Landlords have enjoyed the upper hand since the housing crisis as increased interest from renters coincided with little new supply of rental units. Rising mortgage rates, tighter borrowing requirements and higher home prices have taken many people out of the home-buying market. Plus, many remain burned by the housing crash and don't want to own a home.

Landlords have enjoyed the upper hand since the housing crisis as increased interest from renters coincided with little new supply of rental units. Rising mortgage rates, tighter borrowing requirements and higher home prices have taken many people out of the home-buying market. Plus, many remain burned by the housing crash and don't want to own a home.

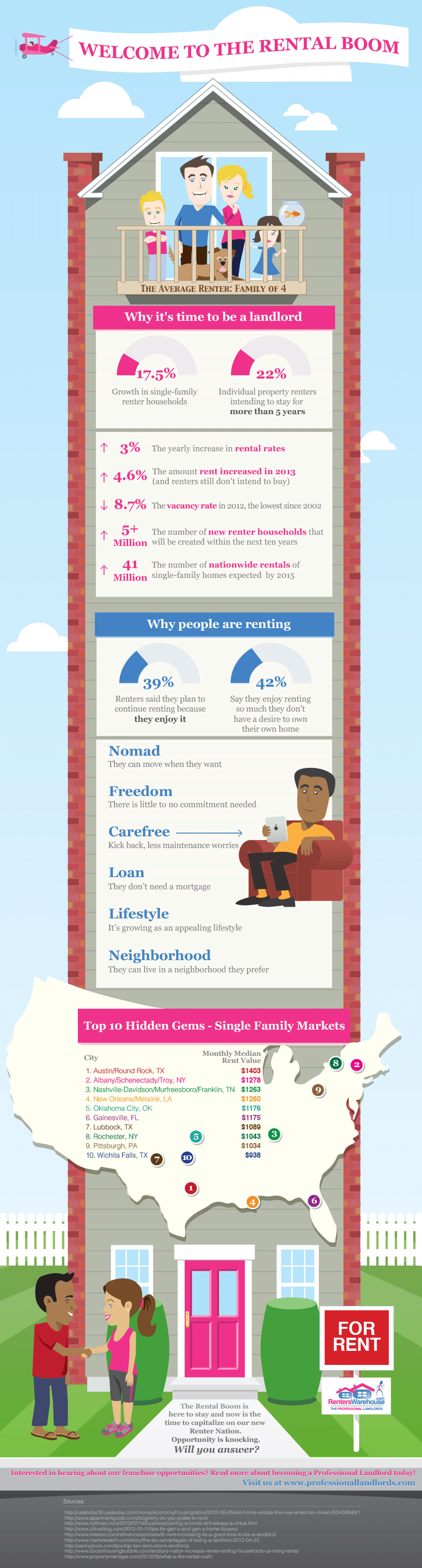

The latest Rental Screening Solutions industry report published by TransUnion found that average rental prices have increased nearly 4% nationwide last year while the credit risk of applicants for those properties as measured by TransUnion's Resident Scoring Model has steadily improved, with an average improvement of 1% in the last year.

According to Zillow data, home-ownership rates are predicted to fall below 65% in 2014, the lowest level since the mid-1990s and a benefit to real estate investors who will see increased demand for their rental properties and continued increase in average rents and home prices.

These rising home prices will encourage Americans to move, but to less expensive areas where housing is more affordable. Metropolitan areas like Atlanta, Dallas, Houston, Indianpolis and Kansas City will continue to see a growth in residents.