcoming presidential election.

As Florida's housing markets navigate these turbulent waters, stakeholders must stay informed, adaptable, and prepared for a range of potential outcomes. The Sunshine State's real estate market has shown resilience in the past, but the current confluence of factors presents a unique and challenging landscape for the months ahead.

Related Articles:

- Miami, Florida Housing Market Faces BIG Crash Risk

- Florida Housing Market Predictions for Next 2 Years: 2025-2026

- Florida Housing Market 2024: Predictions for Next 5 Years

- Florida Housing Market Predictions 2025: Insights Across All Cities

- How Much Do Real Estate Agents Make in Florida?

- Florida's Housing Market Sets a New Record With $70 Million Teardown